Cryptocurrencies are geared towards one or more addressable target markets. Taking a closer look at these target markets is of great importance when it comes to evaluating cryptocurrencies and analyzing their price. In this article we will take a closer look at the size of the different target markets and how widespread cryptocurrencies are already in these markets. These target markets will include reserve currencies, offshore accounts and online payments.

Medium of Exchange and Unit of Account

A medium of exchange is an intermediary instrument or system used to facilitate the sale, purchase, or trade of goods between parties. For a system to function as a medium of exchange, it must represent a standard of value. Using a medium of exchange allows for greater efficiency in an economy and stimulates an increase in overall trading activity. In a traditional barter system, trade between two parties can only happen if one party has a commodity that another party desires, and vice versa. The chance of this happening simultaneously as a cross occurrence–where each party desires something that the other party has–is improbable. Thankfully, with a medium of exchange, such as gold, if one party had a cow and happened to be in the market for a lawnmower, the cow owner could sell his animal for gold coins, which he may, in turn, use to purchase the lawnmower.

The unit of account and medium of exchange markets are currently estimated to be around $126.8 trillion USD. We could argue that all crypto is technically a medium of exchange; however, none more so than Bitcoin being the primer cryptocurrency. If we consider all of BTC currently being used for this purpose, this gives us a current market penetration of 0.13 %.

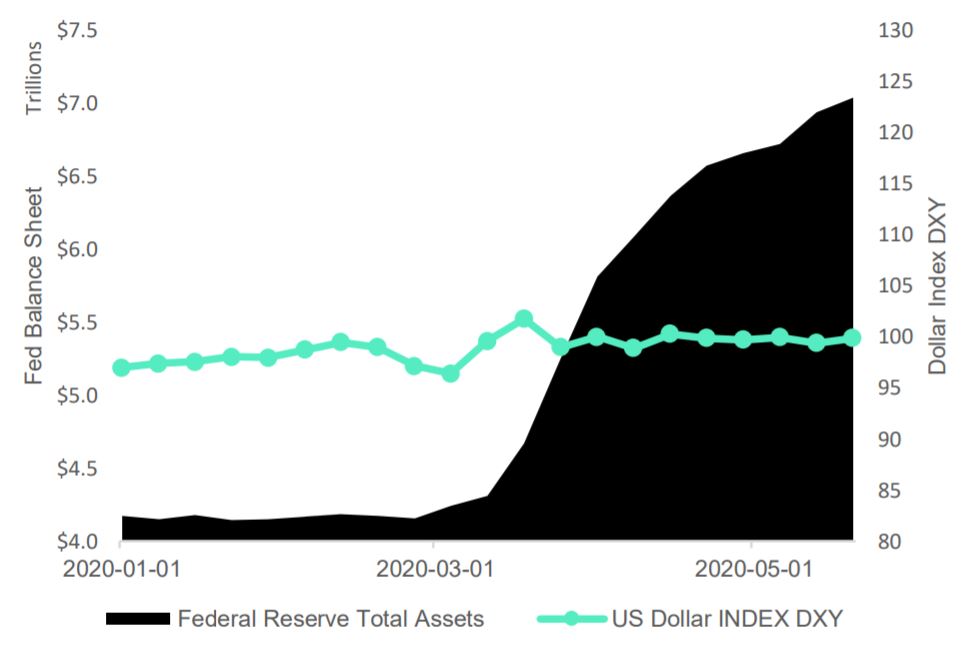

Figure 1: Federal Reserve Assets Almost Double and Dollar Index Stays Flat

Despite unprecedented quantitative easing, trillions of short-term credits to the repurchase agreement market, and lowering interest rates to zero, the US dollar index (DXY) barely moved. This means that the dollar can take a lot more abuse from the printing machines, before it starts to devalue against other fiat currencies. Also, the 5-year forward inflation expectation for the US dollar is sitting at a low 1.43 %. This means that despite massive debasement of the US dollar, markets expect inflation to be below the Federal Reserve’s target 2 %. Fed Chairman Powell understands that he can print more, and most likely he will.

Fortunately, the blockchain technology has reduced the cost of switching between currencies. Phone applications, such as Crypto.com, already allow people to earn interest on several different types of cryptocurrencies and stablecoins that represent different fiat currencies. In the future, people will be able to hold portfolios of tokenized currencies in their bank account and on their phone, and they will easily be able to exchange currencies by pressing a few buttons. When the Turkish lira is losing value, they will be able to switch into a safe haven stablecoin like a tokenized Swiss franc. When Turkish banks offer high interest rates to attract capital, people will be able to easily switch back to the Turkish lira in order to earn higher interest rates on their deposits. This is already possible due to the dollarization of public blockchains discussed later in this report in Tether or Not to Tether by Pascal Hügli.

