For several years legacy financial companies have started to integrate blockchain technology in their existing business model. While digital-native and decentral-native start-ups have been able to directly build on public blockchains like Cosmos, Tezos or Ethereum, legacy finance firms with their complex IT infrastructure started to test private blockchains in order to become familiar with the technology, remain regulatory compliant and experiment in a controlled and surveyed environment with their clients. R3 Corda for example has become the primary permissioned blockchain platform for the legacy financial service industry.

While many companies believe that this is the ultimate goal, several banks, like Goldman Sachs for example, have already left the Corda platform. They belonged to the early joiners, but already left in 2016. However, just last week, Goldman Sachs and Citi announced to conduct the first blockchain equity swap on an Ethereum inspired platform. To conduct this swap, they are collaborating with a new market player called Axoni.

Developments in the Permissioned Blockchain Space

Axoni gave an interesting talk in Prague at DevCon 4 in 2018. They introduced AxLang as a new programming language for secure and reliable Ethereum smart contracts. The speech can still be viewed on Medium. Similar to Hyperledger or Corda, their approach is to use a permissioned distributed ledger platform based on open source software in order to help legacy firms use blockchain technology to operate more efficiently with their customers. Axoni specifically focuses on derivative markets.

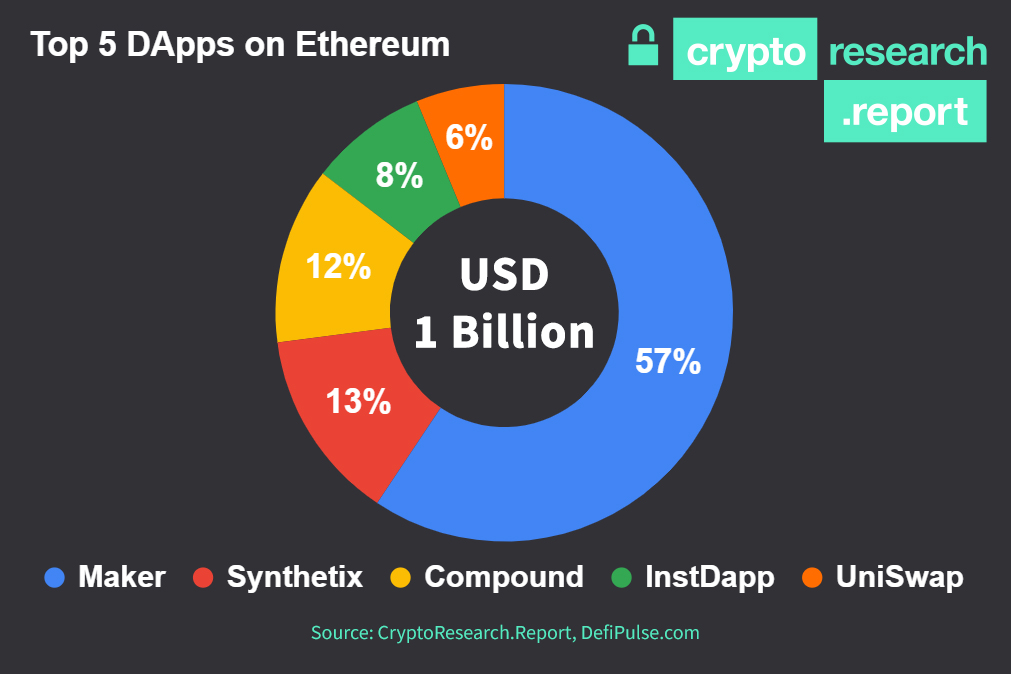

The big advantage is that their infrastructure is built on Ethereum, which is still the largest used blockchain for DeFi applications. According to Defi Pulse, the total value locked in Defi surpassed USD 1 billion on February 9, 2020.

Figure 1: Top 5 DApps on Ethereum

Apart from the Lightning Network, which builds on Bitcoin, all DeFi applications are based on the Ethereum blockchain. This finding is confirmed by State of the Crypto Report, which shows the strong developments and progress around Ethereum and Bitcoin.

Previous market players have struggled to implement Ethereum based permissioned applications. Bank Vontobel, previously a Premium Partner of the Crypto Research Report, for example wanted to launch a certificate on ethereum as well, but there was one main problem. The legal situation and the lack of a payment token recognized between banks has prevented them from conducting the complete process exclusively on the blockchain.

Hence the news around the US investment banks Goldman Sachs and Citi using the Ethereum blockchain is even more positive. Especially with regards to the status of US crypto regulation, where the SEC is extremely reluctant and causes many roadblocks.

While there are just a few crypto advocates in the US, like the so called “crypto mom” Hester Peirce, the EU is overall much more crypto friendly, especially in Germany. Since the Money Laundering Act came into force on January 1, 2020, in which BaFin financial institutions were allowed to conduct crypto asset transactions, more than 40 institutes have shown interest in crypto custody business.

Solaris Bank for example has taken a similar approach to Fidelity with cryptocurrency custody. The young German bank Solaris AG founded the subsidiary Solaris Digital Assets GmbH in December 2019 as digital asset custody service provider. They consider themselves as tech company with a banking license. Alexis Hamel, Managing Director of Solaris Digital Assets says:

“We commit ourselves to become the leading infrastructure provider for the European digital asset ecosystem. We trust that by lowering the hurdles for digital asset pioneers, we are contributing to the development of a functional and secure decentralized world, which will transform the way we exchange value around the globe.”

Alexis Hamel

Private blockchains can constitute the perfect testing environment for legacy firms in order to learn about the technology and make their clients familiar with it. However, in order to unlock the full potential of DLT solutions, the ultimate goal should be the use of public blockchains and full business integration of digital assets.

Sources:

https://fortune.com/2016/11/21/goldman-sachs-r3-blockchain-consortium/

https://www.forbes.com/sites/michaeldelcastillo/2020/02/06/citi-goldman-sachs-conduct-first-blockchain-equity-swap-on-ethereum-inspired-platform/

https://axoni.com/

https://defipulse.com/

https://www.stateofcrypto.report/

https://cvj.ch/invest/finanzprodukte/zweiter-blick-vontobels-strukturiertes-produkt-in-form-eines-asset-token-auf-der-ethereum-blockchain/

https://www.handelsblatt.com/finanzen/banken-versicherungen/digitale-assets-banken-wollen-ins-krypto-geschaeft-einsteigen/25521910.html?ticket=ST-529294-RcShNtKPAt1pJggqK2LS-ap6