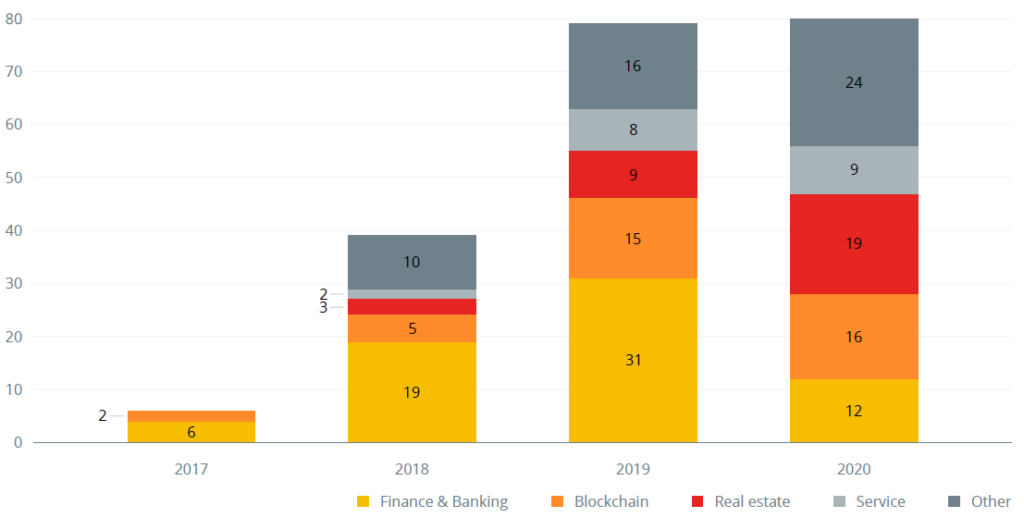

Overall, the number of publicly announced STOs increased in real estate, technology, heavy industries, and consumer services between 2019 to 2020. But the highest growth segment in 2020 was real estate.

It more than doubled its number of offerings compared to 2019, while finance and banking saw a steep decline to nearly a third of the previous year’s figures.

Total Number of STOs by Industry, 2017 – 2020

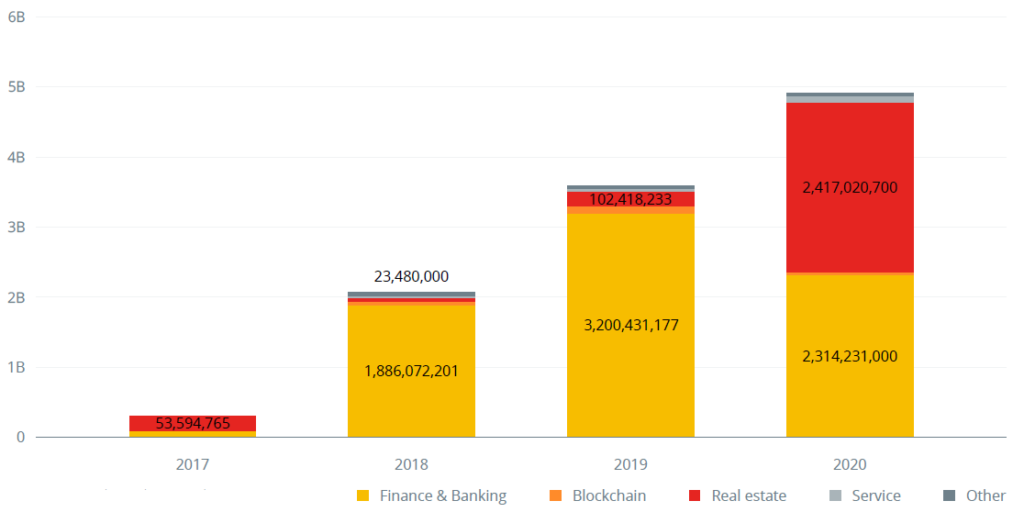

When it comes to the amount raised, real estate is again at the top with banking and finance taking second place. As mentioned previously, this is mainly due to the Red Swan project accounting for almost all of the capital raised during 2020.

