As institutional interest in cryptocurrencies continues to grow, it’s becoming increasingly important to be able to gauge that interest. While it’s difficult to differentiate between retail and institutional interest using transaction data alone, there are several indicators that can be used to get a better sense of institutional demand. In this article, we’ll explore some of these indicators and take a closer look at how they can be used to better understand the current state of institutional demand for cryptocurrencies.

On-chain data cannot tell us whether an address represents an institution or an individual. Services like Glassnode and Nansen employ data scientists to perform more sophisticated entity resolution, but even there, the aggregated data for institutional demand is not available.

Most institutional demand is centered on the major cryptocurrencies because they offer the most liquidity in spot and derivatives markets. While it is not easy to separate retail from institutional interest by transaction data alone, we have identified three valuable indicators to do just that: inflows into funds, annual financial disclosure filings with regulators, and merger and acquisition deals. Let’s take a closer look.

Bitcoin and Ether command the lion’s share of institutional interest. Deep spot, futures and options liquidity combined with offerings by trusts like the Grayscale Bitcoin Trust make these cryptocurrencies especially attractive. Security is one of the major concerns institutional investors want to have addressed, and trusts offer a very convenient and cost-effective solution. Inflows into funds are one way to gauge institutional interest in digital currencies.

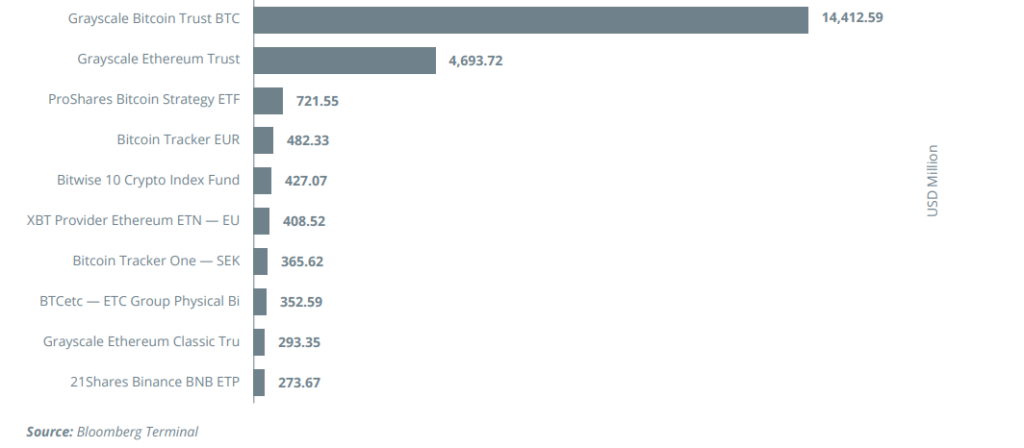

Top 10 Cryptocurrency Funds by Assets Under Management

Grayscale alone holds more than 640,000 BTC, worth $13.6 billion at the time of this writing. The visible plateau in GBTC holdings may be due to increased competition from Bitcoin Futures ETFs, such as ProShares’ Bitcoin Strategy ETF (BITO) ($721 million AUM) and Bitwise’s 10 Crypto Index Fund ($427 million AUM), as well as a general slowdown in institutional uptake of Bitcoin during the 2022 bear market in Bitcoin’s price.

Yearly inflows into cryptocurrency trusts were $9.3 billion in 2021, up 36% from the $6.3 billion in 2020, but this represents a sharp slowdown from the 806% growth in inflows from 2019 to 2020. The market is maturing, and investors should not expect similar gains soon. We have seen time and again that the most explosive potential for upside is in the early stages of digital assets. Bitcoin is now almost a trillion-dollar asset, a mark it has cracked within the last year. In 2013, Bitcoin’s market cap was shy of $1.5 billion, meaning it had multiplied more than 800x at its all-time high in November 2021.

It is hard to believe that Bitcoin is able to reach a market capitalization of more than $700 trillion. However, surpassing gold’s $10-trillion market capitalization is within reach with reasonable assumptions.

Cryptocurrencies like Bitcoin and Ether are attracting significant institutional interest, and this interest is only expected to grow in the coming years. While it can be difficult to differentiate between retail and institutional interest using transaction data alone, there are other indicators that can be used to gauge institutional demand, such as inflows into funds, financial disclosure filings with regulators, and merger and acquisition deals. By analyzing these indicators, investors can get a better sense of where institutional demand is headed and make more informed investment decisions in the crypto space.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.