Tokenized Securities are shaping up as one of the most promising applications for public blockchains, but in which case do they represent an opportunity and in which case do they represent more of a risk?

Practitioner Perspective with Dominik Spicher of the Crypto Finance Group

Within the security universe, interest is strongest in tokenized bond offerings. This investment category is estimated to be worth ~$2.6 trillion by 2025.1 It is worth looking into the mechanics of tokenized bonds and the challenges that arise in a blockchain context. Overall, the specific advantages that tokenized bonds offer stakeholders compared to their traditional form outweigh these factors.

The main challenges facing tokenized bond offerings are the rules and regulations that issuers and other participants are subject to. None of these are fundamental by nature, but they require more tooling and standardization. One of the main opportunities is the advent of multiple institutions cooperating on bond issuance in a transparent way without reliance on trust.

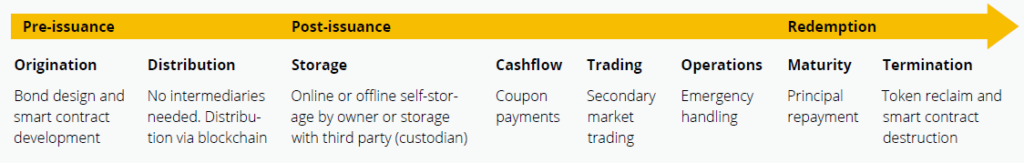

The Tokenised Bond Lifecycle

Pre-issuance

In a tokenized bond offering, similar to a traditional bond offering, pertinent loan parameters — the offering volume, coupon rate and duration — need to be set. These parameters are directly expressed in the smart contract logic, typically within a contract template. The trustless execution on a public smart contract platform ensures adherence to these terms.

It is possible to move the entire offering, book-building and subscription process on-chain, but it is more common and practical to apply the same procedures as traditional offerings do. The advent of stablecoins, however, has made it more attractive to move the actual bond purchase on-chain. Final delivery of the bond tokens is then trustless and atomic, alleviating the need for payment agents and escrow services, thus reducing issuing costs. However, fulfilling regulations for Know Your Customer rules in the smart contract functions poses the main challenge here. 2

Post-issuance

As for almost all digital assets, bond tokens need to be securely storable, transferable, tradable and recoverable during the bond’s lifetime. Financial institutions have many options for digital asset custody and storage, and these options are also available for bond tokens. For those purposes, it is an advantage for the smart contract to adhere to standards, such as the ERC-20 specification. Unfortunately, however, the ecosystem is still in a consolidation phase when it comes to standards supporting more complex functionality, such as permissioned transfers.

Tokens that are not classified as securities typically enjoy completely permissionless transfers. Because the issuing institutions for tokenized bonds are subject to various regulations in virtually all jurisdictions, this is typically unfeasible. In response, approaches have emerged to reconcile compliant behavior and the censorship-resistant nature of public blockchains from simple whitelisting to flexible just-in-time transfer approval. Finding the right trade-off between the end-user experience and the scalability of the underlying platform remains a challenge.

A fundamental requirement when tokenizing bonds is the ability to price the underlying security and its risks in a secondary market. For many security tokens, this can happen off-chain on centralized exchanges or, more interestingly, on-chain on decentralized exchanges, such as Uniswap. However, avoiding liquidity fragmentation across platforms is even more important with tokenized bond offerings, which typically suffer from a lack of liquidity.

Even though smart contract security has made big advances, bond token contracts typically contain an administrator functionality to allow for reactions to unforeseen circumstances, e.g. pausing all transfers. In addition, it is advisable for issuers to be able to handle private key loss by bond token holders. This is especially relevant when coupon and redemption payments happen on-chain.

Finally, bonds usually exhibit regular coupon payments. The public blockchain as the final source of truth makes it convenient for issuers to determine the ultimate beneficiaries of coupon payments: The very same addresses holding the bond token at a particular date in time, which may be expressed in terms of block height, can receive the appropriate amount of stablecoin tokens or some other suitable means of payment on-chain. The flexible nature of smart contracts allows for corporate calendar events to be integrated into the asset itself.

