Solana has a unique consensus mechanism called TowerBFT and proof-of-history (PoH). Co-founder Anatoly Yakovenko, with a background in distributed systems design, thought hard about blockchain scalability problems in 2017 after Bitcoin transactions took days when demand surged.

According to an interview with Acquired, he discovered that most consensus issues vanish when the systems involved agree on a common timeline. Take the dreaded double-spend issue, for instance. In a synchronized system, you can assume that the first transaction is valid and the second is thus fraudulent.

Solana implements a surprisingly straightforward method of synchronizing nodes. It uses a sequential hash that runs over itself continuously, creating a rhythm that all nodes follow.

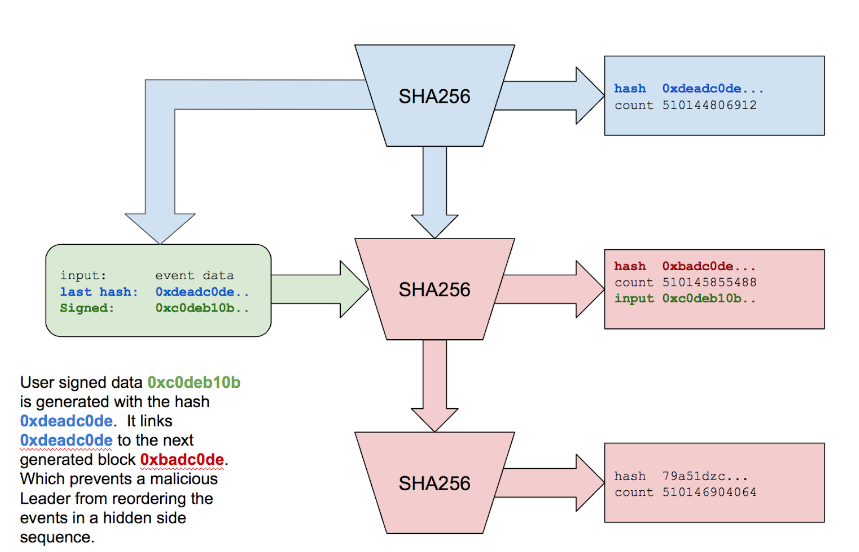

Proof-of-history uses recursive calculations where the previous output is used as the next input. Only with the output of the current function “X” will a validator be able to calculate the output of the next function “Y.” All validators need to solve the same function “X” and then be able to derive the output for the next function “Y” around the same time. Like this, Solana creates synchronization across its network.

Figure: The proof-of-history flow of control

Besides PoH, Solana uses its version of the practical Byzantine fault tolerance (PBFT) consensus mechanism called Tower. PBFT is an industry standard.

Programming language

Solana uses Rust, a recent, functional programming language for programs that run on top of its blockchain and base layer.

Rust has seen a remarkable rise in popularity for blockchain applications thanks to its performance advantages. From a purely technical point of view, it seems like a clear winner compared to Ethereum’s Solidity.

However, the lack of tooling, libraries and knowledgeable developers means that many wheels need reinventing to get DApps off the ground. The advent of the Anchor framework has ameliorated that somewhat by reducing the amount of work necessary just to get started by 80%.

This next article will look at the question if Solana is able to scale. What is the network’s transaction speed in theory and practice? And what are the advantages and disadvantages of the design choices involved?

This article is an extract from the 80+ page Scaling Report: Does the Future of Decentralized Finance Still Belong to Ethereum? co-published by the Crypto Research Report and Cointelegraph Consulting, written by ten authors and supported by Arcana, Brave, ANote Music, Radix, Fuse, Cryptix, Casper Labs, Coinfinity, Ambire, BitPanda and CakeDEFI.