Throughout Europe, investors have already invested millions of Euros and Swiss Francs into digital assets. Without a doubt, this is of significant importance for the economy in general and the crypto sector in particular, since these investors also play a major role in price movements. However, there are still only a small number of reports that systematically assess the demand for cryptocurrencies.

The first study was not focused on the German-speaking countries, and the second has not been published yet. Between November 2019 and early March 2020, Greenwich Associates under the auspices of Fidelity Digital Assets, Fidelity Center for Applied Technology, and Fidelity Consulting interviewed almost 800 investors across the U.S. and Europe.

Across the U.S. and Europe, 36% of the survey’s 774 respondents said they own cryptocurrencies or derivatives. The results show that over a third of institutional investors own digital assets. According to the survey, European investors generally have a more progressive view of digital assets, made evident when comparing the responses across all categories. Interestingly, this study found the same result: 36% of the survey’s 55 asset allocators said they have exposure to cryptocurrencies in the portfolio already.

The one survey that has targeted institutional demand for cryptocurrencies in the DACH region is BaFin’s survey of crypto asset derivatives. The German financial market regulator conducted a survey in late 2019; however, they have not published the results yet. In the survey’s preliminary research report, BaFin reported that there has been enormous growth of certificates that hold digital assets and contract for difference trading. Over 1,000 different certificates are on the market that have exposure to digital assets, and contracts for difference trading volume grew from €10 billion a month in August of 2018 to over €15 billion a month by January of 2019.

This study marks the first comprehensive survey of institutional investors on the topic of digital assets ever conducted across the German-speaking regions. The analysis contains key highlights of the survey’s results in addition to commentary from Crypto Research Report and Cointelegraph Research. Our experience combined with the proprietary dataset drives the unique perspective on the industry’s trends presented in this report.

Methodology

This survey had 55 responses from professional investors across the German-speaking countries including 44 online interviews and 11 case studies via telephone. Respondents included traditional banks, asset managers, and pension funds. This report focuses on buy-side, not sell-side asset allocators. Therefore, we did not send this survey to crypto funds that are invested 100% in digital

assets. The goal of this report is to gauge the demand for digital assets from traditional financial intermediaries.

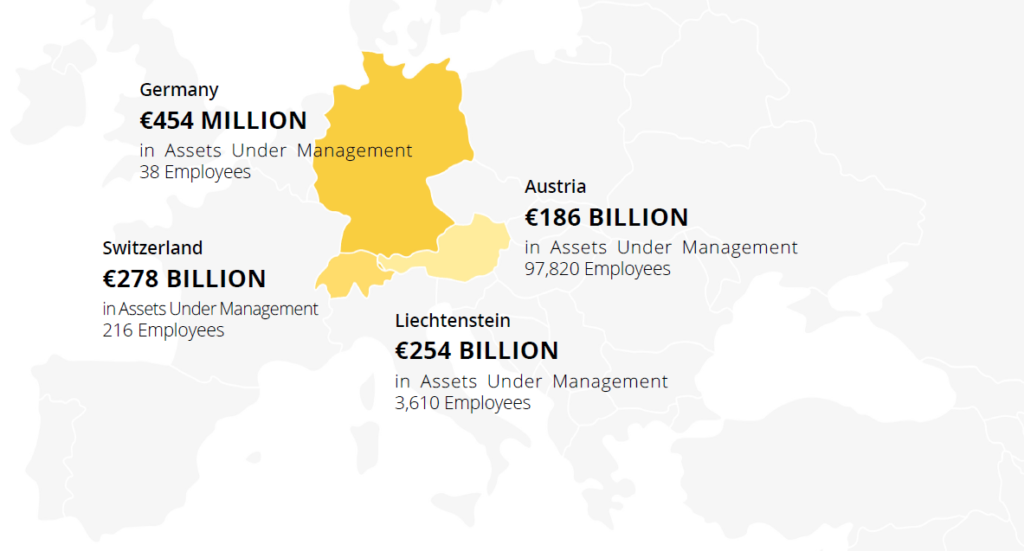

The survey was delivered via email to all registered professional investors with BaFin (Germany), FMA (Austria), FINMA (Switzerland), and the FMA (Liechtenstein) between the months of June to September of 2020. With the help of local banking associations, the survey was also sent out to the members of the BVI Deutscher Fondsverband and BAI in Germany, the Austrian Bankenverband, the Liechtensteinischer Anlagefondsverband, and members of SFAMA in Switzerland.

