Understanding institutional interest is a key aspect of analyzing the cryptocurrency market. Digital asset fund performance reflects this dynamic accurately, as can be expected. Ecosystem-specific funds like the VanEck Avalanche ETN, or the 21 Shares Solana Staking ETP fell in tandem with the underlying cryptocurrencies, while short-selling strategies such as Betapro’s Inverse Bitcoin ETF gained.

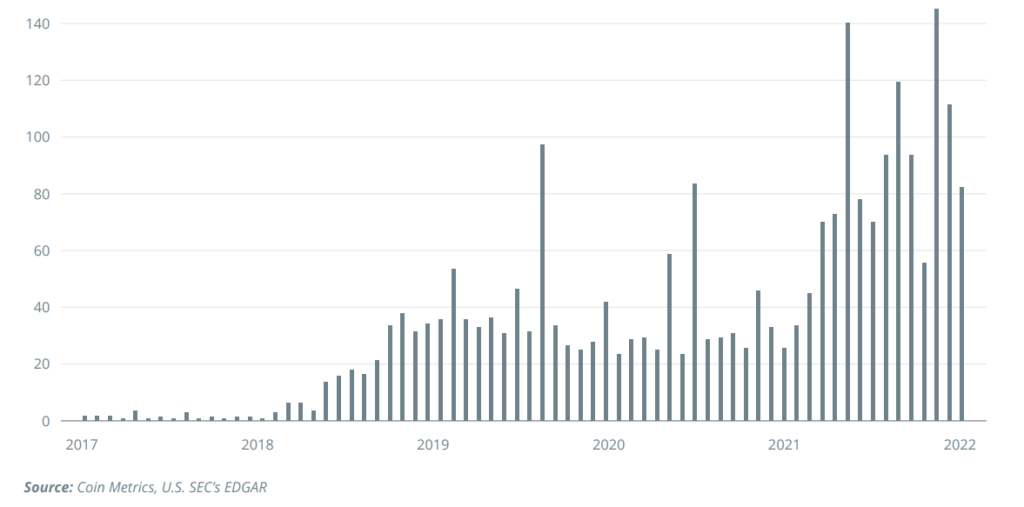

Another way to gauge institutional interest is to check Form 13F filings. An institutional investment manager who has investment discretion of $100 million or more must report holdings quarterly on Form 13F with the United States Securities and Exchange Commission. Only a subset of a fund’s investments need to be reported, and any positions in spot BTC do not need to be filed. However, crypto-related investment vehicles, such as trusts, are often disclosed in Form 13F.

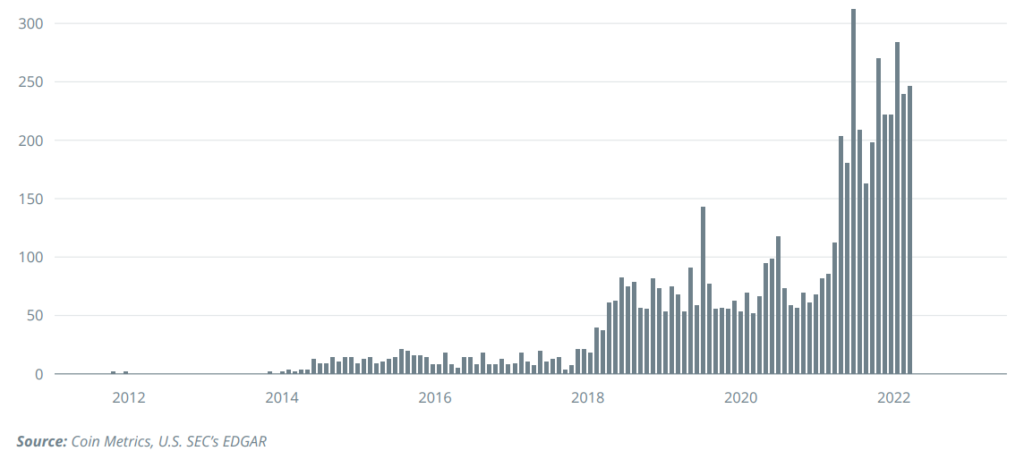

Number of Unique Entities Mentioning “Bitcoin” in SEC filings, Monthly

This surge in institutional interest can be attributed to a number of factors, including the increasing acceptance of cryptocurrencies by mainstream financial institutions and the growing awareness of Bitcoin and other cryptocurrencies as a legitimate asset class. As institutional investors continue to recognize the potential of cryptocurrencies as a hedge against inflation and a means of diversifying their portfolios, it is likely that we will see further increases in institutional investment.

In addition, as regulatory frameworks for cryptocurrencies become more established, institutional investors may become more confident in their ability to invest in the cryptocurrency market without fear of legal or regulatory repercussions. This could lead to even more investment in the space, as institutional investors seek to capitalize on the potential upside of this emerging asset class. Overall, the increase in Bitcoin-related filings in 2021 highlights the growing interest among institutional investors in cryptocurrencies and suggests that the cryptocurrency market may continue to attract significant investment in the coming years.

Coin Metrics’ analysis of the SEC’s EDGAR database shows a significant increase in Bitcoin-related filings in 2021, indicating a growing interest among institutional investors in the cryptocurrency market. As the market continues to mature and become more regulated, it is likely that institutional investment in cryptocurrencies will continue to grow.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.