Along with the number of security token offerings grew the number of potential investment objects that have to be examined individually for a return on investment to determine what potential this new technology brings to investors.

According to the security token database1 compiled by the Cointelegraph Research team, there were 80 publicly announced STOs in 2020, just slightly up from the 79 STOs in 2019.2 Although Polymath claims 2019 had 380 security tokens, they are mistakenly combining the total count for ICOs, IEOs, and STOs in the 6th PwC report on ICOs and STOs.3

In 2020, our database reports $4.8 billion was raised by 80 companies, with a major part of the funding coming from two STOs. The first one was Red Swan, a US-based commercial real estate firm that partnered with Polymath and tokenized $2.2 billion in high-end properties. The second notable STO in 2020 was conducted by Thai Central Bank, which sold $1.6 billion worth of savings bonds using blockchain technology.

In 2019, nine security tokens started trading on secondary markets. During their first 18 – 24 months of trading, three of the coins had positive returns (BCAP: +129.01% and two RealT properties: Audubon: +52.93% (+10.38% APY) and Marlowe: +8.59% (+12.39% APY)). Six of the coins had negative returns (SPiCE: −6.04%, RealT property Fullerton: −6.48% (+12.76% APY), 22X: −53.85%, TZROP: −63.75%m PRTS: −66.67%, LDCC: −95.88%. The largest winner since inception of trading on secondary markets has been Blockchain Capital’s BCAP token, and the largest loser was tZERO’s TZROP token. The market cap of TZROP was bigger than the 8 other tokens listed in 2019, which brought down the entire market capitalization of security tokens between 2019 and 2020 by 50%.4

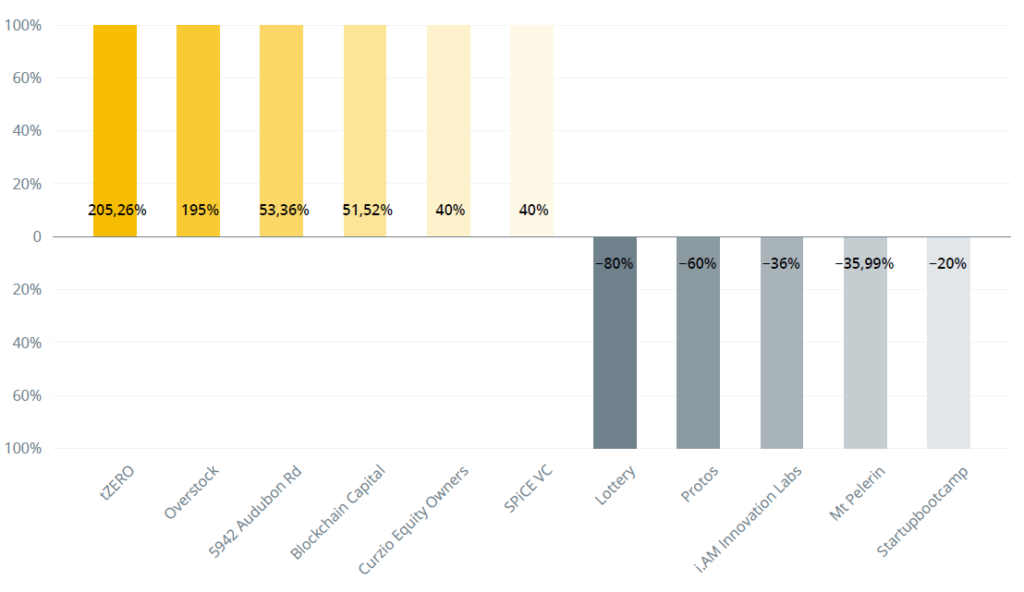

However, 2020 did see some recovery for security tokens. In 2020, the market cap grew 517% from $59 million to $366 million between Jan. 1 and Dec. 31. The daily trading volume grew by over 1,000% between 2019 and 2020 and had an average of $5.8 million in 2020. In 2020, many new coins started trading on secondary markets. The top winners and losers are shown in Figure 5.

2020 Return For Secondary Market Trading of Security Tokens

Which types of security tokens do exist? Considering such a versatile form of investment, it won’t surprise anyone that this question can’t be answered completely. It is, however, quite possible to list the most popular forms of Security Tokens. For this reason we will publish another article on this topic in the next week.

1 To purchase the database, contact [email protected]

2 This is not accounting for projects without an announced sale date

3 https://www.pwc.com/ee/et/publications/pub/Strategy%26_ICO_STO_Study_Version_Spring_2020.pdf

4 https://blog.stomarket.com/security-token-market-end-of-year-report-2020-59151e0caa1d

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.