As one of the most dynamic fintech regions in the world, APAC continues to expand, adapt and evolve in relation to virtual asset adoption. It is also one of the most diverse – spanning multiple jurisdictions without any general “passporting”.

In the security token arena — comprising both digitalised traditional securities and more novel assets that amount to “securities” — APAC is proving an important testing ground, particularly as the pace of more widespread digitalisation increases. Key to this is government digitalisation itself — many emerging markets see this as the crux of leapfrogging traditional phases of development: why waste resources with legacy systems when you can dive straight into the 21st Century?

State of play

To cut to the chase, most jurisdictions across APAC have securities laws. Broadly, they capture shares, bonds, notes, funds and a range of other instruments. In some markets (like Hong Kong), retail structured products also dovetail into the securities regime post-financial crisis reforms. That can capture things like perpetuals/CFDs and certain stablecoins.

When lawyers look at a virtual asset from a securities law angle, we’re often thinking about the same things as most markets — besides considering traditional securities, does it tip into the investment scheme category? Each jurisdiction has its own concept and tests — collective investment scheme in Hong Kong, management investment scheme in Australia etc. At a high level, we’re looking for passive rewards (actual or promised), which can flow from things like profit-enhanced utility tokens and fractionalised asset-backed tokens. In my experience, the tests are a lot clearer in most APAC markets than the brutally elastic Howey Test in the US.

Of course, security tokens can be far more evidently securities — digital shares, digital bonds etc — DLTbased at a fundamental architectural level or represented by a mirror token (or “digital twin”) on a DLTbased ledger.

Where do jurisdictions diverge?

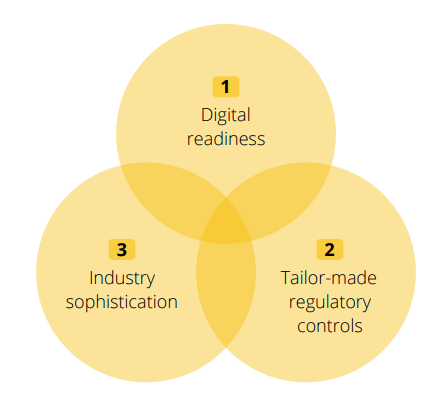

So if most jurisdictions already regulate securities, where do they diverge? In three key areas:

Digital readiness

This refers to three essential elements:

- Digital equivalence legislation — recognising digital signatures, contracts and information. Without this, digital transactions do not have legal recognition. This is in place in multiple jurisdictions already (Singapore, Hong Kong, Australia), but it is also rapidly expanding beyond the core minimum, with jurisdictions like Thailand launching modernised laws and others like Vietnam in the pipeline. Express statutory recognition of smart contracts is still an outlier but gaining traction;

- Mnimal / no paper-based requirements — the efficiencies of a security token offering are greatly diminished when a transaction needs to split into a paper-based workflow. For shares, for example, three key items we look for in any jurisdiction are (i) register formalities; (ii) mandatory share certificates; and (iii) stamp duty / other tax procedures on assignment; and

- Ancillary “plug-ins” — technologies such as digital identity, open API channels to “golden source” government data and even central bank digital currencies (CBDCs) can help make the case that security tokens provide a genuine uplift over a traditional securities regime. In this respect, APAC is galloping ahead — on CBDC projects alone, Mainland China, Hong Kong, Thailand, Japan and Cambodia are already in pilot phase or launch, with others such as Australia revisiting it again. This also ties into industry considerations below.

Of course, we also look for any other deal breakers in relation to issuance and trading — for example, data localisation requirements, assignment formalities, underlying asset (eg gold, real estate) controls etc. To be clear, not all of this is relevant to transactions alone — some are more relevant to issuance, meaning if you can find a good “digital domicile” for the security, the issues can be more streamlined in other places.

Tailor-made regulatory controls

This is where certain APAC jurisdictions are pulling ahead, designing properly bespoke regimes that tackle the novel prudential controls that DLT-based assets require to achieve market integrity and investor protection aims. These tend to leverage existing securities law licensing and conduct requirements, but apply an additional lens to compliance.

This is an enormously important thing. Why? Because despite often loud protestations to the contrary, regulated financial institutions don’t really like to be left to their own devices in designing controls. Principles-based approaches don’t work when they are too high level, because we all know firms are judged with 20-20 hindsight when things go wrong. Those in Asia recall this all too well in the ashes of the Lehman Brothers structured products debacle in 2007/08 and in subsequent rate-setting, FX and algorithmic trading scandals that embroiled them and global counterparts.

And yet, security token platforms and wallet technologies are relatively young, so a blend of principles-based and prescriptive requirements is essential, with latitude for future flex. This helps achieve balanced and proportionate rules than can bend and change.

