Algorand’s democratized variation on PoS, dubbed pure proof-of-stake, is essentially the secret recipe by which the network claims it achieves its holy grail of scalability, decentralization and security.

Three properties actualize this reality:

First, it democratizes access to network participation by requiring only 1 ALGO as the minimum stake to serve as either a relay or a participation node. Relay nodes are responsible for communicating across the network and ensuring messages are propagated properly, while participation nodes run and engage in the consensus algorithm. Second, it distributes validator rewards to all token holders as opposed to only validators present in the ETH model, amassing them ~4%–6% APY. Third, the aspect of randomness that guarantees a fair opportunity of participation for all eligible nodes in respect to their stake.

In that regard, Algorand’s process to block production, executable over three stages and reliant on on-chain randomness, includes a proposal, soft vote and certify phases. Proposals begin with all eligible nodes looping through the sub accounts they oversee while running a cryptographic primitive, known as a verifiable random function (VRF), to determine which ones are nominated to propose a block in the next stage of consensus based on their hashed proofs.

VRFs, in short, are pseudo-random cryptographic functions capable of providing proof that their outputs were correctly calculated by their submitter, as it is mapped to their public key. They perform similar to a weighted lottery system in that the total number of staked ALGO increases the probability of being chosen as every token acts like it is its own lottery ticket for its owner’s address.

Selected accounts then transmit their next proposed block linked up with the associated VRF output that substantiates their validity as a proposer. The next stage proceeds with the aim of reducing all block proposals to one. The VRF gets reexecuted to form the soft vote committee where participants are randomly selected to vote for the proposal with the lowest hash value, repeatedly, until a quorum is reached. Finally, the certify vote stage arrives with the formulation of a new committee to testify that the proposed block is absent of any double- or over-spending issues. The committee then votes to certify the block if a quorum is present in an analogous manner to the previous stage.

Algorand’s key component in achieving scalability without compromising on either security or decentralization is the element of randomness abstracted in the pure proof-of-stake algorithm and its reciprocal cryptographic sortition mechanism relating to the VRF.

Randomness bolsters security as the proposing or committee accounts are chosen randomly and secretly without any peer-to-peer messaging overhead. Nodes only loop through their accounts and run a personal lottery to validate if they were chosen, meaning that block-producing nodes’ identities are concealed, further protecting them against any distributed denial-of-service attacks. Even if they were identified, nodes and committees are replaced intermittently with a randomly selected group in every round of consensus; so, targeting them that late would be fruitless.

Not only does this reduce the chances for a network attack, but it also inhibits the network with its unforkable state. To put in context, miners in PoW-based systems are susceptible to solving the cryptographic puzzle at the same block height, which results in a soft fork of the chain, where the one belonging to the lower-activity chain will be eventually discarded. Within Algorand’s consensus, only one block can be confirmed as accounts are randomly chosen to propose the block and form the committee to fill this expectation at once and then replaced by its next random-weighted round of selected accounts.

Every participating node will be eligible to propose and approve a block, relatively proportional to its stake, as it is periodically and randomly chosen per round. There will never be a rigid set of validators controlling the block production process since nodes are randomly rotating, no matter how deep their pockets might be. Finally, randomness ensures scalability is maintained in that a 1,000-member committee along with a single-block proposer will always periodically and randomly rotate to lead new rounds of consensus, at 100M, 1B, and 10B users network scale.

6.4 Tokenomics

The ALGO token is the network’s native currency and the bedrock for any activity on top of the Algorand blockchain. ALGO is capped at 10 billion tokens that were minted during the token generation event, with only 25 million sold during the first public ICO on CoinList at a price of $2.4 in June 2019. The wide discrepancy between what private investors bought at versus the public price created an initial huge selling pressure, prompting the foundation to offer two buy-back programs in August 2019 and June 2020 for all retail investors who were affected by the chaotic launch, where almost all of the retail investors opted in for redemption, as it was significantly higher than ALGO’s current market price.

