The benefits of tokenization are inevitable. Efficiency gains, automation, transparency, fractional ownership, increased liquidity, and direct access to investors are some but a few examples of why this emerging blockchain and DLT-enabled wave of innovation is increasingly gaining global traction. Will the 2020s be defining years in blockchain history where tokenization finally goes mainstream?

Practitioner Perspective with Marius Smith of Finoa

Tokenization promises to fundamentally disrupt financial markets as we know them today and is a topic that Finoa has covered and researched extensively since its inception in 2018. 1,2

Despite its promises, however, mainstream tokenization or “the tokenization of everything” is still in its early days, and the anticipated boom and wide-spread adoption are yet to be seen. With positive developments globally, the market volume is still expected to grow significantly in the coming years, with innovative use cases emerging everywhere and positive regulatory developments forming on both national and international levels.

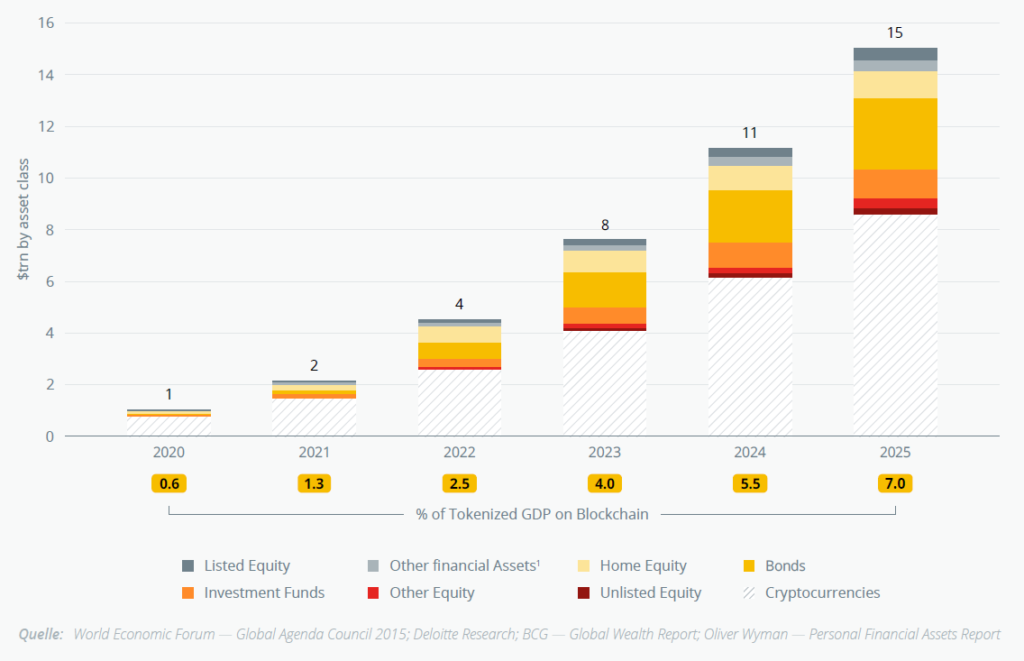

Taking into consideration the developments over the past two years, we have revised our initial tokenization forecast and outlined below findings from an extensive overhaul of our initial computations and models that projects that the tokenized asset market will constitute a $14.7-trillion opportunity by 2025.

Projected Tokenized Market Volume until 2025

With a $1-trillion market capitalization of blockchain-based assets, and this being predominantly attributed to cryptocurrencies, in 2020 (accounting for approximately 0.6% of the global GDP), we expect a significant increase in projected market volume over the coming years. Overall, we project that the tokenized market volume will reach $2 trillion, or 1.3% of global GDP in 2021, and $4 trillion (2.5% of the global GDP) in 2022. This year, we anticipate an acceleration in mainstream adoption of blockchain technologies, leading to an additional 0.7% of GDP to be stored on the blockchain. Overall, this will trigger a market growth from $4.4 trillion in 2022 to $14.7 trillion in only 3 years (2025) — an average of an additional $3.4 billion per year.

Current developments in more detail

Despite 2020 marking a pivotal year for cryptocurrency growth and adoption, leading up to total market capitalization exceeding 2018 highs, we still observe a lower-than-anticipated growth traction for tokenization. With positive developments in both the fintech and startup ecosystems and also increasing interest from traditional financial institutions, regulatory uncertainty still poses as one of the main obstacles hindering asset take-up and, combined with an ongoing pandemic, has put a spoke in the wheel on the otherwise bullish developments anticipated globally.

