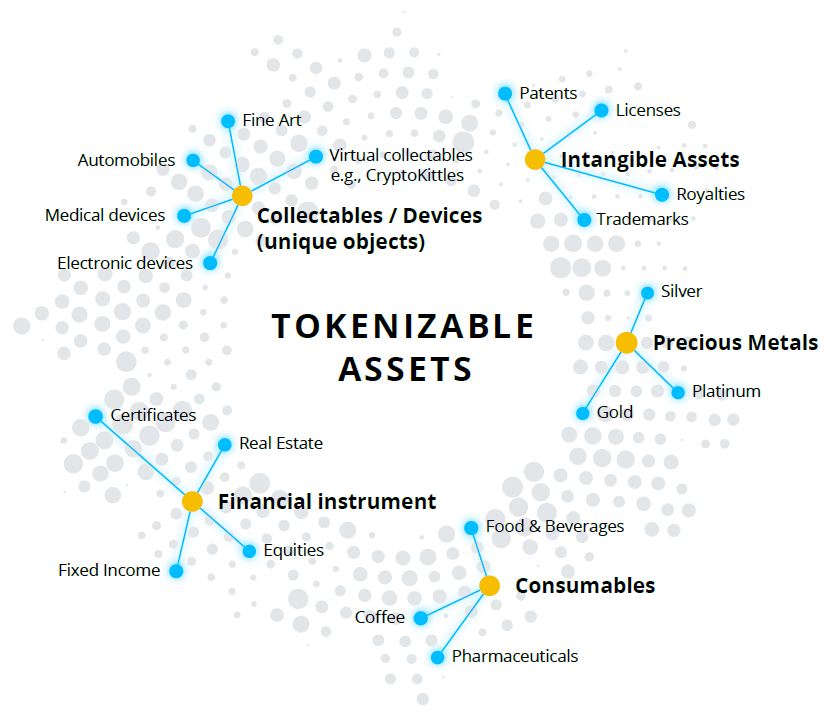

Virtually any asset can be tokenized. However, not all tokenization proceeds in the same way. There are a number of different use cases even in the area of security tokens. We have highlighted a few of these use cases and will now focus on the first 3 in this article.

EY’s Tokenization of Assets Report describes five main categories of assets that are being made into security tokens including collectibles, financial instruments, consumables, precious metals, and intangible assets. However, this list does not describe the most popular ways in which security token issuers extract economic interest from these tangible and intangible assets in practice. The security token can represent one of these four economic interests:

Tokenized Profit Participation Rights

Tokenized profit sharing was originally not very popular for ICO investors, because a firm could hypothetically increase their costs up until the point that the company showed no profit. However, companies with compliant security tokens that follow disclosure requirements and subject themselves to supervision from financial market authorities can garner trust for this type of investment

contract.

Republic

The Republic note, structured as a debt instrument, pays out a portion of its profits in the form of a dividend to investors. However, the dividend is only paid out when a startup company that raised capital on their platform has a successful exit by being acquired or going public. This is because Republic charges a 2% commission and 1 – 16% carry interest to the startup. The note managed to raise more than $16 million despite the risks associated with the security token i.e. that the startups may never have a successful exit or the website Republic.co does not stay in business long enough to see the startups have a successful exit, which can take up to 10 – 20 years.

Bitbond | STO

Bitbond Finance GmbH’s security token is structured as a subordinate bond/loan/note, and they pay out 60% of their company’s pretax profits to token holders over the life of the bond. Bitbond revenue comes from charging 2 – 3% loan origination fees to borrowers and pays out 0.5 – 1.5% to the investors that gave Bitbond the capital to lend out to borrowers.1

Tokenized Revenue Participation Rights

Similar to profit sharing rights, revenue sharing rights are often structured as notes (debt instruments) that give the investor a right to receive a share of top line revenue from a company rather than a fixed periodic payment based on a percentage of the monies loaned to a company.2 Also, similar to profit sharing rights, the investors are not buying the equity of the issuing company. The security token explicitly states the percentage of revenue that investors will receive. However, the dividends each period will be variable as well as the length of the note’s maturity.

INX

The Gibraltar-based securities trading platform that recently merged with Open Finance Network, INX Limited, launched an initial public offering in 2020, which recently ended in April 2021.3 However, the IPO was not really an IPO, because INX was not offering equity. Rather, they offered a revenue share from their operations. Their goal was to raise $10 million in this funding round. INX’s revenue share security token offering in the US is for both retail and professional investors. Currently, INX is also using a SPAC to list their equity on the Canadian stock exchange. A public company owned by a private equity firm bought all INX’s equity and is now listing the equity on the Canadian Stock exchange.

Tokenized Commitments to Use or Voucher

A security token issuer can sell tokens that can be redeemed in the future for a certain good or service. This investment type is popular with ICOs and initial exchange offerings (IEOs). The funds collected from investors are used to finance the company in its early stages. However, if this investment type is deemed to be an investment contract by financial market authorities, it becomes an unregistered security. Therefore, it may behoove companies to have legal experts determine if their tokenized commitment to use or voucher is a utility token or a security token prior to doing the sale. A voucher can also be structured to manage accounting and tax consequences or it can be linked to the other instruments presented above, such as a profit participation right in a corporation.4

Blockstream

The recently announced Blockstream Bitcoin mining security token Blockstream Mining Unit (BMN) represents the use of Blockstream’s mining equipment. The investment contract is structured as a note with a minimum investment of €200,000 that only qualified investors can buy. Each note entitles the security token investor to the BTC mined by up to 2,000 TH/s of hashrate.5 The bitcoin is paid out at the end of the note, and the note’s maturity is set to 36 months. The note is issued by a Luxembourg Securities Vehicle, which is a unique type of fund that can sell shares or issue debt to qualified investors with lighter compliance requirements. 6 Although the structure is not extremely risky, the BMN states that no return is guaranteed due to how fast mining equipment degrades.

And what else can be tokenized? To further explore this question, we will look at various practical examples next week as well. These will include the tokenization of property and the tokenization of organizations.

1 https://www.bitbondsto.com/files/bitbond-sto-lightpaper.pdf

2 http://moolapitch.com/revenue-participation-notes/

3 https://cointelegraph.com/news/sec-registered-crypto-issuer-inx-to-wrap-up-ipo-in-april

4 https://www.svlaw.at/en/tokenize-the-world

5 https://stokr.io/blockstream-mining/pitch

6 https://www.loyensloeff.com/media/475533/lll-securitisation-vehicles-brochure-small.pdf

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.