Because of different requirements, professional investors can only make limited use of the same financial infrastructure that is used by private investors. A forerunner in this respect is the SEBA Bank AG, but other institutions now also offer products that are relevant for professional investors.

SEBA Bank AG is one of the world’s first banks dedicated to the digital asset industry. In addition to SEBA Bank AG’s banking services, SEBA offers a full range of products including directional exposure via tracker certificates, smart beta certificates on an actively-managed index of cryptocurrencies, and capital protected products. In addition, yield enhancement certificates like the Dual Currency Certificate, with which they started our product campaign in July 2020, are available. The relatively high volatility of Bitcoin deters many investors. Indeed, Bitcoin volatility has run as high as ten times that of equities. By the same token, by selling high volatility, a very attractive target yield can be generated. A yield enhancement product like the SEBA Bank Dual Currency Certificate on BTC/USD does exactly that: By selling a put option on BTC/USD, it harvests the inherent Bitcoin volatility and pays it out as an attractive yield to the product holder.

As digital assets emerge as a new asset class, many professional investors like family offices, HNWIs, and independent wealth managers are looking to build exposure. This new asset class offers significant diversification benefits due to low correlations to traditional assets and entirely new performance drivers. Many professional and institutional investors thus look to invest a single digit percentage of their assets in cryptocurrencies in order to tap this new diversification and performance potential. Based on this industry tailwind, SEBA Bank has enhanced its product capabilities to offer clients a variety of investment solutions and pay-offs on Bitcoin and other cryptocurrencies.

“SEBA aims to provide corporate financing, including advising on initial coin offerings, and other cryptocurrency and banking services to traditional corporate clients and cryptocurrency groups.”

— Reuters

Similar to Bank Vontobel, Leonteq is a traditional company that moved into the digital asset space with certificates. Leonteq’s most popular crypto certificate is its reverse convertible on Bitcoin that can be purchased on the SIX Swiss Exchange. Reverse convertibles are particularly suitable for investors who want to generate a guaranteed income over a certain period of time. Anyone who buys a reverse convertible on Bitcoin agrees to deliver the underlying asset, such as Bitcoin, on a specific, predetermined date in the future. At the same time, the buyer is compensated with a fixed coupon.

From the buyer’s perspective, a reverse convertible on Bitcoin works as follows: If the Bitcoin price at maturity is at or above the agreed strike price, the investor gets back 100% of their initial investment, which is also called the principal. In such a scenario, the investor would be in the money. However, if the Bitcoin price is below the agreed strike price at maturity, the investor participates to a certain extent in the negative performance of the underlying asset, in this case Bitcoin. At some point, the investor will be out of the money. This is the case, when the coupon is not able to compensate for the loss that the investor is incurring on the collateral that is being eaten away by the falling Bitcoin price.

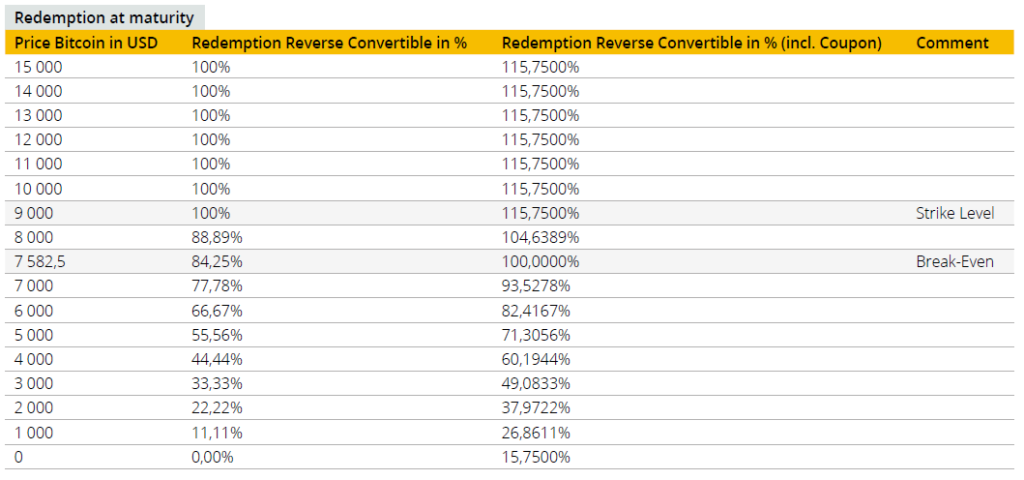

The following table should help as an illustration

Let’s suppose an investor entered a reverse convertible at a Bitcoin price of $9,000. At maturity, if the reverse convertible is redeemed at a Bitcoin price of $11,000, the investor gets 100% of his initially placed collateral as well as the agreed coupon. Notice that the coupon is fixed, even when the Bitcoin price rises and is higher at maturity compared to when the reverse convertible was bought. If the Bitcoin price at maturity drops below $9,000, the investor will not be refunded the entire collateral that he put up. Up until a Bitcoin price of $7,582, he won’t lose any money though, because the agreed coupon is able to compensate for the loss he is incurring because of a falling Bitcoin price. Once the Bitcoin price drops below $7,582 at maturity, the investor will lose money overall.

However, reverse convertibles are not only bought for speculative reasons. By buying a reverse convertible for a premium, the buyer can earn a regular income over the time the reverse convertible is running. This way, they can potentially keep their Bitcoin ,granted the Bitcoin price at maturity stays at or above the agreed strike price, but still earn a yield on it.

An investment in a reverse convertible on Bitcoin thus carries the risk of a capital loss at maturity. So all of the principal or parts of it could be lost. In addition, there is also the risk that if Bitcoin experiences an increase in value and the strike price at maturity is ultimately higher than the initial price, the investor will not benefit from this price increase. The investor’s total return is limited to the guaranteed interest rate of the coupon payment. Against this backdrop, it makes sense that reverse convertibles on Bitcoin are primarily suitable for investors when the Bitcoin market is stagnant or slightly declining in price. Leonteq’s launched structured offering was not only a novelty for Switzerland, but it was also the first reverse convertible on Bitcoin in the world that could be traded on a stock exchange, thus giving a broad investor audience access to such a product.

This innovation was launched at a time when the environment for cryptocurrencies was anything but easy. After a considerable rally in the first half of the year with a price premium of almost 200%, there was a correction to below $7,000, but the risk profile of the reverse convertible enabled the investor to achieve an absolute return of 10% in the first three months of the year. Looking at the product from the time of issue at the end of September 2019 onwards, investors were able to contain their losses significantly compared to a direct investment thanks to the attractive coupon of the reverse convertible.

Leonteq is now one of the leading issuers of yield enhancement products listed on the SIX Swiss Exchange with a market share of around 30% (measured by the traded turnover of products issued by Leonteq and its issuing partners). Leonteq also offers short tracker certificates on Bitcoin as well as tracker certificates and actively managed certificates on Ether, Bitcoin Cash, Litecoin, and Ripple on the SIX Swiss Exchange. Leonteq’s technology platform processes more than 100,000 customer transactions with a transaction volume of over CHF 15 billion per year and has one of the largest universes of structured products with over 2,000 underlyings and 90 payoffs.

For the most part, these offerings are very new and are being expanded all the time, which is another indication of the growth potential that many professional investors attribute to this innovative industry sector. Another form of investment that is also relevant in this respect is the investment in companies from this sector. Therefore the next article will discuss a recent investments in this form.

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.