Redemption

After the bond has expired, the principal is returned to the current token holders. Similar to coupon payments, this can be handled elegantly on-chain with the use of stablecoins, typically after bond token transfers have been disabled.

In order for the on-chain state to reflect the expired bond state, tokens are typically reclaimed by the issuer and subsequently burned — i.e., sent to an address where nobody can spend from — and it could even involve the destruction of the smart contract itself, thus removing all bond artifacts.

Challenges in an On-chain Environment

The main challenge is balancing the manifold possibilities of a public smart contract platform on the one hand and the regulatory environment on the other hand. Today, there is still substantial regulatory uncertainty with respect to the legal status of blockchain-based securities and the legal claims that holders may make, although developments, such as the Swiss DLT bill 3, clarify many previously open questions.

Well-established compliance requirements also apply to tokenized securities and need to be adhered to. Among the most salient ones are KYC rules and Anti-Money Laundering legislation. The inherently open and global nature of blockchains poses an especially pertinent problem here, as legislative details vary across jurisdictions. For example, it is customary to apply specific rules for potential U.S. investors in a security.

Such rules need to be included in a tokenized security offering. Typically, completely on-chain solutions are undesirable for usability, privacy and cost reasons. Instead, most approaches opt for a hybrid on- and off-chain workflow. For example, transfer requests could be required to provide additional associated data that establishes approval by an off-chain entity.

The most important advance needed in this regard is standardization. International bodies, such as the Financial Action Task Force, are starting to propose minimal standards for regulatory requirements in the digital asset space — the Travel Rule being the most well-known example. Technology standardization is also developing for smart contract functionality, enabling a better interplay between end-user wallets, custody solutions and other participants.

Until this standardization and consolidation continues to progress, designers, issuers and users of tokenized security products need to involve legal and compliance experts.

Opportunities: Why Tokenized Bonds

Given the challenges, why involve a public blockchain platform at all in regulated security offerings?

One benefit for tokenized securities: more efficient interactions (such as transfers) and consequential cost reductions. These gains can be small if the processes involved are handled through a single financial institution. The public nature of blockchains shines when multiple entities cooperate in the issuance and handling of tokenized securities. Instead of developing ad-hoc integrations between the different parties, it can then be very attractive to lay down the terms of cooperation in a smart contract and subsequently rely on the blockchain to enforce those terms and synchronize between parties.

A good example is a simple whitelisting functionality to enforce permissioned transfers. Before an address may receive tokens, it needs to be explicitly whitelisted. Having a single administrator role that can whitelist addresses would pose a significant bottleneck for day-to-day operations. A recently developed token standard for the Tezos Blockchain 4 introduced a hierarchical system where administrators could nominate addresses that could subsequently whitelist addresses. Thus, the issuing institution can allow an exchange to whitelist customer addresses independently. An audit trail that records who allowed transfers to a particular address is then readily available.

This example demonstrates how public blockchains can enable defining “the rules of engagement” between financial institutions, allowing them to cooperate on a flexible basis and consider a diverse range of securities and institutional arrangements.

Tokenization can transform almost any asset, real or virtual, into a digital token, but not everywhere in the world is already using this new technology. In 2020, the U.S. took a pioneering role again, but other countries are also already experimenting with the possibilities of these financial instruments. We will deal with this topic in another article next week.

1 Source: “Projection of Tokenized Asset Market 2021 – 2025,” Finoa, page 43

2 Source: “Plumbing for the future of security tokens: Implementing KYC in bank transaction processes.” Dr. Lewin Boehnke, Crypto Finance Group, page 20

3 https://www.admin.ch/gov/de/start/dokumentation/medienmitteilungen.msg-id-77252.html

4 https://github.com/rogerdarin/Digital-Asset-Rules/raw/main/Digital_Asset_Rules_S1_v0.3.pdf

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.