Institutional investors have various options to gain exposure to the cryptocurrency market, including investing in blockchain companies through traditional routes such as seed, VC, growth stage private equity, or mergers and acquisitions. This approach offers a better understanding of legal, accounting, and tax implications in comparison to direct investments in cryptocurrencies.

Apart from directly purchasing digital assets, institutional investors can gain exposure to this market by investing in blockchain companies via the traditional routes of seed, VC, growth state private equity or mergers and acquisitions. The advantage of investing in a blockchain company is that the legal, accounting and tax implications are well understood in comparison to the mirky gray area associated with directly purchasing cryptocurrencies.

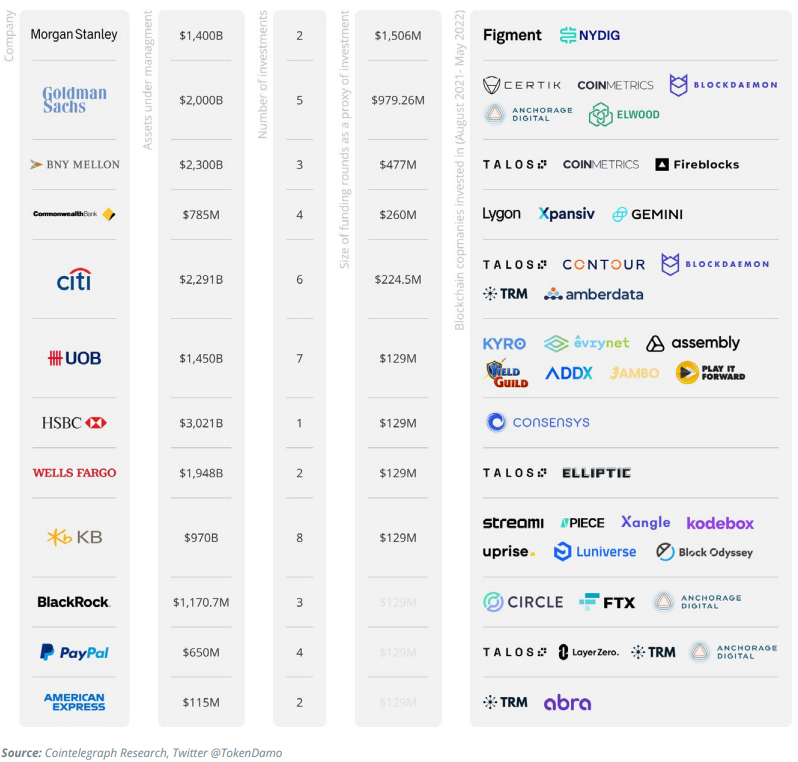

Top Banks, Asset Managers and Payment Companies Investing in Crypto and Blockchain Companies

We can see that many major banks have invested in either blockchain infrastructure companies, such as Fireblocks, cryptocurrency exchanges, such as Gemini, or analytics companies, such as Amberdata. The trend is clear in what types of companies are being invested in — compliance, custodial, and infrastructure. The trend is clear in what types of companies are being invested in – compliance, custodial, and infrastructure.

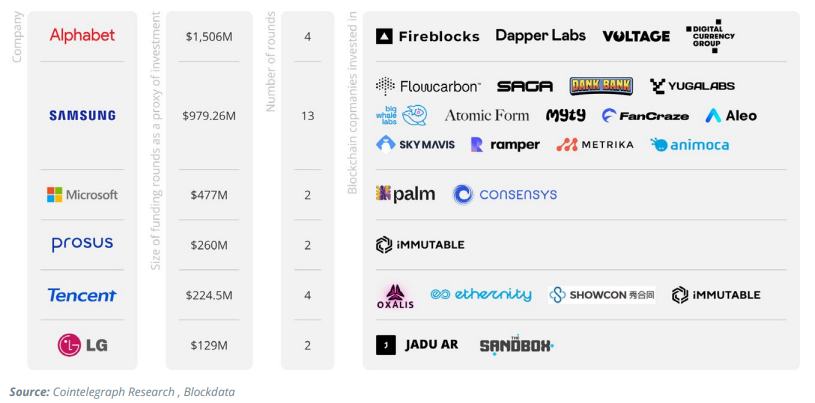

Top Public Companies Investing in Crypto and Blockchain Companies

In addition to banks, global technology giants are also investing in blockchain and crypto companies. The most active investors include household names such as Samsung, PayPal and Google’s parent company, Alphabet. Apart from blockchain developer companies, such as Layer Zero, Immutable and Talos, digital asset custodians, such as Fireblocks or Anchorage, were popular choices, as were GameFi powerhouses like The Sandbox and Dank Bank.

Investing in blockchain companies offers institutional investors a well-understood legal, accounting, and tax framework. This approach has attracted major banks and technology giants who have invested in compliance, custodial, and infrastructure companies. As the crypto market continues to evolve, it is likely that more traditional investors will look towards this route to gain exposure to the market.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.