What makes good money and how has the digital age changed the meaning of this term? This article takes a look at the key characteristics of a sound currency and then apply these to the MimbleWimble Coin. We will also speak with the developers of this project and demonstrate how a MWC transaction is executed.

A good money in the digital age must be: (1) recognizable, (2) scarce, (3) censorship resistant, (4) durable & indestructible, (5) extensible, (6) salable, (7) portable, (8) fungible, (9) private, and (10) divisible. However, most cryptocurrencies don’t meet these criteria. In 2019, one of the most talked about coins was “Grin.” However, investors quickly realized that Grin’s high inflation rate and lack of a hard cap on supply was worse than the inflation in the US dollar. This made people wonder why they should buy Grin with US dollars if Grin is a worse store of value. The Grin emission rate is 1 Grin per second indefinitely. There will be 31,536,000 Grin created per year. Currently, there are approximately 43 million Grin. This results in a very low stock-to-flow ratio in the early years. During 2020, the stock-to-flow ratio of Grin is approximately 1.19x or approximately 43,000,000 Grin divided by the new production of 31,536,000. This acts as a transfer of wealth from holders to miners.

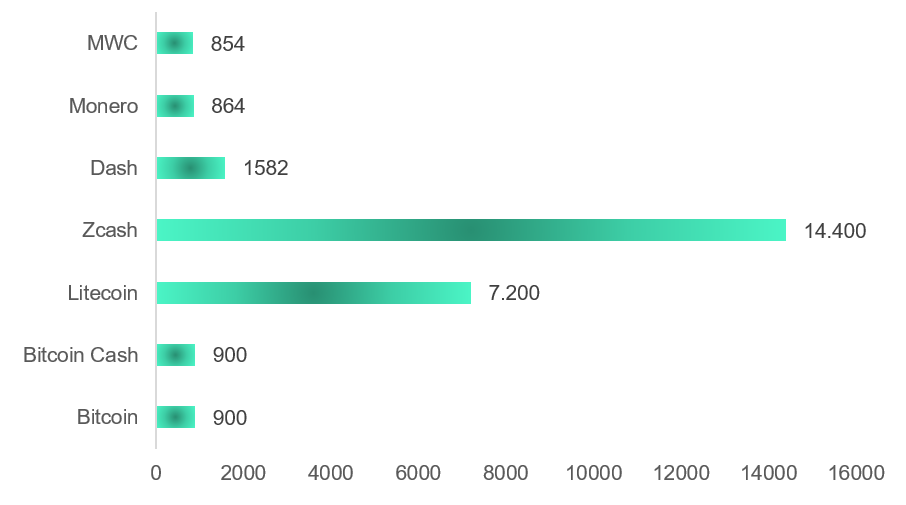

Figure 25: The Number of New Coins Created Per Day

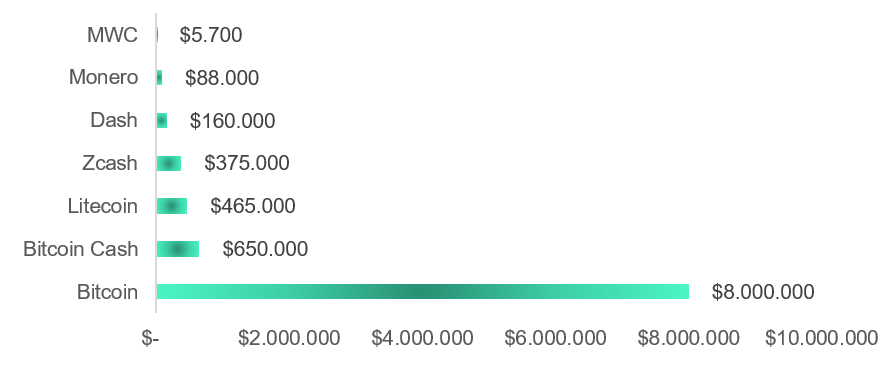

Figure 26: US Dollar Value of New Coins Created Per Day

As Saifedean Ammous explains, a low stock-to-flow ratio results in a transfer of value from holders of the asset to producers, while a high stock-to-flow ratio results in lower costs, measured in the asset itself, for holders. Before Grin launched, a MWC developer suggested there be an supply cap and emission rate change but was swiftly rejected by the Grin community which acted as a green light and was part of the inspiration for forking from Grin. After all, financial innovation is about trying many different approaches when bringing monetary products to market for consumers to enjoy. Every four years is a Bitcoin halving, and after the May 2020 halving the Bitcoin stock-to-flow ratio will be approximately 55. This will make it comparable to gold. MWC addressed the hard cap problem and low stock-to-flow ratio problem by placing a hard cap of 20,000,000 on the coin and then having a much slower emission rate Like Bitcoin, MWC uses a pure proof-of-work algorithm and has the highest stock-to-flow ratio of any base-layer MimbleWimble coin. By October 2020, MWC will have a stock-to-flow ratio almost equal to Bitcoin’s. And by February 2021, it will have a significantly higher stock-to-flow ratio.

