A pivotal transition: from Bitcoin strength to altcoin rotation

The crypto market has entered a pivotal transition phase — Bitcoin dominance is peaking, liquidity is rotating into altcoins, and institutional demand is reshaping the market structure. This is precisely when disciplined, research-driven strategies can outperform.

In 2025, spot Bitcoin ETFs purchased roughly 1,000 BTC per day on average, while digital-asset treasury companies acquired even more—about 1,755 BTC per day. Over the last 90 days, a handful of altcoins have outperformed: ZEC (+489%), BNB (+42%), ETH (+6.67%) versus BTC (−6%). In this environment, active management—grounded in fundamentals rather than narratives—can capture asymmetric opportunities while controlling drawdowns.

This article covers:

1️⃣ The three main reasons why Bitcoin belongs in a portfolio including historical performance, diversification, and the macroeconomic environment.

2️⃣ How altcoins can enhance Bitcoin’s risk-adjusted return, and therefore, also belong in a portfolio.

3️⃣ Why active management is a “must-do” for cryptocurrency investments and what fundamental analysis means in the context of cryptocurrencies.

4️⃣ How Zeltner & Co.’s actively managed strategy — the Cryptocurrency Frontier AMC — brings these ideas together in practice.

Three main reasons why Bitcoin still belongs in portfolios

1️⃣ Return profile: Since 2014, Bitcoin’s average annual return is roughly 46%, making it one of the most compelling long-term assets despite high volatility.

2️⃣ Diversification: Bitcoin’s historically low correlation to equities and bonds means that even a modest allocation can improve a portfolio’s efficiency.

3️⃣ Macro context: In a world of persistent debt burdens and currency debasement, Bitcoin’s fixed supply (21 million) provides a scarcity premium that many investors now treat as a digital store of value.

Bitcoin in a Balanced Portfolio

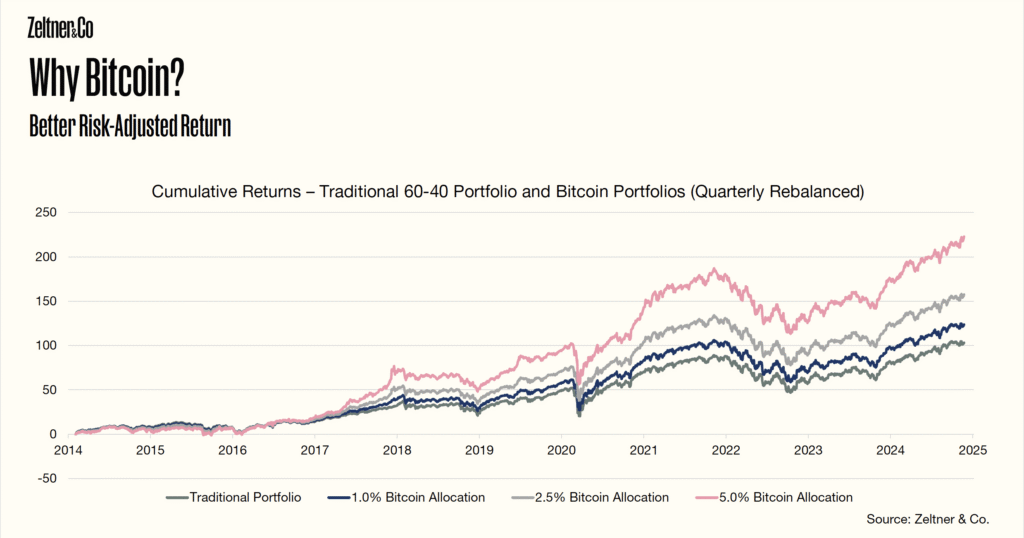

At the Zeltner & Co. investor breakfast in Zurich on September 25, we shared our analysis of a traditional 60/40 portfolio from 2014 onward:

- The traditional 60/40 portfolio without Bitcoin returned 103%.

- A portfolio with just 5% allocated to Bitcoin returned 223% over the same period.