When it comes to its utility, ALGO is used as a medium of exchange to pay for storing data and processing transactions. The token is also used as an instrument to participate in the network’s consensus by allowing any individual with at least 1 staked ALGO to become a validating node, contribute to the block production process, and secure the network. Finally, ALGO will be also used to participate in the newly rolled out community governance, while locking the token for a predefined period enables holders to vote on the root governance matters, in addition to yielding further rewards of ~17% per quarter as a result of governance participation.

Algorand’s initial tokenomics projected that the entire supply of 10 billion should be reached by 2024, with 2.5 billion allocated for communal ALGO sales, 1.9 billion for ecosystem support, 3.1 billion for incentivizing an early relay node runners program, 500 million for the Algorand Foundation, and 2 billion will be dedicated to the software company Algorand Inc. Listening to the community’s criticism nevertheless, the token distribution has been updated with a focus on rewarding participants that can prove their commitment to the long-term growth of the projects through staking for a lengthy period — to be extended until 2030 with the revised distributions below as well as the protracted token release schedule.

6.5 Algorand ecosystem

The carbon-neutral blockchain did not really pick up steam until last year. Early 2020 saw the Algorand 2.0 network upgrade introducing some of the layer-one capabilities that make up the present foundation of the blockchain’s core functionality, such as stateless smart contracts, atomic transfers and the ASA protocol. However, it was the debut of stateful smart contracts in August 2020 that set the ball rolling for Algorand to garner attention as it became capable of servicing the exciting new wave of DeFi projects currently being developed on top of the network.

Figure: Algorand Ecosystem Map

Few players understood Algorand’s potential early in the journey as initial rounds of adoption saw Algorand ink partnership with the Marshall Islands to underpin the issuance of their central bank digital currency while integrating conventional stablecoins such as USDC and USDT onto the network to cater to DeFi’s rudimentary substratum. Algorand also collaborated with SIAE, the largest Italian copywriting agency, to issue 4 million NFTs representing over 95,000 creators as ASAs. This complemented another coalition with planetwatch, an environmental monitoring service designed for capturing data to operate air-quality sensors in hopes of maintaining a global air quality ledger on Algorand’s blockchain.

To capitalize on the network’s upgraded capabilities, Algorand launched its series of accelerator programs – a 12 week initiatives focused on spurring the development of the blockchain’s ecosystem via providing funding resources (in partnership with Eterna and borderless capital) and mentorship (technological, economical, marketing) for aspiring projects hoping to build on top of the blockchain. The first iteration, Algorand’s Asia accelerator program, which ended in early January 2021, wanted to ameliorate Finance 3.0 as its focal point and saw a curated list of projects accepted into the program to build the foundational stage of financial services.

Some of the inductees included DEXTF (an asset management protocol), StakerDAO (a DAO for governing financial assets), Yieldly (the first full-suite of DeFi services on Algorand), and VeriTX (digital commerce marketplace for exchanging physical assets like medical equipment).

The second half of 2021 was the biggest growth catalyst thus far. First, Algorand’s technological stack was updated to include the AVM 1.0 upgrade, which was necessary to predicate the roll-out of more complex smart contracts. It was an equally eventful biannual for the network’s funding as borderless capital set forth a $25-million Miami-based fund for investing in projects harnessing Algorand’s technology. This was followed by Arrington capital’s $100-million advertised fund to back Algorand-focused protocols back in June. In September, SkyBridge Capital allocated another $250-million fund to fuel the growth of DApps building on top of the network.

