In the previous article of this series, we spoke with Stefan Andjelic from Raiffeisen Bank International (RBI) about Digital Assets. In this week’s installment, however, we wanted to look at this topic from a different angle, which is why we talked to Professor Dr. Michael Hanke from the Stiftung Personalvorsorge Liechtenstein.

Bringing a different perspective to the discussion, Professor Dr. Michael Hanke from the Liechtenstein-based pension fund explained that although regulations are not holding them back from investing in digital assets, there are other problems. Hanke points out that pension funds invest on the behalf of pensioners, but they have no way of gauging what the pensioners want them to invest in unless the pensioners actually call up on the phone or send an email requesting their pension to invest in crypto assets.

“Pension fund management is different from other asset management, like fund management, because with funds, you manage the money of clients that have voluntarily selected to invest in your strategy, so you know that they are okay with your asset allocation and strategy.”

— Dr. Michael Hanke, Stiftung Personalvorsorge Liechtenstein

The general public is still very skeptical about digital assets. If pension funds were to invest in assets that are still viewed critically in the eyes of the general population, they risk damaging their reputation, especially if something goes wrong. After all, pensioners cannot choose their pension fund themselves — the choice is made by the employer — which is why this duty of care is required. Hanke also discussed how pension funds in Liechtenstein are not held back from investing in digital assets by regulators. As a second tier pension fund in Liechtenstein, the laws that impact them are set at the federal level in Liechtenstein.

Pension funds, in particular, have another argument against digital assets: Apart from the liquidity that an asset class has to provide to a pension fund, they invest with a very long time horizon. However, the crypto world still seems to be characterized by short-term hypes, rapid incidences of success but also sudden loss stories. In this sense, according to the perception on the part of

pension funds, the world of digital assets does contradict the long-term view of pension funds.

Stiftung Personalvorsorge Liechtenstein is managing CHF 1.2 billion, and Hanke says it would take between 18 months to 24 months before they could actually invest, if they decided to invest, due to the administrative processes that exist when adding a new investment.

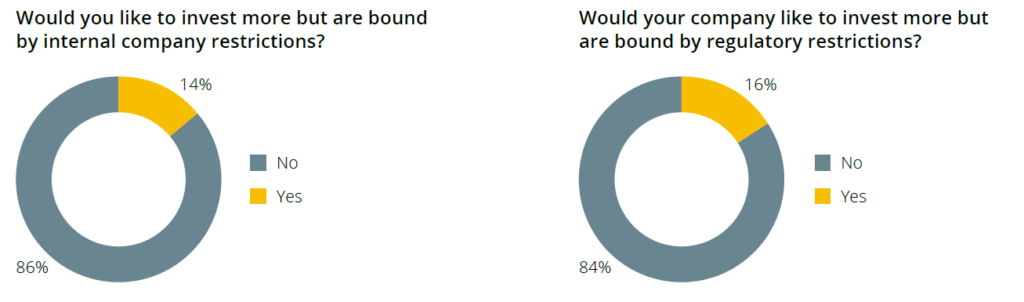

Not being held back by regulations was also echoed by the survey respondents. Rather, asset allocators felt more

constrained by their own employer than by government policies.

How do these figures from the pension fund segment fit into the overall financial landscape? The European Securities and Markets Authority (ESMA) reports that the number of investments in alternative assets across Europe was EUR 4.9 trillion in 2019. We will take a closer look at this figure and its distribution in our next article.

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.