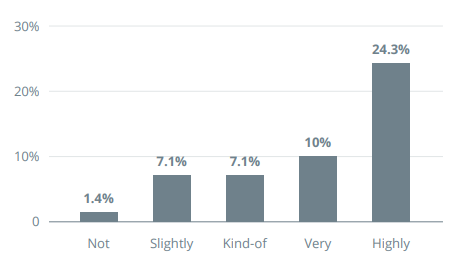

Asset managers revealed the most significant perceived risks when investing in cryptocurrencies, rating liquidity risk as the most important risk, according to a recent survey. This starkly contrasts with the 2020 survey of professional investors, which identified regulatory risk as the most significant perceived risk.

Asset managers were asked to rate the importance of perceived risks when investing in crypto assets; the possible risks were the following: liquidity risks, operational risks (technological risks), cybercrime and fraud, regulatory risks, and market risks (volatility). All of the risks mentioned are in the “important spectrum” of the charts. However, the most important risk for those surveyed was liquidity risk.

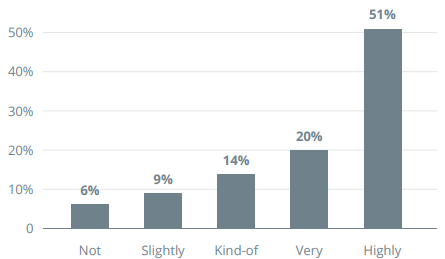

Liquidity Risks

This is a stark difference from the 2020 Cointelegraph survey of professional investors. In 2020, regulatory risk was the most important perceived risk. Almost 80% of the sample fell in the “important region” of the graph.

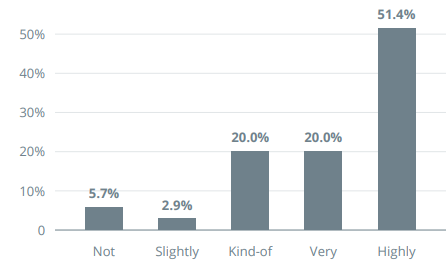

Operational Risks (e.g. Technological risks)

With approximately 71% and 70% of responses in the “important region,” market risk and liquidity were ranked as the second and third most important risks, respectively.

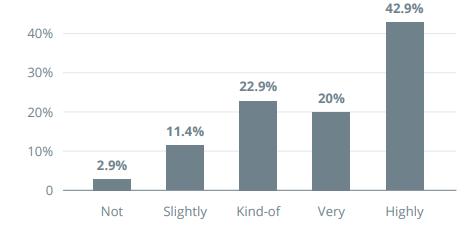

Cybercrime and Fraud

Operational and cybercrime risks have the same number of responses in the “important region” (~ 68%). Institutional buyers display a higher degree of sophistication than their retail counterparts. High liquidity and ability to hedge price fluctuations are among the top requirements before institutions are comfortable deploying meaningful amounts of capital.

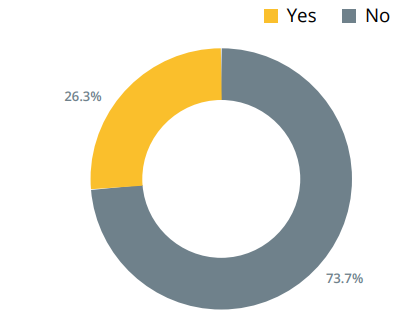

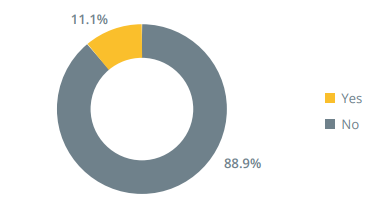

Would your company like to invest more but are bound by regulatory restrictions?

Another blocker for institutional investors is the uncertain regulatory environment and the murky tax implications of holding cryptocurrencies on their balance sheet. As much as crypto proponents decry regulatory creep, it has to be admitted that no pension fund, no money manager and no savings and loan bank will invest considerable sums into digital assets without regulatory clarity. It is up to the industry to engage in dialogue with lawmakers worldwide and demonstrate thought leadership. This way, the thinking of regulators can be informed and decisions-guided. Looking from a perspective of institutional demand, we can only hope that the adversarial thinking that is so prevalent in crypto gives way to a pragmatic approach focused on engagement and education.

Market risks (e.g. Volatility)

The 2020 Cointelegraph survey found that price volatility was the main barrier to adoption, followed by a lack of fundamentals to gauge value and concerns around market manipulation; however, investors cited less concern about complexity for institutions and market infrastructure complexity than previously.

Would you like to invest more but are bound by internal company restrictions?

The uncertain regulatory environment and murky tax implications of holding cryptocurrencies on balance sheets are blockers for institutional investors. The industry needs to engage in dialogue with lawmakers worldwide to create regulatory clarity and demonstrate thought leadership to inform regulators’ thinking. While price volatility was previously cited as the main barrier to adoption, investors now express less concern about complexity for institutions and market infrastructure complexity.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.