Offshore Accounts

The Tax Justice Network estimates that governments lose $189 billion a year from $21–32 trillion in offshore accounts of private wealth. The International Monetary Fund estimates tax evasion to be approximately $12 trillion a year globally. The Satis report analyzed the target addressable markets for the entire cryptoasset market and found that the total implied market cap to be $3.6 trillion by 2028 using the a similar equation of exchange model to the one developed in this research report. According to the Satis report, the major application of cryptocurrencies is offshore deposits. They estimate cryptocurrencies will penetrate approximately 91 % of the offshore deposits market during the next decade. They also estimate the offshore deposit market to grow because of capital controls, national debt, unpopular fiscal policy, and debasement of national fiat currencies.

Figure 2: Cryptocurrencies Will Absorb Part of Global Offshore Wealth Market

Although the Satis report uses “offshore accounts” and “tax evasion” synonymously, offshore accounts can also be used for non-illicit purposes such as opening up a business abroad and earning income. Also, many multinational companies have reserves abroad in case of a banking crisis in their domestic currency. In a bid to protect their assets from financial calamity, institutional investors are embracing the use of offshore crypto deposit accounts. According to several estimates, offshore tax havens account for 10 % of global GDP. Ten percent of global GDP provides the offshore account estimates in the Excel spreadsheet. A 3.6 compound annual growth rate is assumed in order to forecast the future GDP and growth in demand for offshore deposits.

Reserve Currency

Reserve currencies are foreign currencies held by central banks. When a country acquires reserves, it doesn’t place the currency in general circulation. Instead, it parks the reserves in the central bank. The reserves are acquired through trade, with the acquiring country selling goods in exchange for currency.

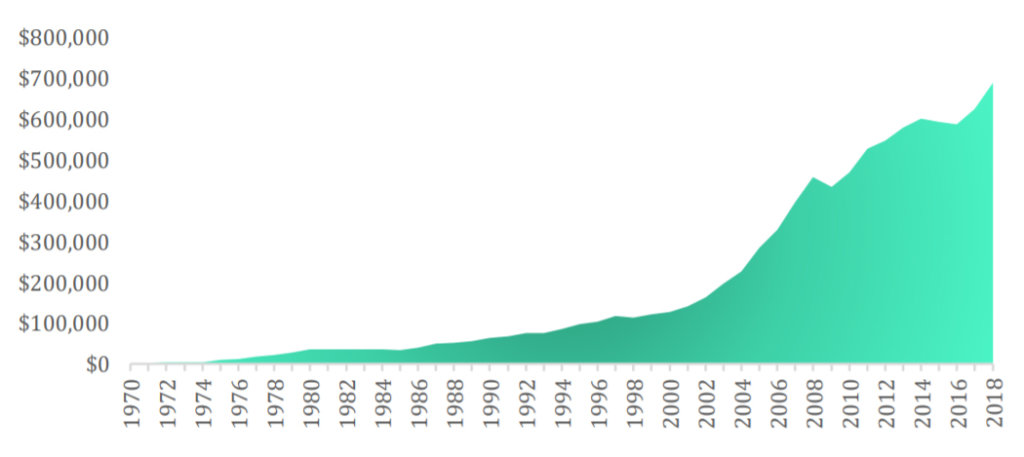

Reserve currencies thus grease the wheels of international commerce by helping countries and businesses conduct transactions using the same currency, a much simpler task than settling transactions involving different currencies. Their popularity is easy to see: Between 1995 and 2011, the amount of currency held in reserve increased by over 730 %, from around $1.4 trillion to $10.2 trillion.

Reserve currencies are typically issued by developed, stable countries. The currency most commonly held as a foreign exchange reserve is the US dollar, which, according to the International Monetary Fund (IMF), comprised nearly 62 % of allocated reserves as of late 2012. Other currencies held in reserve include the euro, Japanese yen, Swiss franc and pound sterling. The dollar, while still the most widely held reserve currency, has seen increased competition from the euro. The euro has grown from slightly less than an 18 % share of allocated reserves when it was introduced into the financial markets in 1999 to 24 % at the end of 2011.

