How are investors in the DACH region accessing cryptocurrencies? What digital asset investment vehicles are particularly popular among professional investors? Which difference is there between the financial landscape in individual states within the DACH region? Questions like these play a particularly important role in a global context, for instance, when it comes to economic analyses for the various German-speaking jurisdictions.

The European Securities and Market Authority (ESMA) reported that investment in alternative investments across Europe was €4.9 trillion in 2019. According to Preqin’s 2019 study on alternative investments in Europe, Germany has €58 billion invested in alternative assets. The largest sector of Germany’s alternative investments is private equity and venture capital, accounting for 23.4%. This is followed by real estate (13.5%), hedge funds (12.2%), infrastructure (5.1%), and private debt (2.9%). Per adult capita, Germany’s investment in alternative assets is approximately €1,248. In comparison, Switzerland has approximately €60 billion in assets under management dedicated to alternative investments. Hedge funds are the most attractive investment vehicle for Swiss investors representing 24.9%. This is followed by private equity and venture capital (14.4%), infrastructure (12.3%), private debt (5.0%), and real estate (2.1%). Per adult capita, Switzerland’s investment in alternative assets is approximately €12,212. Despite Switzerland’s smaller number of potential cryptocurrency investors, the investment amount per adult capita in alternative assets is 10x higher in Switzerland than in Germany. This provides evidence that Swiss investors may have more of an appetite for digital assets.

In the USA, some institutional investors have already invested in financial products that give them exposure to digital assets. Two pension funds in Virginia including the Fairfax Police Officer’s Retirement System and Employees’ Retirement System invested $55 million (€46.2 million) in Morgan Creek’s cryptocurrency fund in October of 2019. Yale University invested in two cryptocurrency funds during 2018 including Paradigm’s $400 million (€336 million) fund and Andreessen Horowitz. The University of Michigan’s endowment also invested $3 million (€2.5 million) in the Andreessen Horowitz cryptocurrency fund. Other university endowments including Harvard, Stanford, Dartmouth, Massachusetts Institute of Technology (MIT), and the University of North Carolina have all invested into digital assets via various financial products.

This section discusses how investors in the DACH region actually gain access to cryptocurrencies and highlights the most popular crypto asset investment vehicles for professional investors in each region.

Financial Landscape in Germany

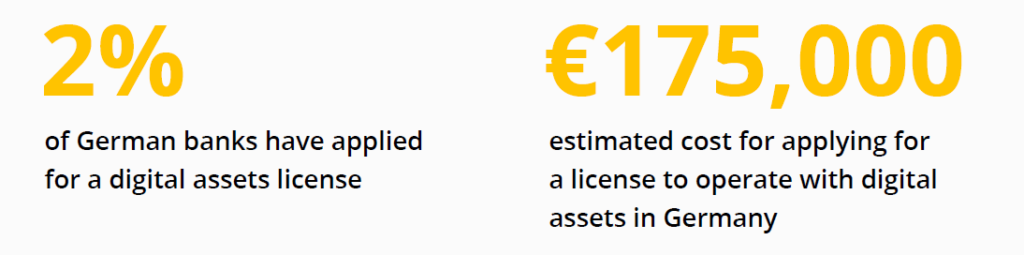

The recent developments in Germany show that financial intermediaries are heavily investing in blockchain infrastructure. In early 2020, over 40 German financial intermediaries applied for a license from BaFin to be allowed to take custody of digital assets. This represents over 2% of Germany’s 1,800 banks. The license costs approximately €175,000 which indicates that many banks are banking on blockchain-based systems becoming the infrastructure technology of future financial markets. For this reason, the legislator is creating the necessary regulatory requirements and engaging in discussions that will decisively shape the financial market of tomorrow. Regarding the development of the necessary regulatory framework for digital assets, two aspects stand out. First, in December 2019, crypto asset custody was incorporated as a financial service in the German Banking Act (KWG) and, therefore, requires authorization from the financial market authority, BaFin, since January 1, 2020. Second, the German legislator published a draft bill in August 2020, which intends to abolish the mandatory paper-based certificate for securities. This development can be regarded as revolutionary — as it signifies a break with a system that is over a hundred years old.

However, besides the regulatory development, companies that actively offer products and services are the foundation for driving the adoption of blockchain technology. For this reason, we provide an overview of the companies in Germany that enable institutional investors to access crypto assets, such as Bitcoin and Ethereum. The analysis shows that the current market is already more fragmented than one may think.

The German legislator has created a regulatory framework that enables financial institutions to invest in crypto assets. At the same time, several companies and banks have also set up the appropriate technical infrastructure for the professional trading of Bitcoin & Co. In sum, this leads to an increased and more differentiated offering around crypto assets. Financial services in the crypto segment have, for some time, included instruments which, for example, reflect the price of Bitcoin or market places for retail investors. Now, however, fully regulated trading venues for professional investors like BSDEX are emerging. Also, some banks are establishing themselves as a BaaS platform. Solarisbank AG and Bankhaus von der Heydt, for instance, provide other financial institutions with the regulatory and technological infrastructure to enable access to crypto assets for their customers. It will be exciting to see how the market develops, given the fact that BaFin will issue first licenses for crypto custody later this year.

How interesting, then, is the German target market for professional investors and what is the difference between it and the Austrian or Swiss markets? We will explore this question in the next part of this series, with the Swiss market in particular being an interesting object of observation.

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.