The majority of the respondents came from Switzerland (16) followed by Austria (10), Germany (7), and Liechtenstein (6). When sorting the survey results by country, the respondents from Switzerland managed the most assets with €278 billion. Austria’s respondents worked in firms with the highest headcount. The majority (83%) of the respondents worked in firms with less than 50 employees. Only three women that were in charge of asset allocation decisions at their company responded to the survey compared to 39 men. The median age of the respondent was 47.5 years old.

Current Exposure

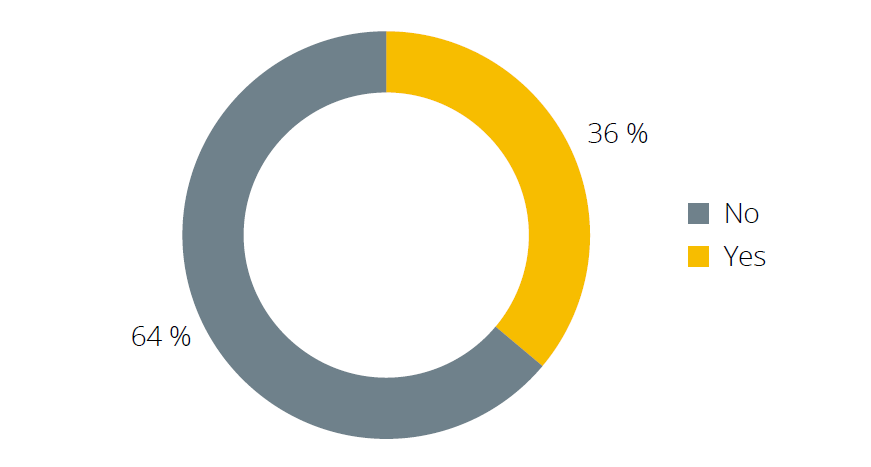

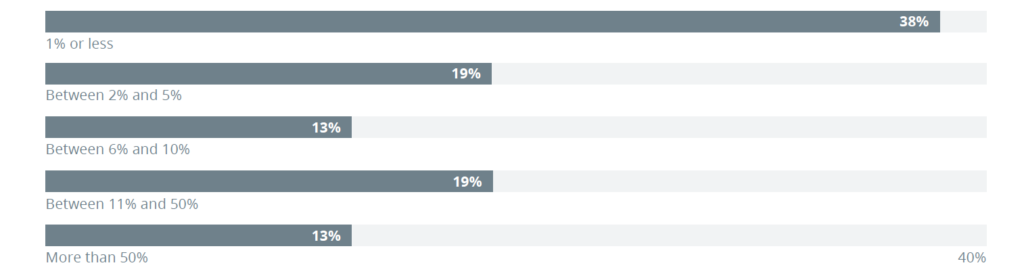

Over a third of the surveyed asset managers have invested in digital assets, while about 64% of respondents have not invested yet. Among the institutional investors who have had exposure to digital assets, approximately 69% of respondents have 10% or less of their assets under management in crypto assets. Notably, over a third of those surveyed have only 1% or less of their assets under management in crypto assets.

Question: Has your company invested in crypto assets in the past?

This survey was conducted during the 2020 shutdown of the economy due to the government’s response to the Corona virus. During mid-March, many investors de-risked their portfolios and went into cash. From peak (February 19, 2020) to trough (March 17, 2020) Bitcoin lost 50% of its value, and briefly trading in the high 4000s. Since then, the price has recovered 115% to above $10,000. Bitcoin has performed better than equities, fixed income, real estate, and gold year to date (as of October 8, 2020). If governments continue to stimulate the economy with newly created money, then this trajectory is expected to continue. If the fiat faucet is ever turned off, there will likely be an ensuing correction in all asset classes.

Question: What percentage of your company’s assets under management are invested in crypto assets?

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.

It is important to note that these figures apply to digital assets in general, but that there is a variety of these assets that are viewed by investors from different angles. Therefore, we will take a look next week at exactly how the interest is composed and what the conditions are for investors to make their purchases.