Amount Raised by Industry, 2017 – 2020

Security Tokens Raised $5 Billion in 2020

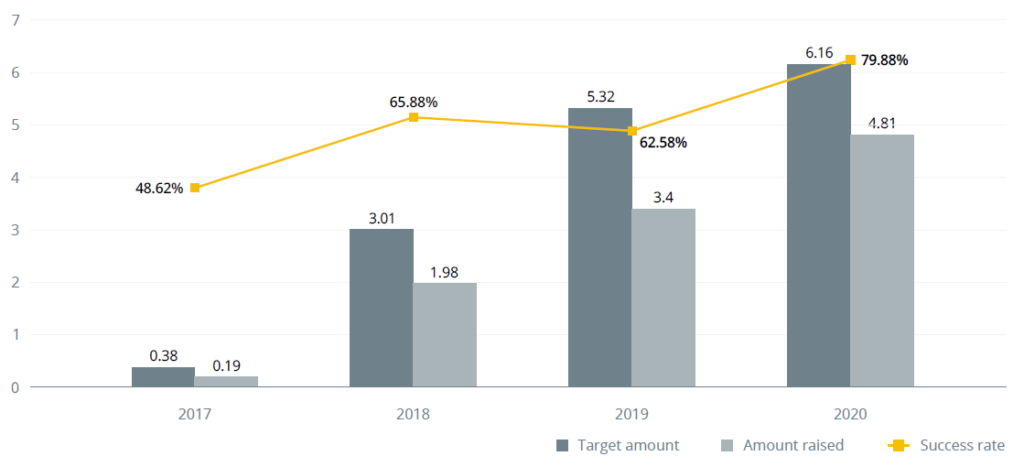

Both the target raise amount and the raise amount saw an increase in 2020, however, the most important trend is the increasing success rate (in terms of % of target raised) which seems to have steadily increased over the past four years, as more and more investors begin to familiarize themselves with STOs.

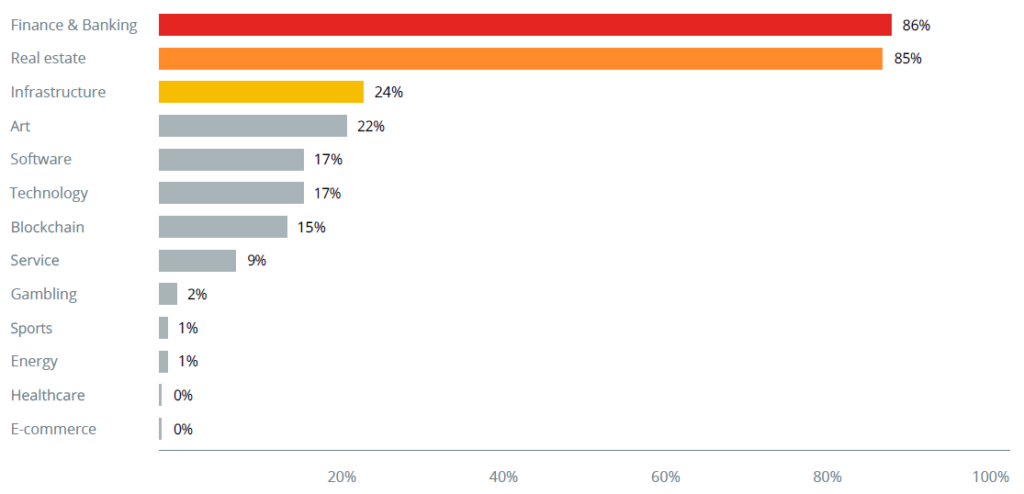

The major segments behind the higher success rate are finance and banking and real estate, as all other segments seem to be lacking in this regard.

Target Amount vs Amount Raised in STOs, 2017 – 2020, $billion

Percentage of Funding Goal Reached, 2017 – 2020

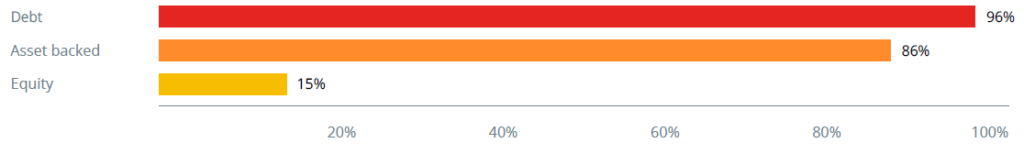

That being said it is interesting to see that debt is the best performing class in terms of % of the raise target achieved, followed closely by asset backed. Equity lags way behind. This is likely due to the perceived risks across those different kinds of security tokens.

Percentage of Funding Goal Achieved by Underlying Asset Class, 2017 – 2020

More countries and companies will also try out STOs for bond issuance as the mechanism matures. We will turn to this topic in an article next week.

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.