When looking at the number of coins created per day, MWC, Monero, Bitcoin, and Bitcoin Cash are the lowest. In terms of the US dollar value of the number of coins created per day, MWC is still the lowest, followed by Monero and Dash. Finally, the US dollar value of new coins created per year in relation to their US dollar market capitalization is also the lowest for MWC with 1.2 % followed by Bitcoin with 1.7 %, Monero with 2.8 %, Litecoin with 6.1 %, Dash with 8.4 %, and Zcash with an astonishing 35.1 %(!).

However, MWC has received some pushback from the cryptocurrency community because of how the initial stock was created. According to the whitepaper and protocol, half of the total supply of MWC were to be mined with proof of work mining, and the other half were created in the genesis block. From this initial stock of 10,000,000 MWC that was worthless when created, 2,000,000 MWC were immediately distributed to the developer team, 2,000,000 MWC were allocated to the HODL Program, and 6,000,000 MWC were airdropped to any Bitcoin holders who successfully registered over a three month period and claimed their MWC allocation during December 2019. Over 5.4 million MWC were successfully airdropped for free to Bitcoin holders and at the time had a total value less than $2 million. MWC primarily uses the C31 proof-of-work algorithm and MWC’s new monthly emission from a pure proof of work algorithm is about $500k.

How To Do A MWC Transaction

MWC was created to meet the demand for transferring money online with full privacy because Bitcoin transactions aren’t that private or fungible.2 MWC payments are slightly different to Bitcoin transactions, the least of which being that there are only outputs and no addresses. After all, everything is CoinJoined with Confidential Transactions and then the signatures are aggregated in the blocks.

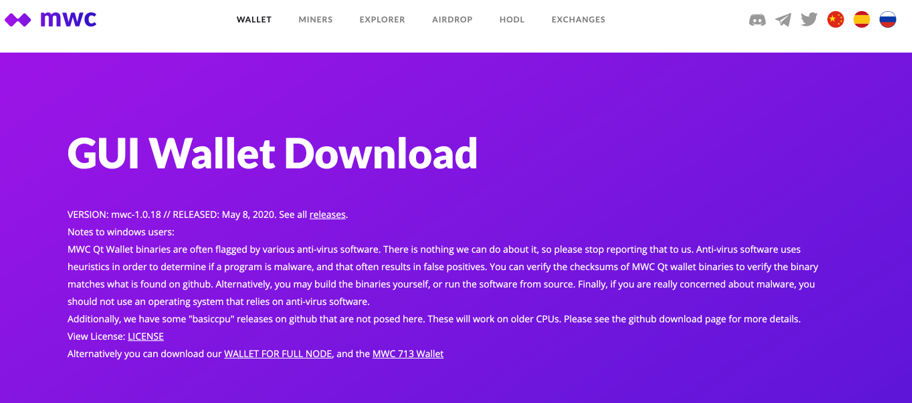

To get started, you have to download a MimbleWimbleCoin wallet. To provide some context, the other privacy coin, Grin, relies mainly on command line interface tools, but they can be difficult for non-technical people to use. This is why MWC has created a very easy-to-use wallet that can be downloaded here: https://www.mwc.mw/downloads

After you have successfully setup your wallet, there are two main ways to send and receive transactions called the MWCMQS method and the File method. In general, this involves six steps:

- The sender creates the transaction using output(s)

- The receiver signs the transaction

- The receiver returns the transaction to the sender

- The sender signs the transaction

- The sender broadcasts the transaction to the network

- The miners confirm the transaction in a block and add it to the blockchain

The MWCMQS Method

Sending and receiving via the MWCMQS method will be most similar to a Bitcoin transaction. However, both the sender and receiver must be able to interact. This means the receiver must be online and listening with the address the sender is attempting to send to. This means you cannot just provide an address and turn off your laptop and go to bed like you can with BTC, LTC, etc.