The IMF reports both allocated reserves, meaning that a country has identified the currencies held in reserve, and total foreign exchange holdings. The overall percentage of total holdings that are allocated reserves has fallen steadily over the years, from 74 % in 1995 to 55 % in 2011. Much of this shift can be explained by changing foreign exchange holdings in emerging and developing countries. In 1995, advanced economies held around 67 % of total foreign exchange reserves, with 82 % of these being allocated reserves. By 2011, the picture had been flipped on its head: Emerging and developing countries held 67 % of total reserves, with less than 39 % allocated. Emerging countries now hold roughly $6.8 trillion in reserve currency.

Currently, reserve currencies sit at around 11.7 trillion and no central bank has officially admitted to holding any cryptocurrency in its reserves.

Store of Value

As shown in Table 2, the target addressable market for stores of value is over $7 trillion. This figure mostly comes from the global market capitalization of gold. However, people also store value in fiat currency. The US dollar alone has a market capitalization of $3.8 trillion, which is 20 times larger than Bitcoin’s market capitalization. People also store their wealth in stocks and bonds and real estate, so $7.07 trillion is a lower-bound on the largest target addressable market for cryptocurrencies. When it comes to store of value, the go-to cryptocurrency seems to be Bitcoin. If we consider that store-of-value seekers don’t move their bitcoin often, we can see that around 11 million BTC have not moved in nearly a year. It is worth nothing that this amount inevitably includes some lost keys. As of the time of writing this report, this accounts to around $98.6 billion or a 1.4 % penetration.

