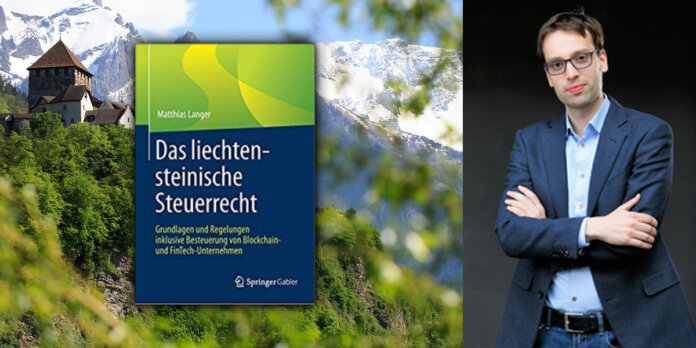

In the book, The Liechtenstein Tax Law, Matthias Langer hits the nail on the head in respect to taxation of blockchain and FinTech companies in Liechtenstein. Alongside the tax law basics of Liechtenstein, Matthias Langer hits the nerve of the time by addressing the regulations for the taxation of blockchain and FinTech companies, and thus creates tax law clarity.

Published in 2019, the book opens up with the history of the Principality of Liechtenstein before moving on to the main topics of company, foundation, and trust law. The existing legal forms are presented concisely, followed by an overview of the type and scope of Liechtenstein’s audit, review and disclosure requirements, as well as the existing accounting regulations.

Matthias Langer has worked as a tax consultant in Liechtenstein for eleven years and now has his own law firm in Triesen. In the book, he delves into topics such as property and acquisition tax, gifts and inheritances, and income tax. The taxation of investment funds and foundations, as well as international tax law pertaining to offsetting and relocation find their way into the reading. Since Liechtenstein is also one of the pioneers in the blockchain and fintech, their handling of taxation is of great international interest. After a brief explanation of the basic terms and the balance sheet approach to cryptocurrencies, the peculiarities of the acquisition, income and value-added tax are discussed. In addition to differentiating different types of coins, the reader learns the tax significance of the transfer, trading, and storage of coins and tokens.

The book is easy to read due to the structure and short and accurate explanations that are illustrated with examples. In addition, the book enables quick reference and comprehension without the reader having to have in-depth tax knowledge. Although the book is primarily aimed at prospective entrepreneurs in Liechtenstein, it also contains information that is interesting for those who want to learn more about life in Liechtenstein and the country itself.

In summary, the book deals with all essential aspects of tax law in Liechtenstein. The treatment of tax law specifics of blockchain and fintech companies deserves special mention. The reader leaves the book with a deeper level of understanding of how crypto funds work and the taxation of cryptocurrencies. The book is only available in German at this time and can be bought on the publisher website, Springer Verlag.