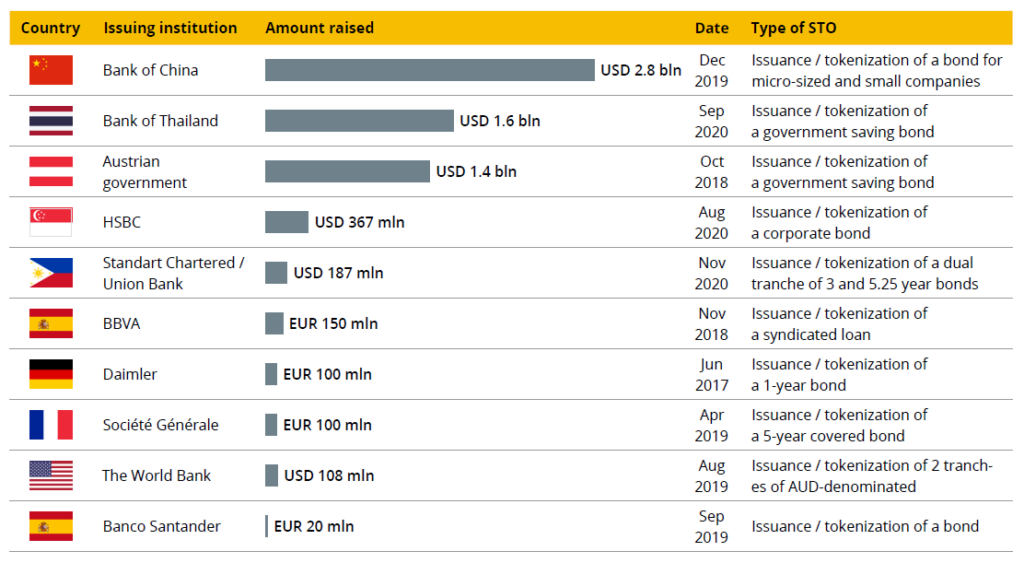

The increasing number of STOs issued by established institutions indicates the potential of this fundraising mechanism. As the mechanism ripens, more countries and corporations tap into piloting STOs for bond issuance.

Key efficiencies observed within the pilots include elimination of settlement risk (for issuer, arranger and investors), reduction in primary issuance settlement (from 5 days to 2 days), as well as automation of coupon and redemption payments and registrar functionality.1

Thanks to the provided benefits in improving liquidity and transparency in the bond markets, debt tokens could disrupt the bond issuance process worldwide. The European digital asset custodian Finoa estimates that $2.65 trillion will be invested in securitized debt tokens by 2025 (see Chapter 3).

“The marriage of a digital order taking platform and backend infrastructure driven by tokens is the future of retail bonds. We are keen to see the day when investors can buy and sell bonds, even on the secondary markets at a click of a button on their phones.”

UnionBank Executive Vice President and Chief Finance Officer, Jose Emmanuel Hilado 2

Most Notable STOs by Institutions, 2017 – 2020

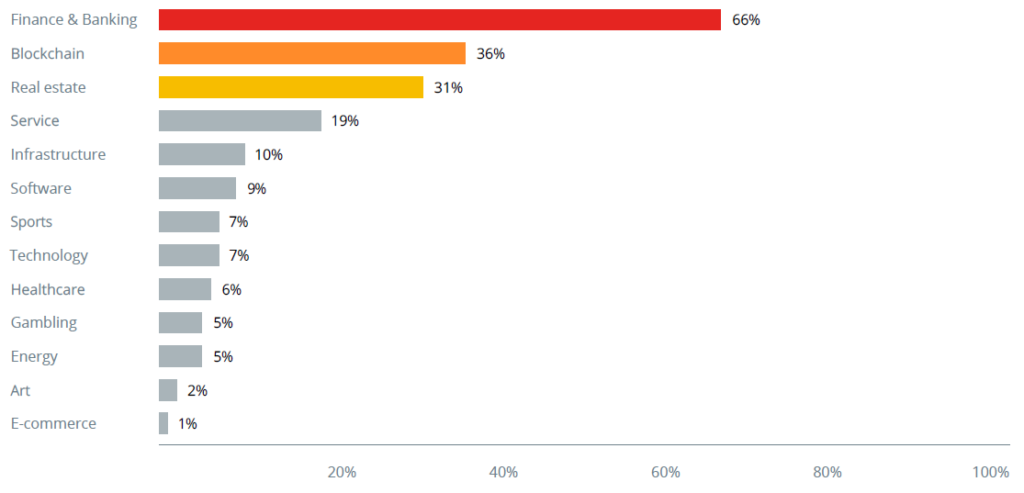

Between 2017 and 2020, STOs were most frequently used for financial services, and this category includes bonds issuance.

Number of STOs by Sector, 2017 – 2020

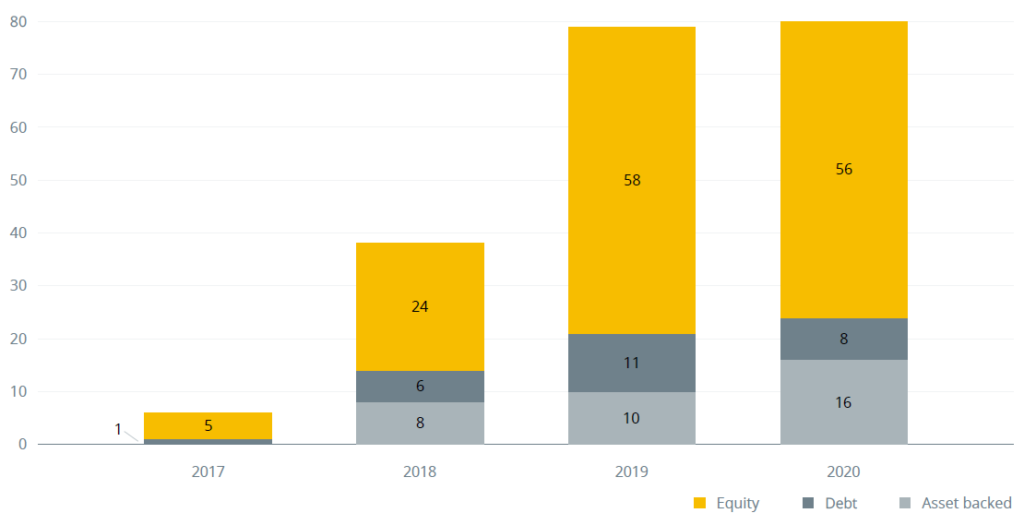

Asset Classes Offered in STOs, 2017 – 2020

Looking across the asset types that are being tokenized, equity remains king, although asset backed securities saw a steady increase (mainly due to real estate).

Type of Asset offered by the STOs by year, 2017 – 2020

Is the tokenization of a security an all around opportunity or does it also pose a risk to certain institutions and companies? This is a question we intend to explore in another article next week.

1 https://www.sgx.com/media-centre/20200901-sgx-collaboration-hsbc-and-temasek-completes-pilot-digital-bond-olam

2 https://av.sc.com/…/SCB_PR-UnionBank-Standard-Chartered-pioneer-blockchain-enabled-bond-issuance-in-the-Philippines-.pdf

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.