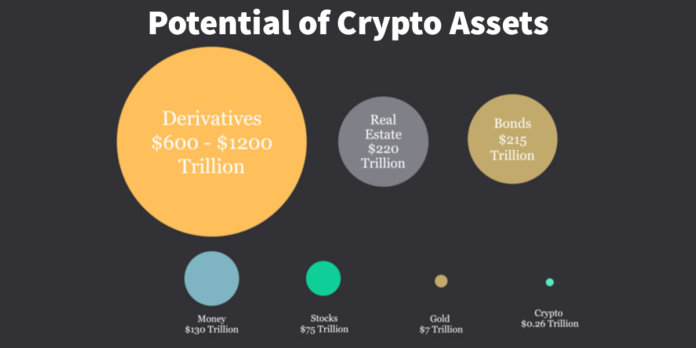

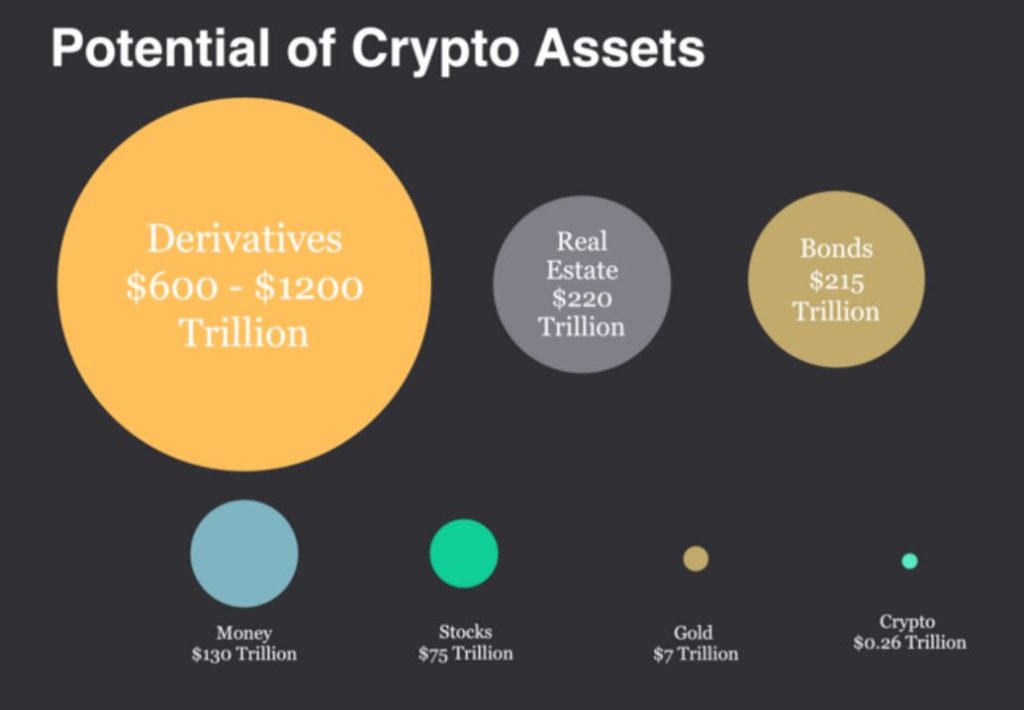

Figure 3: Bitcoin’s Target Addressable Market is Worth $1247 Trillion

Some critics of cryptocurrencies argue that cryptocurrencies aren’t used as a store of value. They argue that cryptocurrencies are only used for day trading and speculation. A good measure of whether coins are used as a store of value or for short term speculation is the “age” of each coin. The average age of 20 % of all of the bitcoin in existence have been held for over 5 years. We assume that these coins are being used as a store of value. The majority of bitcoins have been held for more than 6 months, which provides evidence that bitcoin holders aren’t using bitcoin for day trading but are rather holding for long-term appreciation. Factors promoting crypto use and adoption as a store of value include scarcity, transparency, global availability, pseudonymity, and immutability.

One of the factors contributing to a rise in popularity is the fact that most digital currencies have a finite supply, resulting in scarcity. Currencies controlled by central authorities are often subject to arbitrary inflation, especially in emerging economies (Folkinshteyn & Lennon 2016). Paul Tudor Jones, who runs the Tudor BVI fund, holds a low single-digit percentage of its assets in Bitcoin futures, because of the massive fiscal spending and bond-buying by central banks to combat the coronavirus pandemic. By his calculation, $3.9 trillion of money, the equivalent of 6.6 % of global economic output, have been printed since February 2020.

Online Transactions

According to a report on the digital payment market by Mordor Intelligence and data from Statista, online transactions account for between $4.4 trillion and $3.4 trillion per year. The research firm Chainalysis estimates that cryptocurrency commerce transactions account for $6 million daily. This means that cryptocurrency payments have not even penetrated 1 % of online transactions. However, according to the same report by Chainalysis, the amount of digital money sent to 16 merchant service providers, such as BitPay, rose 65 % between January and July of 2019. This is because cryptocurrency transactions are comparatively faster, taking a few seconds optimally or about an hour when networks are congested. There are also no chargebacks with cryptocurrencies, which stops a lot of online fraud.

Transaction platforms like BitPay recorded consistent annual growth in transaction rates (DeVries, 2016). According to a BitPay annual report in 2017, the platform recorded a payments dollar volume increment of 328 % year-on-year from 2016. During that period, merchants using the platform were getting more than $1 million every month in bitcoin payments. Overall, the service provider was on track to process over $1 billion annually through bitcoin payment acceptance and payouts during 2017 and 2018. BitPay’s B2B business grew 255 % between 2017 and 2018 because law firms, data center providers, and IT vendors signed up to accept Bitcoin. BitPay also hired Rolf Haag, Former Western Union and PayPal executive as Head of Industry Solutions responsible for the B2B business.

The Copay wallet, BitPay wallet, and other wallets using BitPay’s Bitcore Wallet Service (BWS) have over 1.5 million unique wallets. In the past year, the BitPay wallet added integrations with major gift card brands, enabling users to buy gift cards in-app for travel, food, and shopping with Bitcoin and Bitcoin Cash.

Famous merchants such as Microsoft, CheapAir (Flights), Travala (hotel bookings)14, and the Dallas Mavericks basketball team accept cryptocurrency payments in order to reach out to niche markets of cryptocurrency holders. Local governments are also accepting cryptocurrency payments, such as Ticino and Zug in Switzerland and Seminole County, Florida in the US to name a few.

Brick and mortar commerce, online e-commerce, casinos, and tax collectors all need a payment processor to handle the currency risk of accepting cryptocurrencies. For this reason, software and hardware point-of-sale (PoS) systems are an interesting business model that has increasing demand. The Crypto Research Report recently covered how Worldline and Ingenico are both rolling out PoS systems in Europe during the summer of 2020. Additional payment processors companies that settle cryptocurrency payments include Salamantex, AnyPay, CryptoBuyer, GoCoin, Coinpayments, Coingate. These companies offer hardware and software solutions for merchants. For example, Salamantex has a hardware that merchants can add to their existing hardware point of sale system. Gocoin, Coinpayments, and Coingate all offer plugins for e-commerce websites like Woocommerce, Shopify, and WordPress.