We have witnessed many attempts and examples of blueprints and tokenization of different asset classes, with bonds emerging as the most common product thus far. We find this mainly to be correlated with the legal foundations being most developed and fitting for this asset class compared to equities, for instance, and evidently, the case in countries such as Germany. If we consider the wider developments in regulating tokenization going forward, we expect to see positive advancements for other asset classes in the coming years; however, expect some to take a longer time to form and develop. Consequently, we expect that bonds will continue to accelerate and will be preferred over equities initially, as existing legal frameworks will seek to accommodate these first and by 2025, will be the leading tokenized financial asset class (disregarding cryptocurrencies) constituting 18% of the total tokenized financial asset market on the blockchain. We find recent examples of that both in Germany, where the “Gesetz über elektronische Wertpapiere (eWpG)” — the electronic securities act — was recently passed to provide legal certainty around the issuance of securities, as well as the European Commission’s introduction of Market in Crypto Asset (MiCA), both marking important steps for innovation in the capital markets on a national and European level.

While positive developments for tokenization are anticipated in the coming years, we still expect that cryptocurrencies will be the main driving force of growth for tokenized assets. Institutional adoption is on the rise, and we have seen many examples of large corporations and investors recently entering this space to get exposure to, diversify and seek out alpha from emerging asset classes and crypto projects. The interest from large investors, such as Mass Mutual and Tudor Group and platforms like PayPal, are just a few examples of this new wave of institutional adoption that will have a fundamental impact on the future of market development and growth expectations. Combined with a continuous acceleration of innovation in base-layer protocols and layer-two applications as well as ingenious use cases such as decentralized finance, we are particularly bullish on the growth trajectory for cryptocurrencies and conservatively estimate that they will have constituted 57% of the total tokenized financial assets by 2025. We do believe that these developments will have positive spillovers to some of the other asset classes we considered, and thus remain very positive for the years ahead for tokenization generally.

We delimited ourselves to look at a five-year horizon — an exercise that, with the current level of innovation and uncertainty, is already inherently difficult. We are still in the very early days of tokenization, as well as wider blockchain adoption and application. Extending the forecasted horizon to five, 10, or even 20 years, is, therefore, nearly impossible. What we can say with certainty, however, especially with the very positive developments we are currently seeing on a global level, is that the technology has an immense potential to disrupt, and we have seen only a fraction of its full application yet. We are confident that use cases for tokenization will continue to unfold and are strong advocates of its full realization — an evolution that is not only incredibly exciting but also one that we are very proud to take part in and support. We are just getting started.

Methodology: Projection of tokenized assets 2020 – 2025

As our initial methodology proved to be a very accurate reflection of the market developments, we decided to sophisticate it further by differentiating between different asset classes and including more recent sources.

Research and surveys from institutions, such as the World Economic Forum (WEF), Deloitte and McKinsey (see table of sources for more detail), project that up to 10% of the global gross domestic product will be stored and transacted with the help of blockchain technology by 2025 – 27. With this in mind, we triangulated and ran a market simulation to determine (a conservative) potential market size of a global tokenized market.

We delimited ourselves to financial assets as well as real assets clustered into: listed equity, unlisted equity, other equity, investment funds, bonds, other financial assets (i.e., insurance policies, pensions and alternative investments), home equity and cryptocurrencies. Currencies and deposits were excluded, and our study thus does not consider potential central bank digital currencies.

Based on factors such as the past performance and future growth expectations per asset class, we projected the market size of the individual assets using a bottom-up methodology. In subsequent steps, we applied different assumptions of the individual rate of tokenization per asset class and finally matched our bottom-up results with the top-down research from the WEF.

Following this methodology, we project a tokenized asset market of $14.7 trillion of financial assets by 2025. This does not include currently unmeasured (or nonexistent) asset classes or unidentified tokenization use cases of intangible assets — e.g., patents, usage rights — where we expect significant innovation and growth.

1 The Era of Tokenization — market outlook on a $24trn business opportunity

2 Cost disruption in the issuance market: The case for tokenization

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.