Due to the friendly regulatory landscape, Switzerland in particular has seen the development of a market for both passively-structured and actively-managed crypto products for retail investors. This article will take a closer look at 21Shares and other providers in this area, along with their efforts to operate in the EU as well.

If you are looking at the landscape of financial instruments with Bitcoin and other digital assets as underlyings, 21Shares created the first crypto basket ETP (exchange traded product) on the regulated market of the largest Swiss stock exchange in 2018. Since then, 21Shares has issued a total of 11 institutional-grade passive investment trackers with the largest single assets (Bitcoin, Ethereum, Ripple, Tezos, etc.), different index baskets of digital assets, and the world’s first inverse Bitcoin ETP on four different stock exchanges in Switzerland and the EU.

Notably, the 21Shares crypto ETPs are the most readily available crypto products on the market, as any institution with access to Deutsche Börse XETRA or SIX Swiss Exchange can easily access the ETPs. This includes all the large Swiss and European online brokers such as Interactive Broker, Swissquote, Comdirect, etc. This is particularly relevant as it gives retail clients without the proper know-how to set up accounts with unregulated crypto exchanges the ability to participate in this novel asset class. Furthermore, all 21Shares ETPs are 100% collateralized at all times and custodied with independent custodians in order to give institutional clients safer access and reduce the counterparty risk often associated with other financial products.

“Cryptocurrencies offer experienced investors a new way of diversifying their portfolios. With the listing, we are increasing the selection of asset classes on the Vienna Stock Exchange. Investors can also benefit from the advantages of the stock exchange in crypto trading: monitored and transparent trading with real-time information and secure processing via their securities account.”

– Thomas Rainer, Head of Business Development at the Vienna Stock Exchange

RETAIL AND ACTIVELY MANAGED STRUCTURED PRODUCTS

In addition to actively managed structured products for professional investors, Switzerland has become home to the world’s first actively managed Exchange Traded Product featuring cryptocurrencies as the underlying asset class. Launched in summer of 2020, the Bitcoin Capital Active ETP allows retail and institutional investors in Switzerland and, after approval of the prospectus in the EU, across selected EU jurisdictions to invest in digital assets via a certificate structure. The product is issued by Bitcoin Capital AG and managed by FiCAS AG, a Swiss-based crypto asset manager. Its investment objective is to increase the net asset value of the ETP by trading Bitcoin against carefully selected altcoins from the top 15 coins. Their strategy also involves moving in and out of fiat depending on the trading signals they analyze.

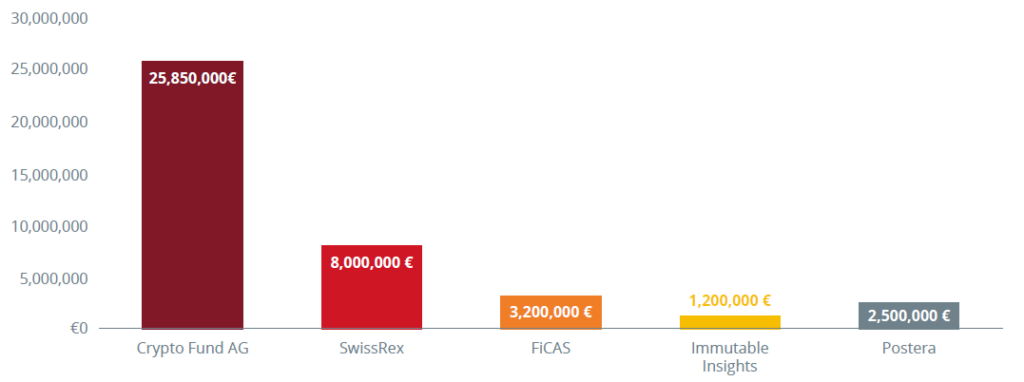

Actively Managed Digital Asset Investment Vehicles’ Assets under Management

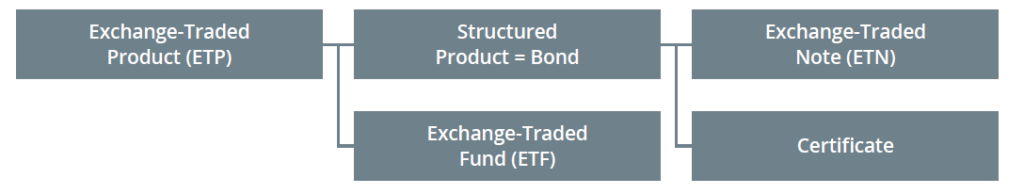

The product is similar to a structured product, but it is not a certificate. Unlike certificates, ETPs are also designed for retail distribution.

Exchange Traded Products are collateralized, non-interest paying debt securities designed to replicate the performance of the underlying assets. ETPs trade on exchanges similar to stocks meaning their prices can fluctuate intraday. ETPs are structured and operate very similarly to traditional Exchange Traded Funds (ETFs). However, contrary to ETFs, ETPs are debt securities issued by a Special Purpose Vehicle (SPV).

Currently, their AUM is CHF 3.2 million. They launched with CHF 2 million on July 15, 2020, so their assets have already increased by more than 50% since their launch. On the launch date, the issue price of each security was CHF 100, and the product as of today is trading at CHF 109 representing a 9% increase in value within six weeks. More information on the FiCAS ETP can be found on the historical chart on the SIX Swiss Exchange.

Their fees include a 2% management fee per annum and a 20% performance above a high water mark (HWM). The fees will be collected quarterly and this will reset the HWM to the new level. Storage of the assets is diversified across five custodians including Crypto Broker AG, Sygnum Bank AG, Coinbase, Bitstamp, and Kraken, and they plan to further diversify by adding further custodians.

This article has so far only dealt with products for private investors. Institutional investors, however, have different requirements for investment products, which is why next week’s article will deal with these very products, focusing in particular on the SEBA Bank AG.

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.