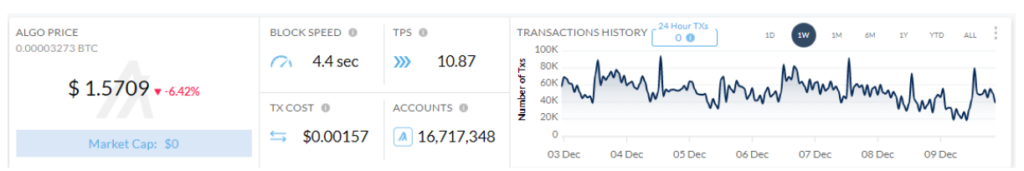

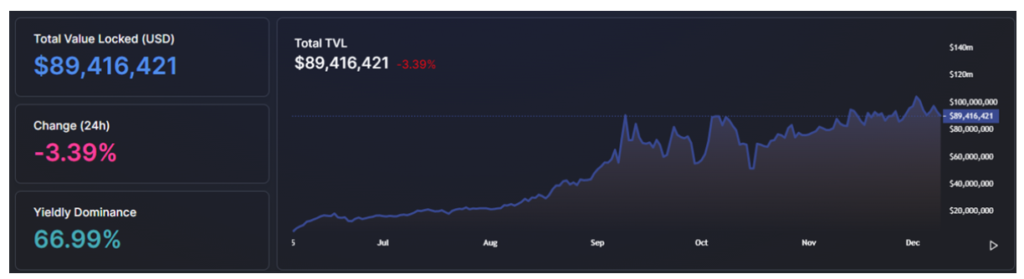

Activity truly began to forge ahead following Algorand Foundation’s decision to launch the $300-million Viridis fund in September, which is focused on growing DeFi on the emerging network, as manifested by the increase of active addresses from last September shown above. Precisely, the capital was to be deployed for bankrolling applications relating to money markets, NFT platforms and synthetics issuance — the ground-laying infrastructure for DeFi. Tinyman, an Algorand-based automated market maker, raised $2.5 million following the fund’s announcement and in hopes of securing the required liquidity at launch. The DEX went live on mainnet on Oct. 31, marking the first true passageway to DeFi on the growing blockchain. Yieldly and Tinyman are the only two DeFi applications live on Algorand’s mainnet where they attribute a sum of $85 million in total value locked.

The upgrade capabilities, combined with the inflow of capital, unequivocally stirred the development of more complex primitives, such as Algofi (a lending, borrowing market), Algodex (an order-book-based DEX), Mese (a micro-equity exchange), Algomint (a synthetics platform), and saw their deployment to testnet.

Amongst an extensive pipeline of DeFi projects coming to Algorand, Prismatic, a treasury management protocol for crypto organizations, is launching in Q2/22. The protocol puts a special emphasis on security and transparency through building multi-sig tooling, enabling crypto organizations to manage digital assets in a time and cost-efficient manner fit for enterprise-grade crypto treasury management. Using Prismatic, organizations can integrate digital assets into their payroll, treasury and financial operations with a high level of security. By building upon Algorand, Prismatic takes advantage of low transaction costs, high speed, strong security and a proven track-record – allowing organizations to securely handle digital assets.

Looking into the future of Algorand, the infant blockchain is expected to undergo a performance boost that will witness the block finalization time reduced to 2.5 seconds from 4.5, while the capacity for processing transactions per second will grow to reach 25,000. The improved latency will surmise as a result of adopting an encoding mechanism that utilizes hex transactions (32 bits) over protracted names (with relation to how transactions are specified and called), while the enhanced transaction throughput will be enabled through the truthful block pipelining mechanism. This is a conceptually similar approach to sharding where a block is proposed without waiting on the finalization of its preceding block.

Considering the influx of VC funding and the blockchain’s elevated capabilities, Algorand should be in for a fruitful journey ahead assuming applications gather significant adoption in the coming year. Once the DeFi stack of protocols reaches a relatively mature level and becomes more entrenched, the Algorand Foundation’s next move will potentially be launching its own liquidity mining program.

6.6 Valuing Algorand

Due to Algorand’s fledgling state of development, the network’s ecosystem hasn’t reached a level of fruition that would make it sensible to conduct an analysis into either its revenue for deducing a P/R Ratio or inferring the network’s value based upon its generated fees. Even though a good number of protocols are being built on the network’s mainnet, it will still be a while before Algorand’s ecosystem matures and enough data can be extracted out of it. Algorand is still in its infancy when compared to other functioning smart contracts-based platforms and layer-one blockchains. This juxtaposition corroborates that ALGO has a long way to go before catching up with a corresponding market sizing similar to its competitors — representing only 2% of Ether’s current market value.

