This article delves into the complexities and opportunities surrounding Bitcoin’s integration into financial portfolios, a topic that has intrigued and perplexed many financial advisers. Despite Bitcoin’s impressive historical performance, its adoption is often hindered by concerns over volatility and perceived risks, as well as a lack of understanding and infrastructure.

However, as leading investors and institutions increasingly recognize the benefits of cryptocurrencies, it signals a shift toward embracing Bitcoin for enhanced returns and diversification. The discussion further explores methods of acquiring Bitcoin, particularly through centralized exchanges (CEX), while addressing the associated trade-offs and potential solutions such as off-chain settlement to mitigate risks.

Given Bitcoin’s historical performance, the key question is, why haven’t more financial advisers incorporated it into their portfolios? The answer often lies in the volatility and perceived risks associated with cryptocurrencies, along with a lack of understanding and infrastructure to handle such assets.

However, as the world’s leading investors and institutions gradually embrace Bitcoin and the broader cryptocurrency domain, it clearly indicates its potential to enhance returns and offer diversification benefits.

For institutional investors who opt to buy Bitcoin directly, the first question is, “Where should I buy Bitcoin?” Although we cannot give financial advice in this report, we can provide information on the largest centralized exchanges, OTC desks, and brokers that sell Bitcoin to institutional investors around the world.

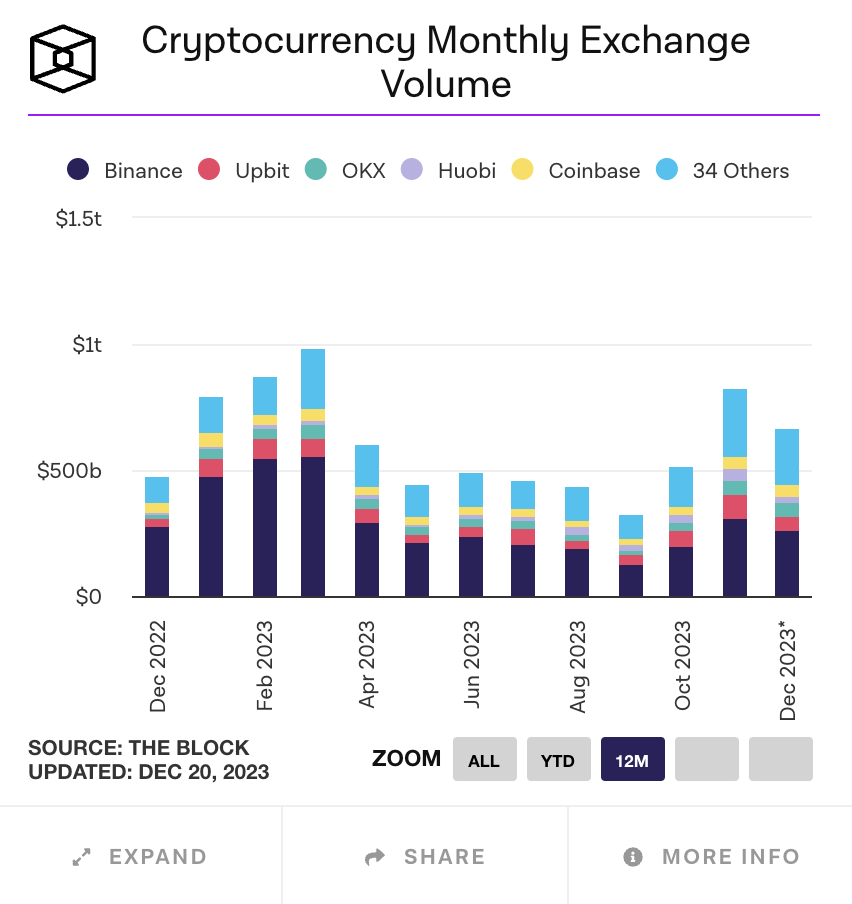

The most popular method for first acquiring Bitcoin is likely a centralized exchange or CEX. These exchanges generally require Know Your Customer (KYC) information so that governments can have a way to find individuals for tax and Anti-Money Laundering (AML) purposes. The largest Bitcoin exchanges are typically ranked based on their trading volume, liquidity, and overall user base. However, it’s important to note that the rankings can vary over time due to changes in market dynamics, regulatory environments, and other factors. The annual revenue for Kraken is not published since the company is held privately; however, the SEC mentioned an annual revenue of $43 billion between 2020 and 2021 in their public complaint against Kraken in 2023. The research team at Cointelegraph suspects that this number was mistyped and that the figure reported by the Karens at the SEC may refer to volume. As of December 2023, the top Bitcoin exchanges include:

While CEX can be a convenient way to accumulate Bitcoin, one needs to be aware of trade-offs.

- While you may have a Bitcoin address on a CEX, the private keys are not only exclusively known to you. Meaning that your BTC can be withheld from you for whatever reason. This includes not processing your transactions promptly and your account being locked out for various reasons – let’s say you lost your password or the email address you usually log in with. Customer service can take a long time, and you do not have access to your Bitcoin.

- If the CEX you are using does not have proof of reserves, you do not know how the CEX is using your Bitcoin. Proof of reserves means the CEX has a third-party audit to ensure that the assets the CEX says are on their books are on their books. Celsius famously rehypothecated (sold the same asset multiple times) to help provide a scheme to produce yield for its users, which ultimately backfired and caused significant market issues.

A potential solution to the risks associated with buying Bitcoin from exchanges is off-chain settlement. The off-exchange settlement allows institutions and investors to mitigate counter-party risk and increase capital efficiency. The biggest exchanges are launching their own custodians with this technology already enabled. The custodian, the biggest provider of off-chain settlement technology, Clear Loop, is Copper, which is based in the UK.

In conclusion, the journey toward incorporating Bitcoin into financial portfolios is marked by both significant opportunities and notable challenges. While the appeal of enhanced returns and diversification is strong, the volatility and risk perceptions surrounding Bitcoin require careful navigation. This article has highlighted the evolving landscape where institutional investors are gradually accepting cryptocurrencies, along with practical considerations for purchasing Bitcoin through centralized exchanges.

Moreover, the potential of off-chain settlement offers a promising solution to mitigate risks associated with these transactions. As the financial world continues to adapt, Bitcoin’s role in diversified portfolios seems poised for growth, reflecting broader trends in asset management innovation.