The largest start-up in this space is Spedn, which is owned by Flexa which the Winklevoss Twins invested in. They will enable all Starbucks coffee shops in the USA to accept cryptocurrency payments beginning in 2020. Coinbase also offers the service of payment processing. One of the most recent newcomers to this space is Crypto.com, but they are expected to make a big splash.

Although cryptocurrencies were originally designed to be digital cash, online transactions with cryptocurrencies have not really picked up traction. In a recent peer-reviewed journal paper, Nicole Jonker found that crypto acceptance from online retailers is a modest 2 % of all online stores. This is mostly because most cryptocurrencies are deflationary, and investors don’t want to spend them. Most merchants convert crypto payments to fiat to avoid volatility issues. However, online transactions may gain adoption with stablecoins since they aren’t deflationary. For example, BitPay added settlement support for US dollar stablecoins from Circle, Gemini, and Paxos in 2018.

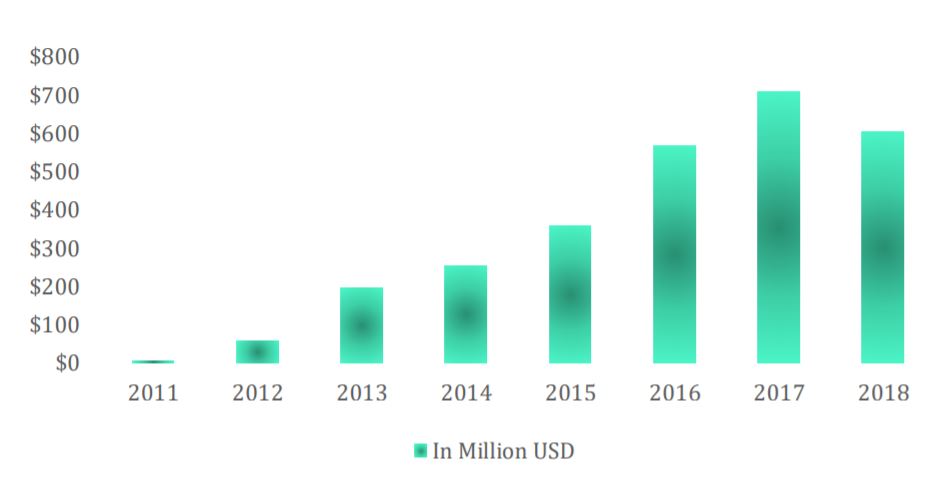

In addition to be used in brick and mortar stores and for online shopping, cryptocurrencies are also spent online on illegal goods and services. According to Chainalysis, darknet trading volume was estimated to be as high as $700 million in 2017 and $600 million in 2018.

Figure 4: $600 Million in Darknet Volume Annually

Remittance

In 2018, migrants in various parts of the globe sent upwards of $613 billion to their home countries. However, the use of traditional banking services means high transaction fees and slow processing. The Philippines, which is one of the world’s top remittance markets, already has solutions like Coins.ph that use crypto and blockchain technology that allow individuals to send money home with lower fees.

Figure 5: Remittance Market is Annually Increasing

Many remittances are being conducted via Bitcoin ATMs that have remittance features enabled. This feature allows an individual to put British pounds into an ATM in London and to receive a code. They can send that code to a relative or friend in New York. Their friend can go to a Bitcoin ATM in New York and put the code in and then receive US dollars. This feature is currently working for over 100 countries and 35 different currencies.

