The first types of DAMs (Digital Asset Marketplaces) to emerge were centralized cryptocurrency exchanges. Binance, Coinbase, and Kraken are examples of these. They now mostly concentrate on the development of their audiences, having already successfully delivered easy-to-use and optimized web platforms for buyers and sellers of crypto tokens.

Practitioner Perspective with Ivor Colson of Tokeny Sarl in Luxembourg

Decentralized exchanges offering cryptocurrencies also began to emerge in 2020, manifesting in platforms such as Uniswap, Pancake Swap, and Sushi Swap. DeFi protocols such as Aave and Compound can also be considered decentralized marketplaces.

These types of venues are now beginning to emerge within the security token industry, driven by investors who want:

- Lower trading and custody fees

- Ability to earn interest from lending digital assets to other traders, such as shorters

- Transparency with number of shares outstanding, fees, and orderbook liquidity in order to reduce manipulation such as naked short selling

- Ability to use digital assets as collateral for margin trading accounts or loans

- Faster settlement

- Diversified liquidity from traders around the world

- 24/7 trading

Why are DAMs emerging?

Naturally, the security token market will always innovate at a slower pace than the purely retail markets due to the heavy regulation requirements. In that light, it was not a surprise that we firstly saw the rise of unregulated cryptocurrency-based DAMs. However, interest in DAMs for privately issued security tokens is currently on the rise. We see three reasons why they have accelerated recently:

1. Private markets are currently dysfunctional. This is an extremely fragmented industry that is still reliant on paper-based processes. Old technology such as fax machines are still being used and Excel is the norm. As a consequence, investors have to deal with long lock up periods or pay premiums to liquidate their portfolios. Investors are now seeing DAMs as venues whereby they can find and transfer their assets to others, P2P, and for a few Euros/Dollars per transfer.

2. The regulation for security tokens has moved quickly recently, especially in Europe. Tokenized securities now fall under the same rules and regulations as traditional financial instruments in many other European countries including France, Germany, Italy, the Netherlands, Romania, Spain and the UK. This has given market actors the confidence to start experimenting and implementing blockchain technology operationally.

3. Blockchain technology has officially gone mainstream this year. The foundations were laid in 2020 with many users utilising smart contracts and custody solutions. At the break of 2021, FinTechs such as Paypal and Square adopted Bitcoin for their millions of users, institutions such as Microstrategy and Ruffer have announced over nearly $2bn in combined Bitcoin purchases. Financial institutions have also joined. The FT asked whether Bitcoin has gone mainstream on its front cover. As one of the world’s most respected financial publishers, the FT actually answered its own question by asking it. Blockchain technology is now normalised and accepted.

Benefits for Stakeholders

There would be no emergence of DAMs if there were not any benefits and improvements to the current state of affairs. So, what are these benefits?

Issuer

Issuers of financial securities seek investors by offering them shares in their asset. For this they need to describe their value proposition, detail the financial perspectives and legal structure of their project, distribute this information to eligible investors and provide the mechanisms for the transfer of funds in exchange for shares.

A DAM realizes two key benefits for issuers:

A. Digital administration of shares

Issuers can quickly issue and allocate shares to investors via a self-service and user-friendly interface. The compliance is coded into the security tokens and all investors need to satisfy the legal obligations of the offering. These checks are performed in seconds in conjunction with KYC/AML checks. Once administered, cap tables are automatically updated, and issuers benefit from efficiency gains with the digital administration of shares.

B. Access new segments of investors

Due to a digital-first issuance and allocation of shares, issuers can easily, and cost efficiently target investors around the world. New types of investors can also be opened up, as efficiency gains translate into better opportunities to fractionalize and reduce the investment ticket size, allowing issuers to potentially target retail investors. The prospect of a more liquid secondary market also opens up a greater band of investors.

Investor

On the buy-side, investors are concerned about whether they can free themselves from an investment easily, and the types of investment opportunities available on the DAM. For this, they need to have an interface where they can access the documents that satisfy their due diligence requirements. After this, they need the mechanisms to easily subscribe and then transfer/free themselves from that investment should they wish.

A DAM offers two key benefits for investors:

A. Greater access to opportunities

Investors can also discover more opportunities via one marketplace across both the primary and secondary markets. All the necessary documentation is available on demand and investors can log in to a marketplace and filter opportunities based on their investment mandates. Issuer contact information is accessible for further information.

B. Increase in liquidity

Investors that hold a share in a company can also utilize the DAM to discover other investors to interact with. They can act as a ‘maker’ or ‘taker’, i.e., selling or buying respectively. They can firstly discover other investors on the DAM and interact by connecting with and making buying and selling offers. The transfer is then made P2P. By offering a venue and the needed functionality, investors are more likely to meet each other and free themselves from their positions when they want to, offering a significant benefit to how current private markets operate.

DAM Operator

The DAM operator provides these digital and compliant services to enable issuers and investors to meet with the least amount of friction possible. They provide clearly defined rules and responsibilities that apply to the marketplace. They will conduct its due diligence on the projects listed on the platform. Not only that, but they need to prove they are trustworthy for both investors and issuers. The core benefits are:

A. Monetize customer base

By migrating their issuers and investors over to a DAM, they will be in a better position to monetize their audience at scale. For the issuers, they can monetize the setup of their offerings, onboarding of investors and management services that are needed for asset owners. On the buy-side, they can monetize investors via a SaaS model and/or a transaction based model.

