Security Token have gained importance among Digital Assets in recent years, as they play an important role connecting the new technology and the traditional markets. In this article, we will clarify what Security Tokens are, how they work and their potential impact in the future.

Security token offerings (STOs) are a hybrid between initial coin offerings (ICO) and the more traditional initial public offering (IPO). Instead of offering a digital share or bond stored in a single company’s database, such as the shares held by the Depository Trust Company (DTCC) in New Jersey, a STO involves a security token. A security token is a regulated investment contract hosted on a distributed ledger technology. Two defining features of a security token are that the investment con-tract is “tokenized”, which means that 1.) cryptographic techniques such as hash functions are used to verify the integrity of the data (which wallet address owns the token and how many tokens does that wallet address have) and 2.) asymmetric encryption is used to create public and private key pairs.

Security Token Market Cap on Secondary Markets is Expected to Breach $1 Billion by August 1, 2021

In practice, security tokens often exist in both traditional databases stored by one company and a duplicate, or courtesy copy, lives on a blockchain. This allows investors to have the best of both worlds. On the one hand, one copy exists to outline which investors own which securities in case a problem arises with the blockchain technology, and on the other hand, a tokenized copy exists on a blockchain so that investors can have more control over the use of their security such as 24-hour trading and lending. We predict a large trend over the next few decades will be the emergence of self-custody of securities and the re-establishment of bearer financial instruments.

STOs can be for blockchain related investment or non-blockchain related investments. Today, security tokens can already be bought, sold, and traded in regulated and centralized security token exchanges referred to as “digital asset marketplaces” such as tZERO, MERJ, TokenSoft, or on decentralized cryptocurrency exchanges such as Uniswap.

When we first started writing this report, we were not convinced that security tokens would have a disruptive impact on financial markets. This is because the global market cap of security tokens trading on regulated secondary markets is currently only $700 million, and the daily trading volume averaged a little over $100,000 in April 2021.

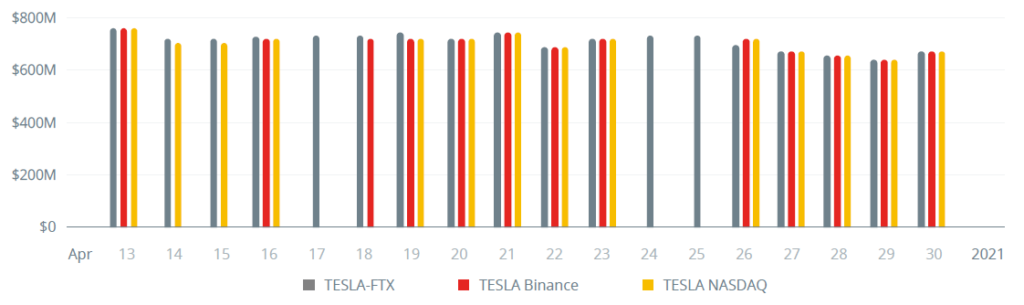

However, our perspective completely changed once we understood the hockey stick in demand for tokenized traditional stocks such as Tesla (TSLA), Coinbase (COIN), Gamestop (GME), and Apple (AAPL). Tokenized stocks are fully backed digital representations of traditional stocks that are traded on a traditional exchange such as the NYSE or an alternative trading system (ATS) such as NASDAQ. Recently, the cryptocurrency exchanges FTX and Binance enabled tokenized stock trading for their users, and the daily trading volume grew from zero to over $4 million within one month. The US-based Uphold exchange also recently acquired JNK Securities and can now use their broker-dealer license in order to enable security token issuance and trading as well.1 Also, in the US, the newly chartered crypto bank, Anchorage, may become a leader in security token custody. Anchorage recently struck a partnership with Prometheum, a retail platform for trading digital securities.2

Many people think the digital representations are derivatives, but they actually aren’t. The tokenized stocks can be converted into traditional stocks through a process with the issuer named CM Equity AG in Germany. Although various regulators have questioned the legality of tokenizing traditional stocks, the CEO of CM Equity AG, Michael Kott, upholds that they are fully compliant with all regulations.

Gap in Prices of TESLA Stock on Different Exchanges Leaves Room For Arbitrageurs

Whether the current first movers are shut down or not, we see a wave of demand for tokenized stocks from investors on the horizon. Blockchain-based assets put investors in the driver’s seat instead of letting regulators steer. We see a large trend being the self-custody of securities and the re-establishment of bearer financial instruments. In the future, investors will be able to remove securities from an exchange such as Binance and send them to a different exchange such as the NYSE with a private key.

Arbitrageurs will seek risk-free returns by trading the same shares on different exchanges. Exchanges will compete with each other in order to attract investors by offering them interest on their security deposits for lending their securities to the exchange who will in turn lend the shares to other borrowers (i.e. shorts or leveraged longs). Exchanges may also allow investors to use their securities as collateral for loans or margin trading. This will drastically change the demand for securities as less investors will sell and trigger taxable events in order to acquire liquidity. The demand will also increase for attractive securities as a global pool of investors will now be able to easily invest in securities in other countries.

Securities aren’t the only asset that can be tokenized. The new technology can be applied in many other areas of finance, as well as in other sectors of the economy. Next week, we will therefore turn to the question in which areas this tokenization is already gaining importance and we will also look at some examples.

1 https://www.prnewswire.com/news-releases/uphold-to-acquire-us-broker-dealer-jnk-securities-after-regulatory-approval-301259582.html

2 https://medium.com/anchorage/better-trading-ahead-anchorage-and-prometheum-partner-to-launch-first-digital-asset-ats-c9c8ba868417

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.