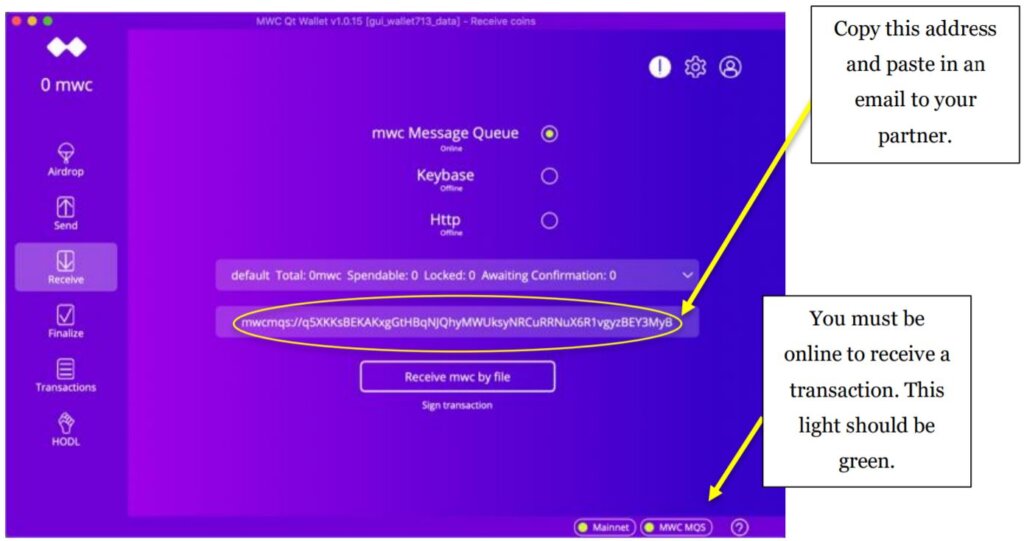

To get started, open up the wallet and click “Receive” in the left-hand menu. Copy the mwcmqs:// address and send it to your partner. Sending via email or a messaging application is fine. In order for your partner to send you a transaction, your wallet will need to be online and listening (in the lower right the MWCMQS will need to be green) for that specific address.

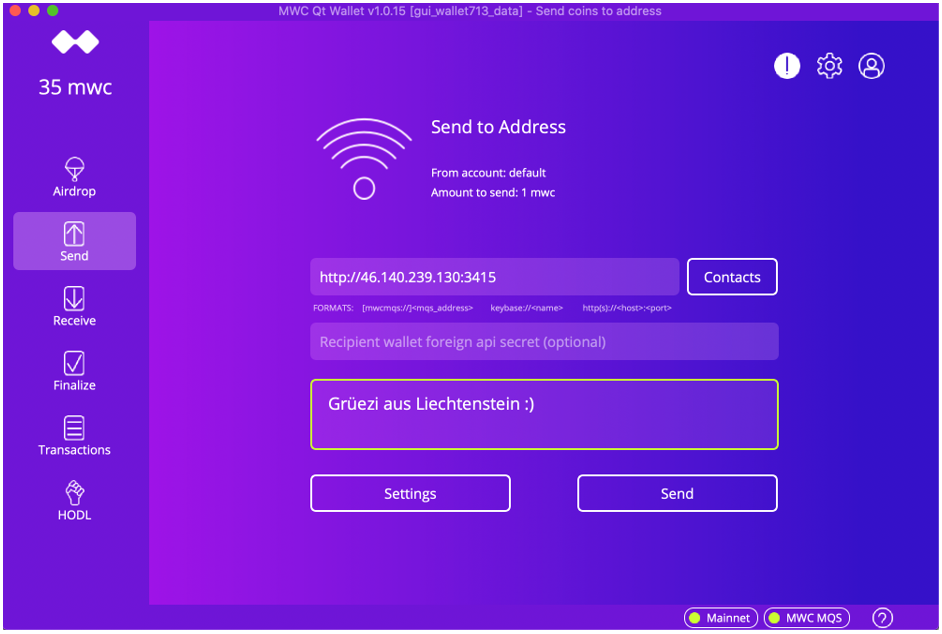

Once your sender copies in the address that you send them, they can paste in the address on the wallet by clicking on the “Send” option in the left-hand menu. They can also send a message along with the transaction.

The File Method

Although the MWCMQS method is the easiest method for people that used to send Bitcoin transactions, the most private way to send MWC transactions is with the File method.

Sending and receiving by File requires five steps.

- The sender creates the transaction and generates a .tx file

- The sender provides the .tx file to the receiver

- The receiver signs the transaction and generates a .tx.response file

- The receiver provides the .tx.response file to the sender

- The sender signs the transaction and broadcasts it to the network by finalizing the transaction

To get started, a sender will attach the mwc-payment.tx file to an email and then email this file to the receiver. This covers the first two steps. The receiver must then download the file from the email and then go into their MWC wallet and insert the file. Depending on your operating system, a little box may pop up when you click “Receive mwc by file.” This box will ask you for permission to access files in your Downloads folder. Once you click “OK” you will need to find the specific .tx file that the sender sent you.