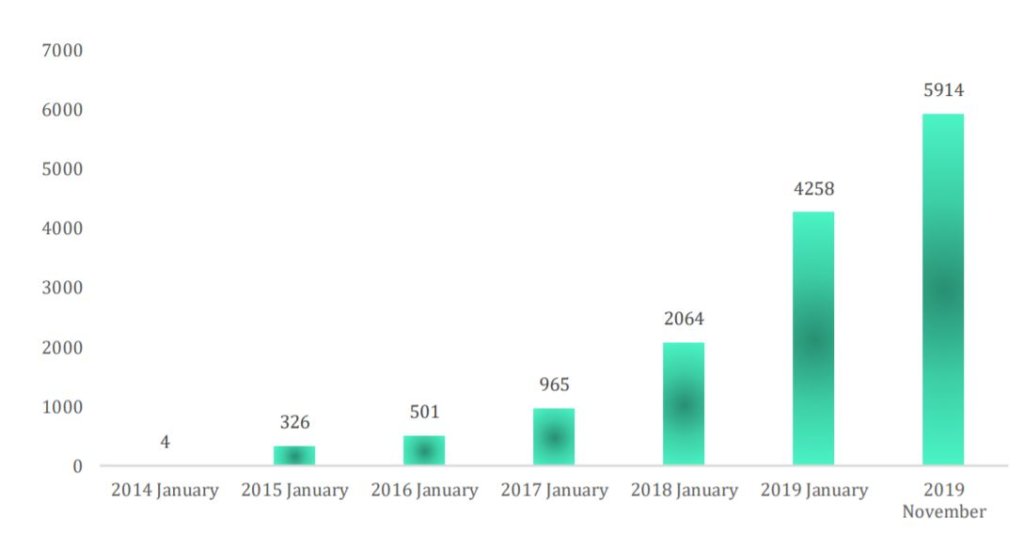

Figure 6: The Number of Bitcoin ATMs Installed Across the Globe

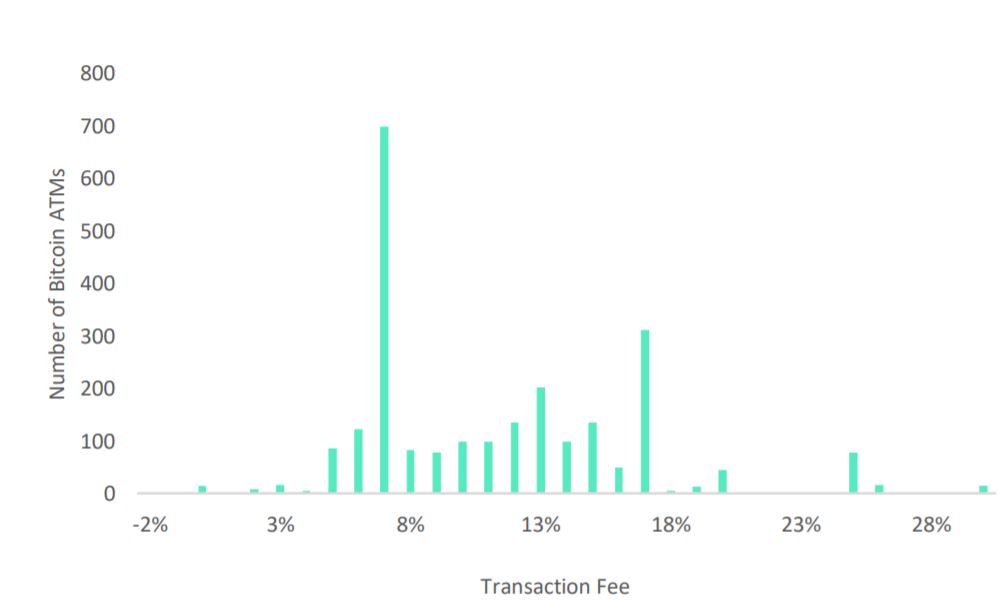

Statistical data on the number of Bitcoin ATMs globally reveals a consistent rise over the years. In January 2016, Coinatmradar shows that there were only 501 of them worldwide but by January 2017, the number had grown to 965. In January 2018, they had more than doubled to 2,073, almost doubling again by January 2019 to 4,112. However, the average Bitcoin ATM fee is 10 %. There are 84 Bitcoin ATMs in Switzerland, 296 in DACH, not including SBB and kiosk ATMs.

Figure 7: Average Fee on Bitcoin ATMs is 10%.

Tax Evasion

The original ethos of crypto was libertarian, and that attitude still prevails in the industry. It’s no surprise that some cryptocurrency users aren’t fully reporting their gains, and that some tax evaders adopt cryptocurrencies for this purpose. Each country has a unique level of tax evasion, and that level is dynamic over time and depending on variables such as tax rates, public debt amount, history of nationalization of industries, culture, etc. Cryptocurrencies offer tax evaders a new way to hide assets, and they will be used in this way. Even if KYC/ AML is implemented on every exchange via the Travel Rule, money can still be laundered and hidden with cryptocurrencies by mining newly minted coins. One way to ensure access to untracked or “dirty” Bitcoin and other cryptocurrencies is to become a cryptocurrency miner. Cryptocurrency miners can simply buy graphics cards and electricity and turn this into untracked assets. There is evidence that miners in Asia are entering the mining industry in order to get capital out of China and India without tax authorities knowing. Another way is to buy coins with cash; however, the war on cash (demonetization of large denominations) and inflation has reduced the ability to transact with large quantities of cash. Therefore, a large portion of tax evasion and money laundering in this space will focus on mining. This is a form of tax evasion for high net worth individuals (HNWI) and corporations.

