Raiffeisen Bank International’s Blockchain Hub team including Head of Strategic Partnerships & Ecosystems Christian Wolf, Senior Partnerships & Ecosystem Manager at RBI Gernot Prettenthaler, and Digital Banking Analyst Vid Hribar joined us for an exclusive interview about security tokens and to answer the question if they see demand for security tokens from their clients.

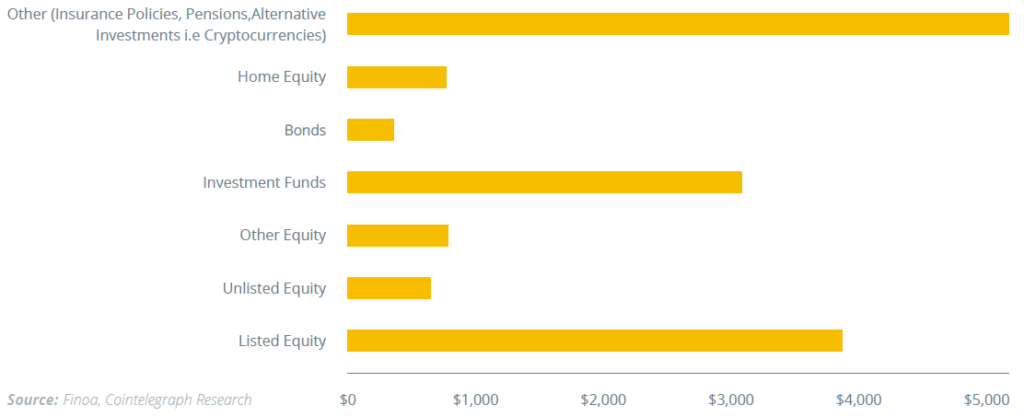

Various estimates of the security token market exist. KPMG and WEF project that the market will grow to $8 trillion by 2025.1 Benjamin Schaub and Stefan Schmitt of the Frankfurt School Blockchain Center (FSBC) predict the European market will account for $1.5 trillion by 2024.2 This chapter discusses a new estimate by Finoa, a German digital asset platform for institutional investors. Their calculations estimate that the tokenized asset market will have $14.7 trillion in assets under management by 2025; however, their estimate does include cryptocurrencies such as Bitcoin in addition to security tokens. The not cryptocurrency part of their tokenized asset market estimate is $9.5 trillion by 2025.

Finoa Estimate of Global Tokenized Security Market by 2025, $ trillions

With €176 million total assets, 17.4 million customers, and presence in 25 countries3, RBI’s forward thinking corporate culture has a huge impact. In the beginning of our interview with one of Europe’s largest banks, we established that RBI is seeing increased demand for cryptocurrencies from both retail and professional clients. RBI’s client demand for digital assets ranges from high in politically unstable regions to none in Russia where cryptocurrencies are prohibited. They noted there are regional differences in interest. Slovakia and the Czech Republic are willing to invest more in cryptocurrencies whereas Austria is more conservative when holding variables such as household income constant.

Christian Wolf stated that although clients are not directly asking for security tokens, they are asking for a better trading experience when handling traditional securities like stocks and bonds. Clients want cheaper, faster, and more transparent security trading. Wolf said, “the way we currently trade securities will be gone within 10 years.”

However, compliance with the new Anti-Money Laundering Directive (AMLD5) that came into effect on January 10th, 2020, may have made working with cryptocurrencies more difficult for the bank, although, AMLD5 also brought regulatory clarity which is a positive development. AMLD5 says that any business that exchanges fiat currency for a crypto asset (brokers, exchanges) or stores crypto assets on the behalf of customers (custodians, wallets) is required to register with financial market authorities where they are doing business and implement money laundering policies such as collecting and safely storing the identification data of users, monitoring user transactions, and reporting suspicious activity.

The trio mentioned that RBI is rethinking their compliance’s approach to digital assets. RBI is currently very cautious, but demand from clients, regulators, and the technology are all maturing, which gives them the impetus to progress as well.

Luckily, AMLD5 is most likely not applicable to security tokens, because they do not constitute a means of exchange. However, this is not the case in all countries. For example, the UK expanded the scope of its regulation by referring to crypto assets instead of virtual currencies and the new term can be interpreted to encompass security tokens. France is following a similar approach.

RBI is emerging from an experimental phase to market ready phase. They are working on a host of white-labeled products and digital asset custody for institutional and professional investors. One of their most exciting products is their tokenization of fund shares.

Gernot Prettenthaler mentioned that RBI has experimented with the tokenization of fund shares, debt, equity, and the euro with their REST (Raiffeisen Euro-backed stable token). “We now understand the technology, we just need to see what is possible from a legal perspective in Austria.”

Looking ahead, the next decade will be critical to the success of tokenized securities. That is why next week we will take an in-depth look at whether the 2020s will be the pivotal years in blockchain history when tokenization finally goes mainstream.

1 https://blockstate.com/global-sto-study-en/

2 https://dailyhodl.com/2020/03/05/tokenization-in-europe-market-size-to-reach-1-5-trillion-in-2024/

3 https://www.rbinternational.com/en/who-we-are/facts-figures.html

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.