With assets in ETPs and mutual funds with cryptocurrency exposure exceeding 10.5 billion euros, Europeans are adopting cryptocurrencies through providers like XBT and 21Shares. Ruffer Investment Management made a $745-million bet on Bitcoin in December 2020 to hedge against risks in a fragile economy, while DeFi protocols have boosted the cryptocurrency industry in Central, Northern and Western Europe, according to Chainalysis.

In terms of crypto adoption, Europeans aren’t lagging behind. Assets in European exchange-traded products (ETPs) and mutual funds with cryptocurrency exposure have topped 10.5 billion euros, according to Morningstar data, showing the potential appeal of these products for asset managers.

XBT, part of CoinShares, is the largest provider in Europe, with assets of 5.4 billion euros across eight products domiciled in Sweden and Jersey, followed by Swiss group 21Shares, which manages 2.1 billion euros across its range.

Ruffer Investment Management, a fund manager based in Britain, made a $745-million bet on Bitcoin in December 2020. Ruffer’s allocation fetched $27.3 billion in assets, which it claimed would work as a hedge. It effectively secured 6,500 clients against the risks involved in a fragile digital economy.

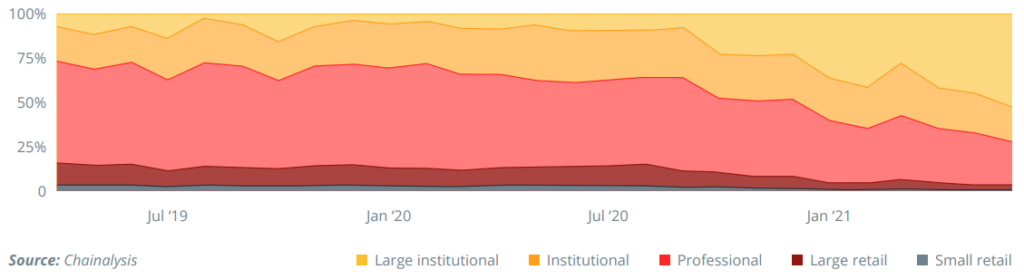

Central, Northern & Western Europe Share of Transaction Volume by Transfer Size, Apr ‘19 – Jun ‘21

DeFi, a blanket term for a network of decentralized, noncustodial financial protocols focused on lending, yield farming, crypto derivatives and other products, has reportedly given a huge boost to the cryptocurrency industry in England, France, Germany and other European countries.

According to Chainalysis, European institutional investors are embracing DeFi; transaction volume in Central, Northern and Western Europe grew significantly across virtually all cryptocurrencies and service types, especially on DeFi protocols. An influx of institutional investment, signaled by large transactions, drove most of the growth.

As the cryptocurrency market continues to gain momentum in Europe, institutions are embracing new technologies like DeFi to fuel growth. With transaction volume growing significantly across the region, the future of cryptocurrency in Europe looks bright. As more institutional investors jump on board and invest in cryptocurrencies, we can expect to see continued growth and adoption in the years ahead.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.