Then the receiver needs to email back a new mwc-payment.tx.response file, which will constitute the next two steps. Then, the final step will be finalizing the transaction on the sender’s side. The sender and receiver can check the transaction on the block explorer: https://explorer.mwc.mw/. By clicking in the upper right corner on the Gear, MWC users can see their transactions on the blockchain by double-clicking on the output. What is cool is that only you and the person you transacted know how many MWCs are associated with that particular output.

Fireside with the MWC Team

- Are you inspired by Austrian economics? If so, please who is your favorite Austrian economist? What is your favorite book on Austrian economics? And, last but not least, what is your favorite quote?

- Yes, we like the Austrian school of economics because of its objectivity. It is about understanding how things are in contrast to how we many want them to be. Mises, Rothbard, Gordon, Block and others have produced some excellent work. Human Action is a foundational text in the area. We are monetary sovereignty maximalists and are big fans of any means that help accomplish that purpose or aim whether that comes in the form of gold, silver, Bitcoin, Dogecoin, MWC or whatever. As Mises explained, “It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of rights. The demand for constitutional guarantees and for bills of rights was a reaction against arbitrary rule and the nonobservance of old customs by kings. The postulate of sound money was first brought up as a response to the princely practice of debasing the coinage. It was later carefully elaborated and perfected in the age which—through the experience of the American continental currency, the paper money of the French Revolution and the British restriction period—had learned what a government can do to a nation’s currency system… Thus, the sound-money principle has two aspects. It is affirmative in approving the market’s choice of a commonly used medium of exchange. It is negative in obstructing the government’s propensity to meddle with the currency system.”

- You mention that the MWC team are invested in Bitcoin. Are you invested in any other privacy-related coins?

- We do not know. The MWC Team is composed of a significant number of people who are united by the purpose or aim of monetary sovereignty. And part of that means that what each of us does with our own money is our own business and not the business of others.

- What do you say to the argument, “Only criminals use privacy coins?”

- Without the ability to keep secrets, individuals lose the capacity to distinguish themselves from others, to maintain independent lives, to be complete and autonomous persons. This does not mean that a person actually has to keep secrets to be autonomous, just that she must possess the ability to do so. The ability to keep secrets implies the ability to disclose secrets selectively, and so the capacity for selective disclosure at one’s own discretion is important to individual autonomy as well.

Secrecy is a form of power. The ability to protect a secret, to preserve one’s privacy, is a form of power. The ability to penetrate secrets, to learn them, to use them, is also a form of power. Secrecy empowers, secrecy protects, secrecy hurts. The ability to learn a person’s secrets without his or her knowledge — to pierce a person’s privacy in secret — is a greater power still.

We want to help humanity exercise their unalienable right to secrecy, or in other words, to have you and your property left alone. This is even more important now that we have tools like Bitcoin and MWC which are based on public-private key encryption.

- Who is the target demographic for privacy coins? What do you think is the average demographic of a privacy coin user? I mean, do you think that privacy coins are primarily used in developed countries or in developing countries? Do you think they are used by relatively rich people or relatively poor people?

- We are not really sure since we have not done much market analysis besides personal introspection. For the most part, we have been significant Bitcoin holders for many years but are cognizant of its characteristics and how it does not necessarily perform very well all of the jobs we may want it to. We saw the opportunity to build a product we wanted to use ourselves, extremely scarce ghost money, and the other monetary entrepreneurs in the marketplace were currently neglecting that market demand or choosing design characteristics we did not find compelling in a product. So we built the type of monetary product we wanted to use ourselves.

- What are the main points on the roadmap for MWC during the next 12 months?

- Fully distributing the initial stock via the unclaimed airdrop fund and HODL program, additional exchange integrations, greater market liquidity, additional Grin rebases, release a mobile wallet, atomic swaps, a decentralized exchange, multisig, Lightning Network and other features.

Conclusion

The MWC network was launched in November 2019 and has functioned flawlessly with 100 % uptime. The MWC team considers the protocol ossified and currently sees no need for a future hard or soft fork unless a defensive action were required to protect the network. We feel the MimbleWimble sector may be neglected, to contain significant disruptive technological innovation potential, and there may be significant information asymmetry in the market. This type of technology is especially important in the age of surveillance.

Disclaimer: The author of this article owns MWC.