A new crypto fund report published by Cointelegraph Research investigates how the Dash protocol’s innovative design provides security benefits to its users, as well as a thorough examination of the tokenomics and value proposition. The report highlights how investors can participate in Dash, and what future possibilities for users and developers will emerge from Dash’s upcoming developments.

Cointelegraph Research presents facts and figures on all aspects of Dash in collaboration with multiple research partners including Allnodes, Staking Rewards, CryptoRefills, CoinRoutes, intotheblock, Bitwise, Santiment, and Rekt Capital. Dash’s unique features as a payment solution including its role as an asset for investments are examined. The report is intended for investors who want to learn more about the cryptocurrency.

Dash’s evolution will achieve a major milestone in 2022. With the launch of the Dash Platform on mainnet, developers and users will be able to take full advantage of a complete ecosystem for decentralized applications and data storage.

Link to Download the full report here, complete with charts and infographics

Cointelegraph’s Crypto Fund Survey Research

An original survey of over 2,000 crypto funds was conducted in 2021 to gain a better understanding of how investors feel about Dash. This 80+ page report, written by five authors from around the world, shows which funds currently hold Dash as well as the number of funds that plan to invest in Dash over the next year.

The 200 funds that participated in the survey manage an estimated total of $1.2 billion in cryptocurrency and blockchain investments. The survey revealed that:

- 20 funds already have Dash exposure in their investment portfolio.

- An additional 40 funds indicated their intention to invest in Dash within the next 12 months.

- 70% of the survey respondents requested to receive the results of this crypto fund report.

The study revealed these 20 asset allocators reported that they already have exposure to Dash in their investment portfolio including Digital Capital Management, Liquibit Limited, BN Capital, Postera Capital, Blockwall Capital, Hilbert Capital, Smart Block Laboratory, Asymmetry Asset Management, Resilience AG, Pecun.io, All Blue Capital, INDX Capital, EZCAMG, Plutus21 Capital, How2Ventures, Block Ventures, Parallax Digital, Bohr Arbitrage Crypto Fund, and Valkyrie.

Dash has distinguished itself from Bitcoin and other blockchains by emerging as one of the most prominent digital currencies focused on payments, i.e., becoming digital cash. The report not only explains how Dash’s masternode solution has helped to improve network scalability, but also elaborates on the regulatory environment for Dash and other cryptocurrencies in the world’s largest jurisdictions.

“As far as I know, there’s no other project that comes close to what we’re trying to build which is the ability to efficiently query information directly from the system database to users. We’ve seen a lot of DApps that store information on other blockchains, but they all require the use of oracles for their system to work. Dash Platform is going to be much more decentralized. Users on their mobile devices will be querying DAPI directly. There’s no oracle between them, users can query the blockchain directly with decentralized cryptographic proofs that the information is valid. You don’t have to trust any server. In my opinion, it will be a new paradigm of how decentralized systems can work.”

Sam Westrich, CTO at Dash Core Group

Aside from Dash’s vision and general features, the report delves into tokenomics, price performance, future development roadmap, and regulation. This report also outlines how Dash remains an innovative cryptocurrency that has evolved from a scalable payment solution to a Web3 ecosystem.

“Dash is a well-known, respected name in the payments space in many areas of the world, and has an engaged, loyal following. One of our goals at Valkyrie is to enable those underserved by traditional financial firms to have access to financial services, and expanding investment into the Dash ecosystem is part of that mission.”

Leah Wald, CEO at Valkyrie Investments

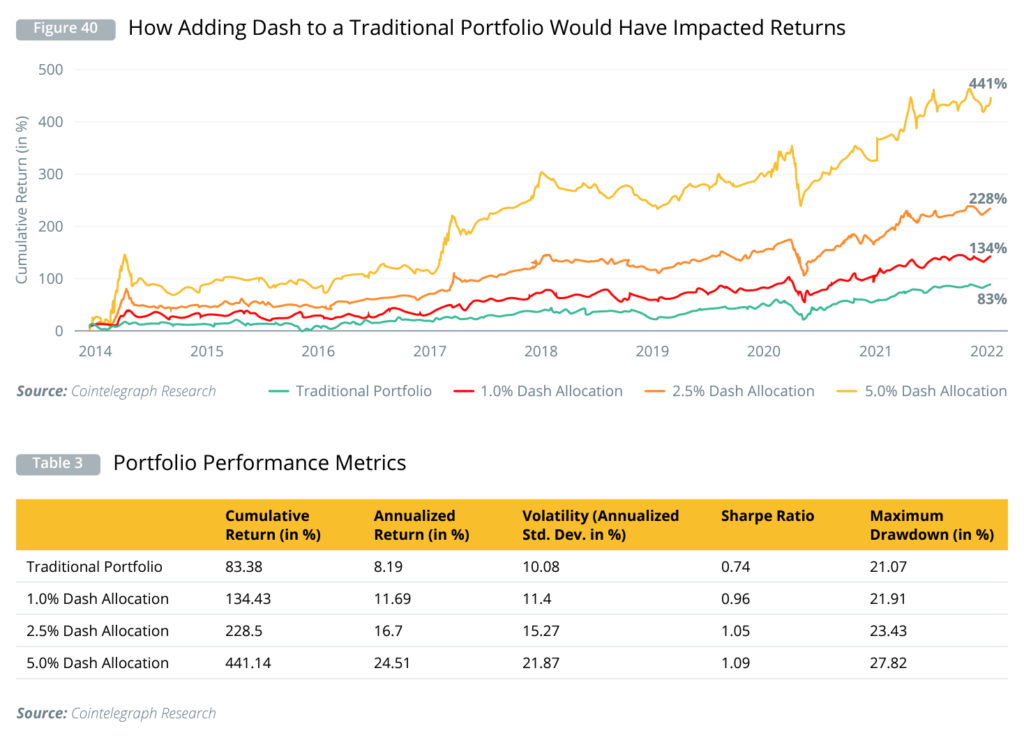

According to Cointelegraph Research, any amount of Dash can improve a traditional equity and bond portfolio by strengthening not only the cumulative return but also the sharpe ratio. Dash’s low correlation to traditional asset classes like equities and gold can also help investors manage their risk.

Link to Download the full report here, complete with charts and infographics