Ether, or ETH, are the native tokens of Ethereum. It has no cap, and there are currently 118.9 million Ether in circulation. Ether is added when miners are paid for finding blocks (block rewards), and decreases as base transaction fees are burned. In 2021, Ethereum has a net annual inflation of 1.8%.

Ether’s price has been above $3,000 since August 2021, and its average market capitalization was $440 billion in October 2021. Starting in July 2020, its market cap rose in tandem with the TVL. In December 2021 the ratio of market cap to TVL was around 2.9x which places Ethereum between Fantom with just 0.76x and Solana with 4.4x. This is a good measure for how valuable a chain is in relation to the assets locked.

Figure 1: Ethereum’s price near all-time-highs in December 2021

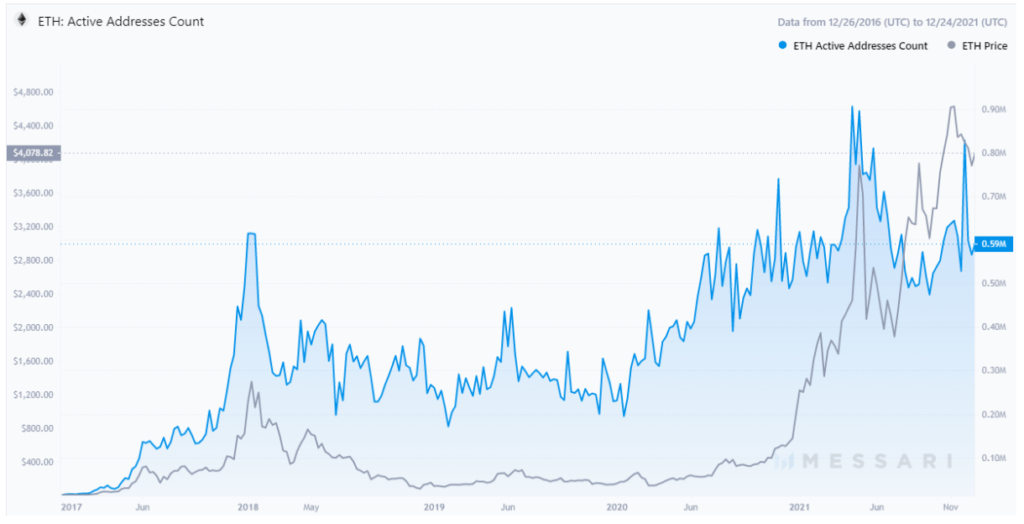

Ethereum daily active addresses

The number of active addresses represents the number of accounts with at least one transaction on a given day, which is a good measure for the overall liveness of a blockchain. Ethereum surpassed 500,000 daily active addresses in the second half of 2021 and peaked at 800,000 in November 2021. Growth has been hampered by high transaction fees and longer wait times lately, as can be seen by the plateau on the graph above, which started in May 2020. The amount of active addresses is likely to stay at current levels until major technical upgrades become available.

Figure 2: Ethereum active addresses surpass 500,000 in the second half of 2021

Ethereum protocol revenue and price-to-sales ratio

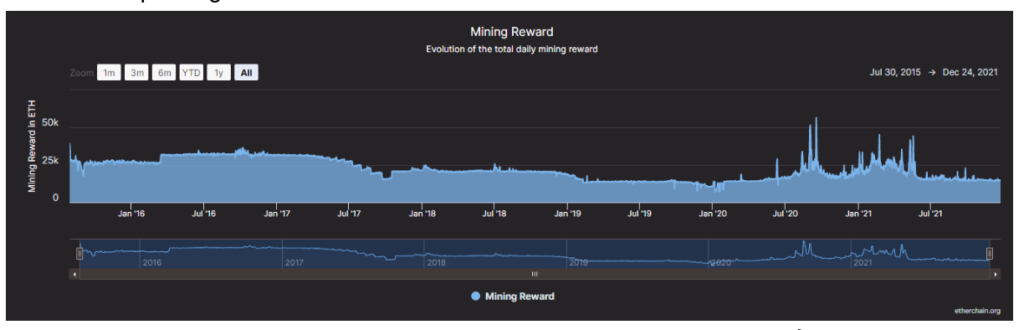

The Ethereum network currently employs a PoW consensus mechanism. More on this later. Miners secure the blockchain in return for block rewards and transaction fees. Block rewards

were 5 ETH per block until October 2017, when the Byzantium upgrade reduced the rewards to 3 ETH per block. The Constantinople upgrade in February 2019 went a step further, and now miners receive only 2 ETH per block or around 13,000 ETH per day for their services.

Figure 3: The total mining reward per day in ETH is the block rewards plus the transaction fees

Transaction fees are now split into base and priority fees ever since Ethereum Improvement Proposal 1559 was implemented, part of the famed August 2021 London upgrade. Apart from different naming geography, it introduced a mechanism to burn the base transaction fees and only award miners the priority fee. The priority fee is like a tip that users add to their transactions to be processed quicker. Sometimes, substantial amounts are tipped during high transaction demand, like NFT launches. Burning the base fee will make Ether net deflationary when the network merges to its next iteration, Eth2, scheduled in 2022.

With Ether prices around $4,000, block rewards are close to $19 billion per year. Priority fees per day can peak up to 32,000 ETH. In the second half of 2021, they have evened out at an average of 1,500 ETH per day or $2.19 billion per year.

The price-to-sales ratio divides the market capitalization by the protocol revenue to make blockchains more comparable in the same way a price-to-earnings ratio does for stocks.

Ethereum has a 22.2x price-to-sales ratio, and a 214.9x ratio of price to transaction-fees. Both reflect a solid fundamental value of Ethereum when other blockchains such as Solana have a P/S of more than 30,000x.

1 More information about Ethereum’s inflation here

This article is an extract from the 80+ page Scaling Report: Does the Future of Decentralized Finance Still Belong to Ethereum? co-published by the Crypto Research Report and Cointelegraph Consulting, written by ten authors and supported by Arcana, Brave, ANote Music, Radix, Fuse, Cryptix, Casper Labs, Coinfinity, Ambire, BitPanda and CakeDEFI.