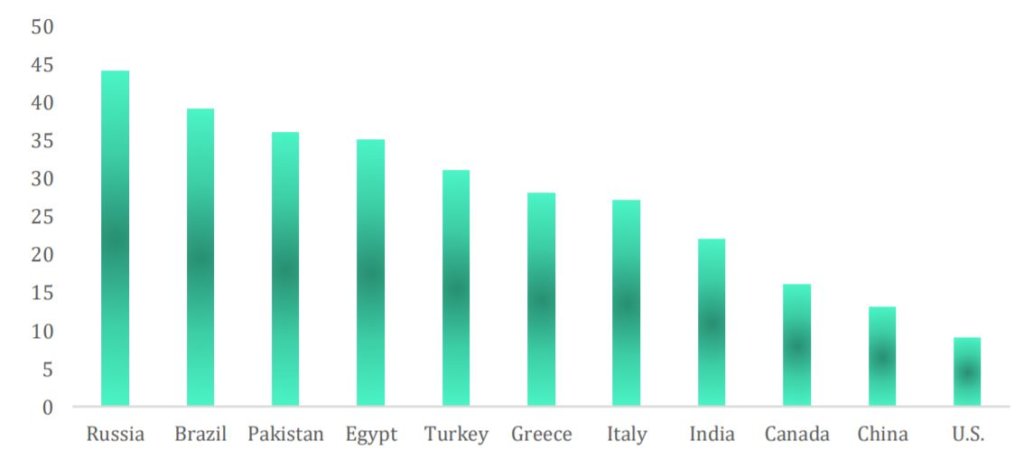

Figure 8: Size of the Untaxed “Shadow” Economy in Selected Countries 2010, as a Share of GDP

Due to the difficulty of estimating the amount of tax evasion globally, and the difficulty in forecasting this variable into the future, this paper uses the S&P 500 growth rate and assumes the percentage of tax evasion in the economy is constant over time. This paper estimates the tax evasion market to be $600 billion based on estimates provided by the United Nations University. Tax evasion by institutions and HNWIs will be more likely to target privacy coins and low-volatility coins such as stablecoins and Bitcoin rather than physical fiat cash because of the sums involved. However, this is also a large portion of tax evasion through “black economies” where lower and middle classes don’t report earnings. Physical fiat cash may be better for black market tax evasion by middle class and lower-class workers because there is no record and there is limited volatility. However, black markets in countries where this is heavy inflation in the domestic currency are more likely to switch to cryptoassets.

In this regard, the closest proxy which we can come for this in the crypto world are privacy coins. It stands to reason that anyone using crypto for tax evasion would focus primarily on fully untraceable coins. Looking at the two biggest ones, Monero and Dash have a combined market cap of $1.8 billion. Even if all of them are used solely for this purpose, this still gives us a penetration of less than 0.3 %.

Smaller Target Markets and Use Cases

Micropayments and Unbanked

Cryptocurrencies that are stable and have low transaction fees are well-suited for micropayments because they eliminate the inconvenience and security risk of submitting credit card data for every minor transaction (Spilka, 2018). In certain cases, merchants have been put off by the high fees associated with low-cost transactions on traditional systems. With lower fees, higher security and fast transaction processing, more businesses could adopt micro-transactions using crypto (Spilka, 2018). This could enable new business models such as a browser that pays online news websites to block advertisements. According to Business Insider, micropayments help solve a problem for online content providers, such as digital music and app purchases.

Close to 2 billion people remain unbanked globally, a third of whom live in Sub-Saharan Africa (Bank4YOU, 2018). In some of the countries within this region, smartphone proliferation is quite high (“Banking is Only the Beginning,” 2018). With an internet connection, they can access crypto services and get funding and remittance services among other opportunities with ease.

ICO and STO Funding and Crypto Trading

Ethereum has led to the rise of an alternative fund-raising model. Though these are often associated with fraud and poor investor protection, they have created new capital flow pathways with broader investor access. Creating digital representations of assets can reduce the costs and level of friction associated with management, transfer and issuance of traditional assets. They have therefore helped to enhance liquidity and transparency in the life cycle of such assets (Nagaraj, Hunter & Captain, 2018). These practical applications of the technology are highly likely to remain relevant and foster adoption.

