Distributed ledger technology has gained significant attention in recent years, and professional inventors are seeking ways to gain exposure to it. This article focuses on the four main ways that investors are gaining exposure to digital assets – directly holding cryptocurrencies, buying crypto funds, mergers and acquisitions (M&As), and derivatives. It looks at the survey results of the preferred ways that investors are gaining exposure to digital assets and analyzes the role of active and passive management strategies in this area.

This article focuses on the different ways that professional inventors are gaining exposure to distributed ledger technology. The four key ways include directly holding cryptocurrencies, buying crypto funds, mergers and acquisitions (M&As) and derivatives.

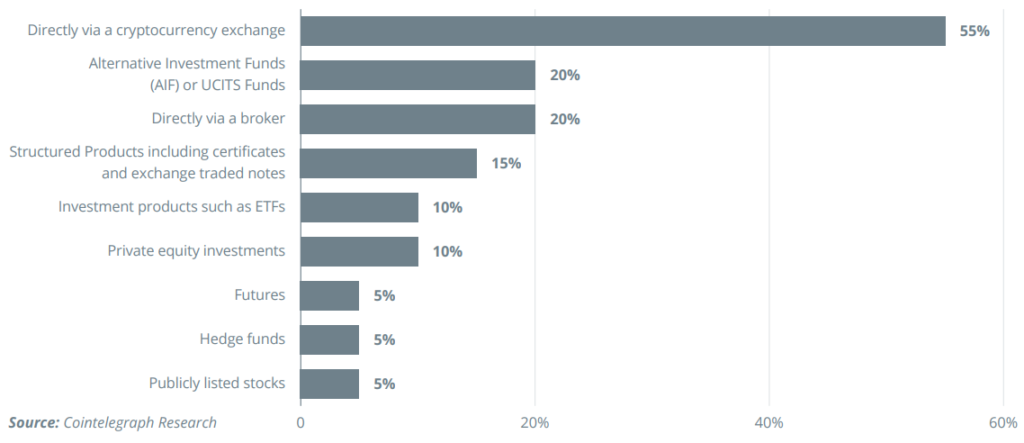

What would be your company’s ideal way to gain exposure to crypto assets?

There are many regulated investment products that give investors exposure to digital assets, including long-only single-asset or index products, derivative products, bank accounts for proprietary desk trading and much more. The survey results show that a slim majority of investors (55%) prefer to hold cryptocurrencies directly. Interestingly, professional investors prefer to buy a regulated alternative investment fund before buying structured products or trading futures. Active strategies beat out passive strategies by a narrow margin.

Do you prefer crypto investment products with passive or active management?

To further explore this area of crypto investment products we asked Dr. Alexander Thoma, the Head of Digital Assets at PostFinance about his position on digital assets:

“Digital Assets are one of our strategic focus fields because we believe in the fundamental technology behind it and see a potential for many future use cases. Cryptocurrencies, which we subsume under digital assets, are currently the one digital asset with the highest market readiness. For us, the growing institutionalization over the last 18–24 months has helped to grow and mature this market in a way that cryptocurrencies are the fifth asset class and are here to stay.

On the other hand, we register an increasing demand from our customers regarding services and products centered around digital assets and in particular cryptocurrencies. Our customers wish to handle their cryptocurrencies business where they handle the rest of their financial business: with us as their main house bank. We believe that a substantial part of exchange services derive from necessity, as most traditional banks still don’t offer crypto services. We want to change that. Hence, it is our job to establish a safe and easy way for our customers to access this market.”

The growing institutionalization of cryptocurrencies over the last 18-24 months has helped to mature this market, and it has become the fifth asset class that is here to stay. With the increasing demand from customers for services and products centered around digital assets, the article highlights the need for a safe and easy way for customers to access this market. The survey results show that a majority of investors prefer to hold cryptocurrencies directly and opt for regulated alternative investment funds over structured products or futures trading.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.