While the legal battle between the SEC and Ripple is being discussed a lot right now and has taken some surprising turns in recent months, looking at the SEC’s actions against companies that have conducted unregistered ICOs, it’s striking that the regulator has charged many different companies of varying sizes.

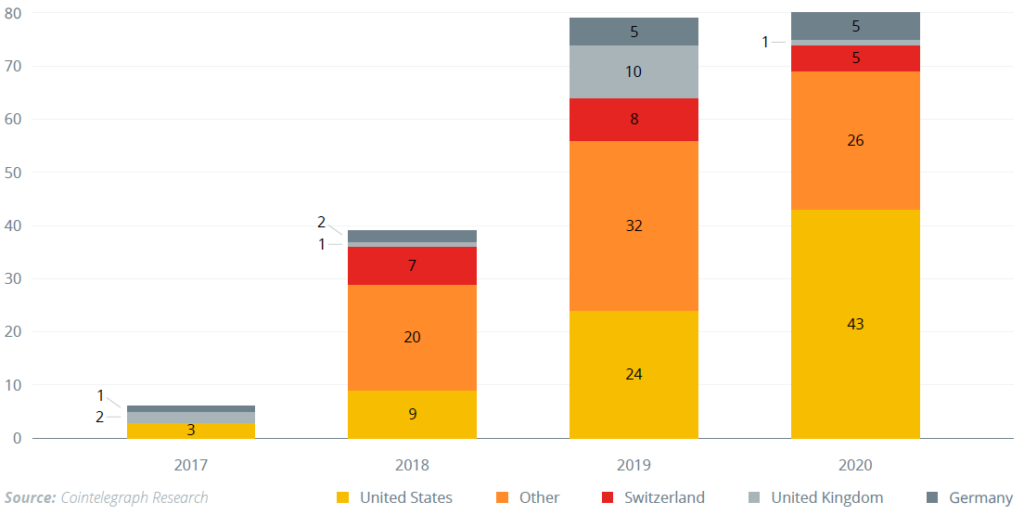

The United States solidified its position as the most popular jurisdiction for the incorporation of STOs, with Switzerland being a distant second.

STO Count by Country of Incorporation, 2017 – 2020

“In simple words, tokenization can turn almost any asset, either real or virtual, into a digital token and enables the digital transfer, ownership and storage without the necessary need of a central third party / intermediary.”

E&Y Tokenization of Assets

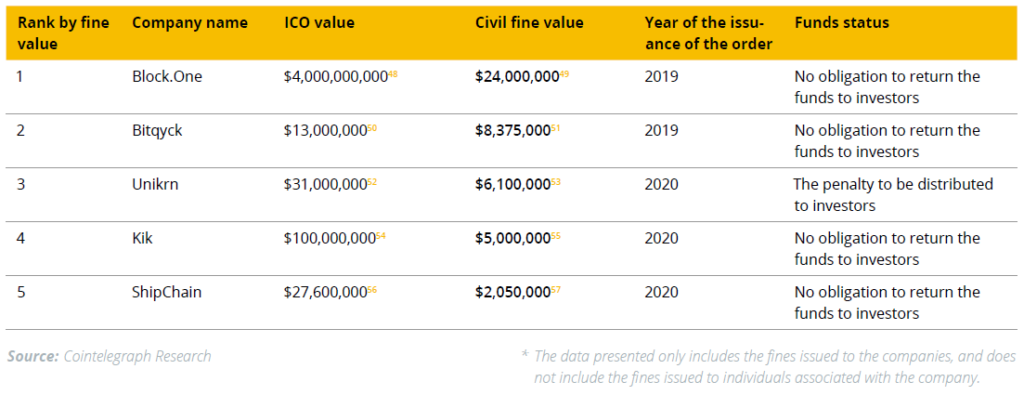

Largest Fines for Conducting Unregistered Security Offerings

Looking at the SEC’s charges against companies that completed unregistered ICOs, we can say that the Securities and Exchange Commission goes after companies of all stripes. Indeed, while the largest ICO that faced the allegations from the SEC brought in a whopping $4 billion, there are much smaller companies that were also charged with fraudulent ICOs.

A vivid example is the SEC case against B2B blockchain marketplace Opporty. The company completed an ICO in 2018 and raised $600,000.43 Nevertheless, the company did break the law as it conducted unregistered securities offering by selling OPP tokens in an ICO and misleading the investors, according to the SEC.44

Although some cases are still pending, many cases have already finished and some companies have been forced to pay civil fines. However, the fine is a light penalty in comparison to the companies that were forced to return the raised funds to investors. (Table 3)