ICO funding has also fostered the adoption of crypto in spite of the bad press that has resulted from scams in the sector. By lowering the entry barrier to obtain funding for and making investments in start-ups, start-ups are now able to bypass early seed investment or use crowdfunding in addition to early seed investment (Davis, 2018). Interestingly, ICOs have not eliminated traditional venture capital but has made them adapt and evolve (Town, 2018). Start-ups raised $ 5.5 billion worldwide in 2017 by issuing tokens in the framework of ICOs – and this year the total amount has already swelled to $ 14.3 billion.

It goes without saying that crypto has already a full penetration of this market, as token sales which accept only fiat currencies are practically non-existent.

Gambling and Gaming

In addition to online e-commerce, online gambling is also an important market for cryptocurrencies. In a few short years, Ethereum has become home to over 400 decentralized gambling applications, with gameplay ranging from traditional casino slots to gamified options trading and prediction markets. There are several online casinos, which offer payment in cryptocurrencies. Casinoanbieter.com states that their clients’ demand for crypto gambling is increasing.

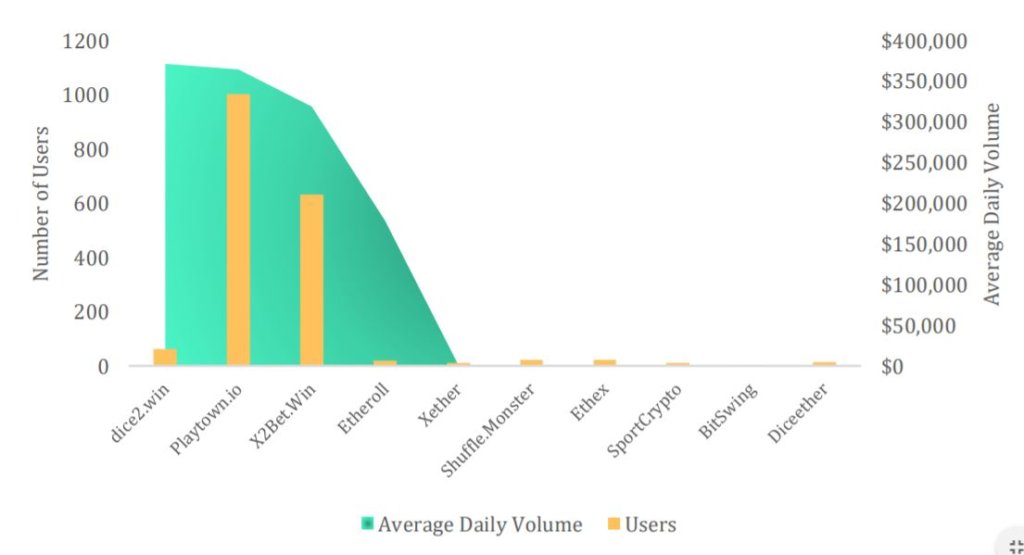

Figure 9: Top 10 Decentralized Gambling Applications Have Over $1 Million in Total Daily Volume

Though the online gambling industry has been on an uptrend (“Banking is only the beginning,” 2018), its core issues related to transparency have yet to find solutions. The use of crypto has however made it possible to reestablish trust, transparency and fairness. It curbs the vice of record manipulation, ruling out the “house always wins” mantra.

The global gaming industry which is expected to grow to $143 billion by 2020 (Wolfson, 2018) is yet another ripe market for virtual currency adoption. Virtual money is in fact not new to the sector since digital gold has for over a decade been used for in-game purchases. With the advent of crypto, however, players can now trade virtual gaming items more easily with each other (Wolfson, 2018). It has also solved the problem of in-game asset ownership through tokenization. Under this model, gamers will retain ownership of their acquired assets within a digital wallet till they decide to trade or sell them.

According to the following report22, the crypto-specific gambling scene sees volumes close to $2.5 billion annually on its top gambling apps. Compared to an estimated $59 billion for the industry as a whole, this makes it one of the most penetrated markets by crypto at 4.2%.

Now that we have taken a close look at the target markets, we must include potential growth in the analysis. There are various approaches to this, which define an area with positive and negative upper and lower limits. In addition, the relationship between the cryptocurrencies is characterized by considerable uncertainty, which means that not every single coin has to experience the same growth effect. These factors will be the subject of next week’s article.