Low fees are one of the existential selling points for Solana. As with Ethereum, the actual fee is a function of supply and demand. When demand for block space rises, the price to include a given transaction in a block appreciates accordingly.

Solana features a much higher transaction capacity than Ethereum. We’ll cover just how much in the chapter on theoretical transactions per second.

A look at network explorer Solana Beach reveals transactions cost between 5,000 and 10,000 lamports. One lamport equals one-billionth SOL. In dollar terms, the average Solana transaction has cost $0.00025.

Actual transactions per second (TPS)

Between 2,000 and 3,000 TPS are conducted on the Solana network at the time of this report. This number dwarves Ethereum’s 35 TPS by almost two orders of magnitude.

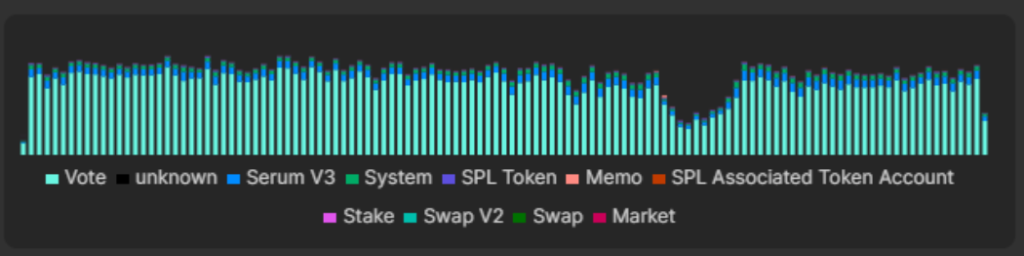

Figure: Solana transaction breakdown

On Solana, 80%–90% of all transactions are used for voting and synchronization, so this number is misleading on its own. Other blockchain projects have ridiculed Solana for its inflated numbers in the past.

Before comparing apples to apples, voting has to be factored out of transaction counts since Ethereum nodes don’t vote. Assuming the upper bound of 90% votes, Solana would still process 200–300 TPS or 10x Ethereum at a fraction of the cost.

This article is an extract from the 80+ page Scaling Report: Does the Future of Decentralized Finance Still Belong to Ethereum? co-published by the Crypto Research Report and Cointelegraph Consulting, written by ten authors and supported by Arcana, Brave, ANote Music, Radix, Fuse, Cryptix, Casper Labs, Coinfinity, Ambire, BitPanda and CakeDEFI.