The Dash Investment Foundation (DIF) announced on social media that they have begun to purchase the digital asset RUNE in support and preparation for THORChain’s upcoming DEX. The Dash network elected DIF Supervisors voted to actively purchase THORChain’s native token RUNE with an initial investment of $100,000.

Why is the DIF buying RUNE?

Dr. Darren Tapp, a DIF Supervisor informed the Dash community on Discord that “The Rune will be used to vote to add Dash to THORChain once it’s available. We consider THORChain to be an up-and-coming DEX. After Dash is added the Rune will be used to provide liquidity to a DASH/RUNE pair on THORChain. We expect liquidity providing to be revenue positive, although there are risks, it should outperform 50/50 exposure to DASH and RUNE.”

What is the DIF?

The Dash Investment Foundation (DIF) is the world’s first ownerless and memberless investment fund. The DIF was incorporated on March 21st, 2019 as a Cayman Islands foundation company limited by guarantee and is completely controlled by Dash’s decentralized network. The Dash Investment Foundation is tasked with strengthening the Dash network through investment operations. By this, the foundation creates a bridge between the network protocol and the legacy financial and legal systems. This opens new possibilities for entrepreneurs and the Dash network to partner and mutually benefit from the funding available through the Dash network via Dash Investment Foundation.

Mark Mason, Communications Manager for Dash recently tweeted an update showcasing the Dash Investment Foundation’s investment portfolio emphasizing “Companies own Bitcoin, Dash owns companies!”.

Why is Dash excited about THORChain?

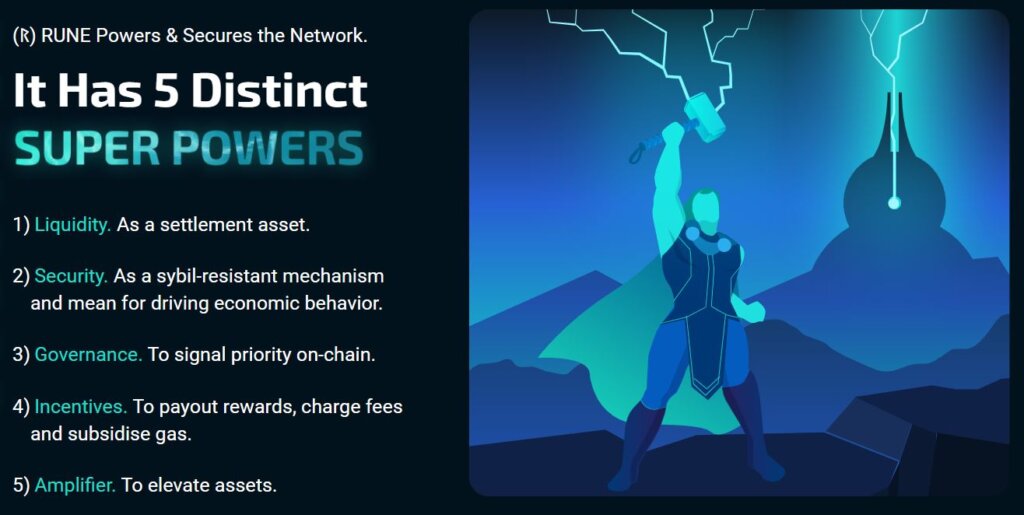

THORChain (RUNE) is a permissionless cross-chain liquidity platform that supports interoperable blockchain communication. It is a non-custodial liquidity marketplace for blockchains that allows users to swap assets freely through multiple networks (cross-chain transfers).

With THORChain’s decentralized liquidity protocol, cryptocurrency projects such as Dash can deposit native assets into Liquidity Pools to earn a yield. THORChain’s liquidity protocol is 100% autonomous and decentralized. Cryptocurrency projects such as Dash can deposit native assets into Liquidity Pools.

THORChain distributes rewards in the form of RUNE (the network’s native token) to any user that adds tokens to a liquidity pool. At the same time, token owners in this instance Dash can stake their assets and earn the fees accumulated from other users accessing the pool.

Dash Incubator Developers begin to implement THORChain

The Dash Incubator is an open-source app that connects users who want to earn rewards for working together to improve the Dash cryptocurrency. The Dash Incubator recently celebrated a 1,000 completed bounty milestone. Ash Francis, a Dash community developer and admin for the Dash Incubator commented about the work that has begun on implementing Dash with THORChain: “Yes this is really happening, we’re estimating around 2 months of development to give us good time to create the bifrost module (chain client) which involves porting a lot of dependencies to Dash. At that point, the THORchain team will need to merge our pull requests, and then once the nodes have upgraded we can create a Dash <> RUNE pool that will get us listed if we’re the highest staked pool in any 3 day period.”

Are DEX’s like THORChain the future of Crypto?

The THORChain project was founded in 2018 under the premise that the use of centralized exchanges to transfer crypto-assets between different blockchains was flawed. Non-custodial exchanges, otherwise known as decentralized exchanges (DEXs), were the long-term solution. Therefore, the THORChain team set out to build an independent blockchain that could bridge to external networks and thus facilitate cross-chain transfers, functioning similarly to a DEX.

The problem often facing DEXs is finding sufficient liquidity. Traders gravitate towards platforms where they won’t lose any value due to slippage. But these same traders are the ones to provide enough liquidity to prevent slippage in the first place. In response, the THORChain team plans to implement an adapted model of Bancor’s “smart token” to create what it calls Continuous Liquidity Pools (CLPs). These pools of available assets give traders access to liquidity without needing to find or contact another buyer or seller.