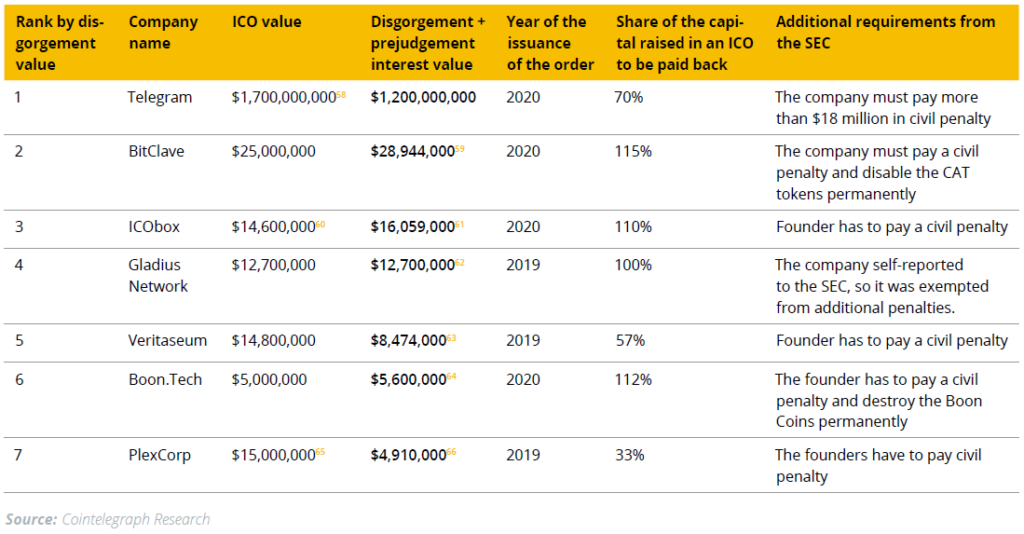

However, there is a second tool that the SEC uses to punish companies that host illegal security sales: disgorgement. This type of punishment seems to be used by the SEC more often, and it is more severe as the value of disgorgement and prejudgement interest usually outstrips the proceeds from an ICO. (Table 4)

With many surprising plot twists packed into a few months, the SEC versus Ripple lawsuit tends to be the most-talked about of the ongoing litigations. The essence of the SEC claim is that Ripple was conducting an unregistered sale of securities.45 However, Ripple’s position is based on the fact that XRP tokens should be classified as commodities, not securities, like Bitcoin and Ethereum. Ripple seems to be sure of its high chances to win the case as the company announced its plan to go public once the agreement with the SEC is settled.46

Another ongoing case is against LBRY, a decentralized video content platform, which is accused of hosting a four-year-long unregistered securities sale. After the SEC complaint in March, 2021, the company tried to raise a wave of publicity to support the project. The advocates for LBRY stressed that the project tokens, LBRY Credits, are not investment contracts, while the SEC highlighted that the company tokens are indeed securities according to the Howey test. The litigation continues, but it seems like the SEC will win the case.

The crypto industry advances, and so does the crypto regulation. The SEC is closely following the development of the industry: Hester Pierce, the SEC’s “crypto mom”, recently commented on the NFTs gold rush. Potentially subject to speculative activities, NFTs could be easily turned into securities if they are fractionalized.47 Due to grey areas in the regulation, the companies that offer such investment vehicles could get under the SEC’s fire.

Completed Cases Without Disgorgement

Completed Cases With Disgorgement

There are several estimates on the size of the security token market, but even more complex are the projections for the future development of the same. Therefore we will look at different assumptions that have been made by financial institutions over the last few months in the next week.

43 https://cointelegraph.com/news/sec-charges-600-000-ico-project-opporty-for-fraudulent-security-offering

44 https://www.sec.gov/litigation/litreleases/2020/lr24723.htm

45 https://www.sec.gov/news/press-release/2020-338

46 https://cointelegraph.com/news/ripple-wants-go-public-after-settling-sec-lawsuit-sbi-ceo-says

47 https://cointelegraph.com/news/sec-s-crypto-mom-warns-selling-fractionalized-nfts-could-break-the-law

48 https://www.wsj.com/articles/investors-bet-4-billion-on-a-cryptocurrency-startup-1527591600

49 https://www.sec.gov/news/press-release/2019-202

50 https://www.sec.gov/news/press-release/2019-164

51 https://www.sec.gov/news/press-release/2019-164

52 https://www.sec.gov/news/press-release/2020-211

53 https://www.sec.gov/news/press-release/2020-211

54 https://www.sec.gov/news/press-release/2019-87

55 https://www.sec.gov/news/press-release/2020-262

56 https://www.sec.gov/litigation/admin/2020/33-10909.pdf

57 https://www.sec.gov/litigation/admin/2020/33-10909.pdf

58 https://www.sec.gov/news/press-release/2019-212

59 https://www.sec.gov/news/press-release/2020-124

60 https://www.sec.gov/litigation/litreleases/2020/lr24763.htm

61 https://www.sec.gov/litigation/litreleases/2020/lr24763.htm

62 https://www.sec.gov/news/press-release/2019-15

63 https://www.sec.gov/divisions/enforce/claims/reginald-middleton.htm

64 https://www.sec.gov/news/press-release/2020-181

65 https://www.sec.gov/news/press-release/2017-219

66 https://www.coindesk.com/plexcorps-reaches-settlement-with-sec-following-extended-legal-woes

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.