6.7 Risks

Compared to most Layer-one blockchains, apart from Ethereum, Algorand’s mainnet went live just shy of two years ago. In this period, activity had only recently begun ramping up due to the network’s new capabilities that accommodate the plethora of complex smart contracts and long tail of Web3 applications. However, with only two DApps live on the mainnet, it shows that Algorand’s technology is even less battle-tested than other relatively functioning blockchains, such as Solana and Avalanche, which have hundreds of deployed apps and still have their fair share of issues that are in the process of being addressed. Seeing the big picture nevertheless depicts how early Algorand is to the layer-one blockchain wars.

Seeing how Algorand’s operating system AVM now supports creating DApps with five different programming languages, caution should be exercised, as two out of the five (Clarity and Reach) are quite experimental languages that don’t have a provable record of stability yet, notwithstanding their prospects.

An issue that originally plagued the blockchain was the degree of centralization present in who ran the introductory round of relay nodes. Even though there are around 100 relay nodes distributed geographically around the world, they’re all vetted and appointed through the Algorand Foundation so that that they satisfy the necessary performance requirements and avoid clogging the blockchain. However, this is being addressed with Algorand’s community relay pilot program, launched on Nov. 2, 2021, where it began accepting and onboarding more users to increase the diversity of relay nodes, eventually leading to more decentralization.

Finally, due to the network’s approach of increasing the block size while reducing block time, the full ledger size of the Algorand blockchain was estimated at 647GB back in May. For context, this figure is aggregated over two years in contrast to Bitcoin’s 360GB aggregated over 11 years. So, considering it has exceeded 1 trillion GB by this stage, average users will soon be quoted out of participating as relay nodes due to the unfeasible hardware requirements. Possible workarounds could include introducing zero-knowledge proofs to compress transaction history, or adopting decentralized data storage solutions, such as Arweave.

Blockchains diverting away from EVM compatibility risk sacrificing on the network effect accrued from Ethereum’s ecosystem of developers and users accustomed to the workings of the architecture. Algorand has decided to take a longer path by rebuilding from scratch and bootstrapping its own operating system. Thus, adopting Algorand as the go-to platform for underpinning complex smart contracts is predicated on developers appropriating the new developmental environment to create competing DApps to those found on the more familiar EVM-compatible chains.

Another emerging issue, despite its irrelevance at the moment, comes down to instituting a reliable incentivizing mechanism to remunerate early backers of relay nodes after 2024, as their advertised allocation (25% of ALGO’s total supply) will have run out by then. There currently isn’t a rewarding mechanism for new entities hoping to join the relay node force.

Summary

Algorand uses a zero-knowledge proof algorithm to solve the blockchain trilemma. Its new consensus mechanism enables the system to be efficient and secure while being sufficiently decentralized. In theory, Algorand’s blocks can reach their final state in seconds, and the transaction throughput of the entire blockchain network will be comparable to that of large financial networks. Given the current adoption metrics, it is hard to imagine that Algorand is a threat to Ethereum; however, if the Algorand public chain is fully realized, the project and the entire blockchain industry will benefit greatly.

No matter which dimension is analyzed, the project will not lack market attention. With the likes of crypto companies such as Circle developing solutions on the Algorand chain and the government of El Salvador choosing Algorand as the backbone of the nation’s blockchain infrastructure, the longer-term picture looks constructive.

This article is an extract from the 80+ page Scaling Report: Does the Future of Decentralized Finance Still Belong to Ethereum? co-published by the Crypto Research Report and Cointelegraph Consulting, written by ten authors and supported by Arcana, Brave, ANote Music, Radix, Fuse, Cryptix, Casper Labs, Coinfinity, Ambire, BitPanda and CakeDEFI.