A few examples of this more bespoke approach include the following:

- Hong Kong — the Securities and Futures Commission (SFC) has multiple initiatives to support the security token ecosystem, ranging from guidance to brokers and fund managers, through to a bespoke regime for exchanges that offer at least one security token (often called an “Opt-in Regime”). A more broad-based virtual asset regulatory regime beyond security tokens is currently under consultation by the Financial Services and the Treasury Bureau (FSTB). The current SFC regime for exchanges carries a sophisticated level of requirements from minimum financial and personnel requirements, through to custody, market surveillance and conduct rules. The SFC granted its first licence for a security token exchange

in December 2020 to OSL Limited, a member of the Hong Kong-listed BC Technology Group. The FSTB proposals signal an expectation to keep retail out by applying a professional investor-only condition, mirroring the current SFC Opt-in Regime for security tokens. This is under significant debate. - Japan — Over the past year, the Financial Services Agency has implemented specific rules relating to security token offerings and virtual asset derivatives under the Financial Instruments and Exchange Act and related instruments. Additional rules for exchanges have also been implemented. A key aspect of the security token-related rules is a clarification of how these fit into Japan’s “Paragraph I” vs “Paragraph II” securities regime that impacts how they are offered and sold. Market manipulation and other prudential rules have also been implemented.

- Singapore — Singapore has been actively building a sophisticated virtual asset framework that encompasses everything from payment tokens (within the Payment Services Act) through to security tokens (under the Securities and Futures Act), with a lot in between. In mid-July 2020, a Monetary Authority of Singapore-approved exchange called 1x was launched. Since then other players such as incumbent behemoth DBS Bank have announced their own plans to enter the space.

- Taiwan — The Financial Supervisory Commission of Taiwan clarified that security tokens fall within the existing Securities and Exchange Act in 2019. Like a number of other jurisdictions, retail is out. Other requirements such as NT$ denomination and maximum offer size for certain security token offerings, information standards, plus high minimum financial resource requirements for exchanges apply.

- Labuan (Malaysia) — Labuan is a special Malaysian territory and “international business and financial centre” that has developed a large-scale framework for the virtual asset sector. The Labuan Financial Securities Authority has actively pursued a digital strategy, including licensing two digital securities exchanges (within the Fusang Group and GSX Group). An array of conduct, financial resources and risk management requirements apply.

- Thailand — The Securities and Exchange Commission has regulated digital asset businesses since 2018, with several licences issued for more “classic” virtual asset brokers, exchanges and dealers with various requirements imposed on issuance and prudential standards. More recent regulatory developments focus on blockchain-based securities and providing a pathway to tokenisation, depositary activities and exchange. Reports suggest the Stock Exchange of Thailand is setting up a security token exchange.

Clarity of tax and accounting treatment is also a critical feature, but generally significantly behind. The same applies in relation to other issues such as data privacy.

Industry readiness

Finally, at the heart of security token development is industry readiness — for example —

Across APAC, this ecosystem is growing and often leveraging global offerings by providers such as analytics firms. However, industry sophistication and size varies across different markets. For example, institutional appetite varies — key examples being:

- Australia — product development is well underway, including at an institutional level. This includes the World Bank’s digital bond managed by Commonwealth Bank of Australia (among others) — the first created, allocated, transferred and managed with DLT. There is on the other hand limited roll-out of security token platforms on a public scale at this stage, although it is worth noting that the Australian Stock Exchange is expected to implement DLT as part of its proposed new clearing and settlement system for shares.

- Labuan (Malaysia) — one of the world’s largest digital bond offerings involving China Construction Bank and the Fusang Group was tipped for a USD 3 billion raise, although it was paused shortly before launch with further news to be announced.

- Japan — two key market developments of note include the establishment of a self-regulatory body for security tokens — the Japan Security Token Association — involving the likes of local heavyweights Nomura, SBI Securities, Rakuten and Daiwa Securities; and secondly, Announcement of SBI Digital Asset Holdings institutional-grade digital wallet solution integrated with Securitize’s digital securities platform. SBI has also announced a Singapore digital asset joint venture, with an exchange planned for 2022 including digital bonds, equities and securitised loans.

Concluding remarks

Digital economies across APAC are expanding swiftly. Regulators have attuned perspectives on shaping their securities markets amidst rapid digitalisation. There is a strong degree of directional harmony to ensure issues such as the FATF Recommendations and investor protection are covered, but different views on issues such as financial resources, market participation, prudential controls, security token structuring and retail access — as well as adjacent technology availability and regulation — make a close assessment of each target market important.

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.