B. Automate and digitize operations

Many operations today are manual, and a DAM operating on top of a blockchain has the ability to automate many tiresome operations. Faxes will be a thing of the past, so will manual cap table updates, duplicated KYC checks and long investor onboarding times. DAMs can utilise automation across all of these currently laborious processes and realise a highly automated and efficient operation. They can offer a seamless experience for their clients, one that is truly digital from the ground up.

Services Available on a DAM

In order for the DAM to be used, there are some essential services it needs to offer. These services can be broken down into the primary market, and those required for both issuers and investors and the secondary market, which is a venue for investors.

А. Primary market

The primary market is where the company releases shares from its entity to investors, so it is from the company to the investors. The company needs to go through various steps to issue its shares to eligible investors.

For the issuer

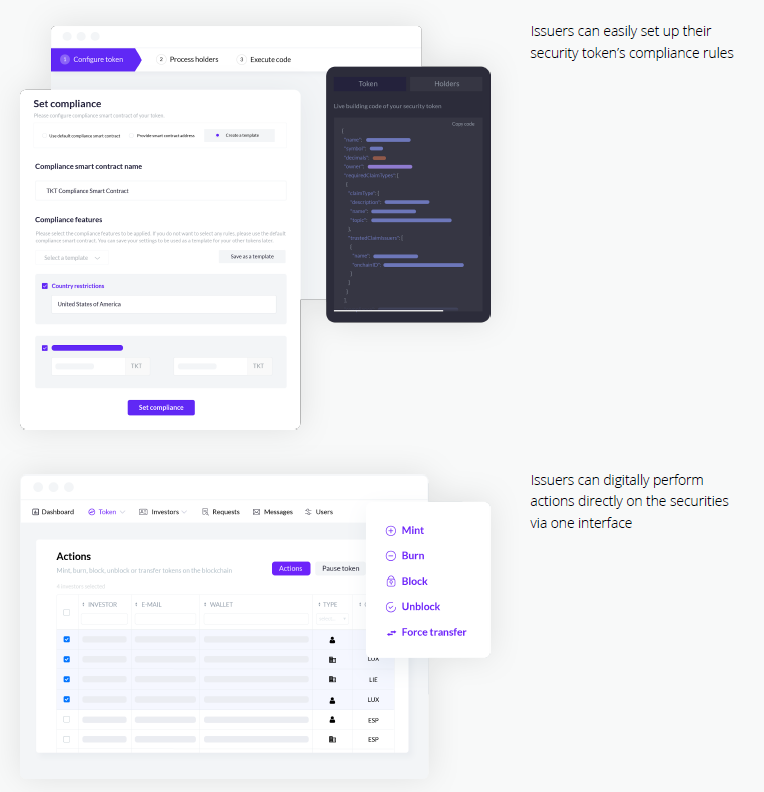

Issuers need a platform that allows them to create, deploy and issue compliant security tokens to its investors. To satisfy the compliance obligations, issuers need to be able to create/upload smart contracts and integrate KYC/AML services in order for them to approve or reject participating investors. Once the issuer has whitelisted its investors, it can go ahead and allocate the tokens in return for funds from investors.

After the issuer has allocated shares to their investors they need to be able to report and perform post-issuance actions on the securities. Actions like capital calls, buybacks and share splits are functions issuers or their agents need to perform. They can do this directly through the platform. Issuers also need to keep control of their assets by being able to block and unlock tokens, mint and burn, along with forcing transfers between investors. Cap tables are automatically updated when share transfers are executed as the blockchain is used as the source of truth. Reporting functionality is also required, and issuers can easily schedule the delivery of position and transaction reports.

For the investor

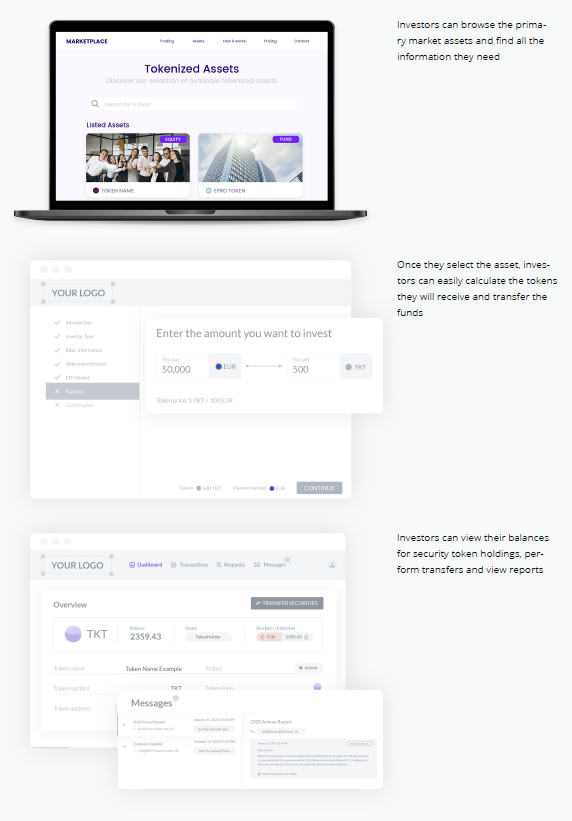

On the buy side, investors need an easy-to-use service to firstly view offerings and their documentation

in the primary market. Secondly, when they want to invest they need an easy-to-use service that allows

them to enter their personal information and upload their documentation to prove their claims and finally

execute the investment by transferring funds from their wallet.

B. Secondary market

The secondary market is where security token investors can meet, interact and exchange their shares with one another. For security tokens, this is normally a P2P (peer-to-peer) marketplace in practice.

Right now there is an unspoken race being waged over who will win the world’s demand for security token trading. Who are the participants of this race? That is a question that we will answer next week in another article.

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.