In other words, a small Bitcoin allocation — quarterly rebalanced — more than doubled overall returns.

To test whether this only applies to early investors, we ran a rolling three-year analysis covering every investment window since 2014. The result?

Every single three-year holding period for Bitcoin produced a positive return.

Even those who invested at the all-time high in November 2021 at $69,000 and held through a full three-year cycle would still have achieved a positive return, despite Bitcoin losing 77% of its value at one point during that period.

This consistency through time is what makes Bitcoin such a powerful addition to diversified portfolios.

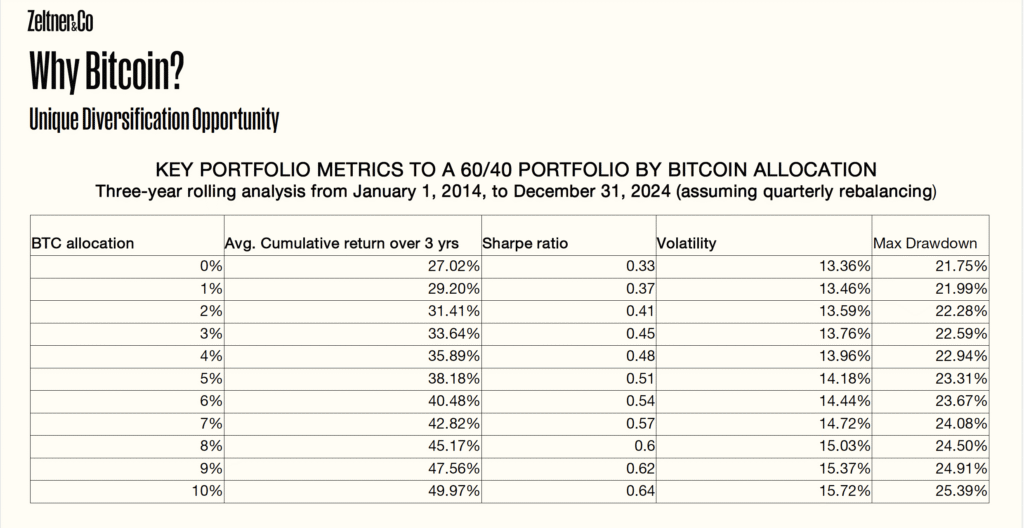

The three-year rolling results table tells a simple story:

- A 0% Bitcoin portfolio had an average 3-year return of 27%, with a max drawdown of 21.75%.

- A 10% Bitcoin portfolio increased the average 3-year return to 50%, while only slightly raising the max drawdown to 25.4%.

The data is clear: Bitcoin improves return potential far more than it increases risk, thanks to its low correlation with traditional markets.

Two reasons why altcoins can complement Bitcoin allocations

After understanding Bitcoin’s role, the next question is: why invest in altcoins at all?

There are two key reasons — technology and seasonal performance cycles.

1️⃣ Technology

Altcoins expand the functionality of blockchain beyond Bitcoin’s base layer.

There are certain use cases that Bitcoin’s design simply cannot fulfill, including:

- Stablecoins, which provide price stability and are vital for on-chain commerce.

- Trading and lending protocols, which form the backbone of decentralized finance (DeFi).

Each of these represents a new frontier of innovation — and potential value creation — that Bitcoin alone cannot capture.

2️⃣ Seasonal Patterns

Crypto markets tend to move in cycles. Historically, altcoins outperform Bitcoin during mid-cycle phases when liquidity expands and risk appetite increases.

For example, over the past 90 days, 25 coins from the top 100 coins measured by market capitalization have outperformed Bitcoin, underscoring that we are currently in an altcoin rotation phase — what many refer to as the start of “Altcoin Season.” Altcoins in our portfolio, such as ETH with a 90-day return of +6.67% and Tron with a 90-day return of 2.81% have outperformed Bitcoin’s 90-day return of -6%.

Portfolio Example: Solana’s Growth

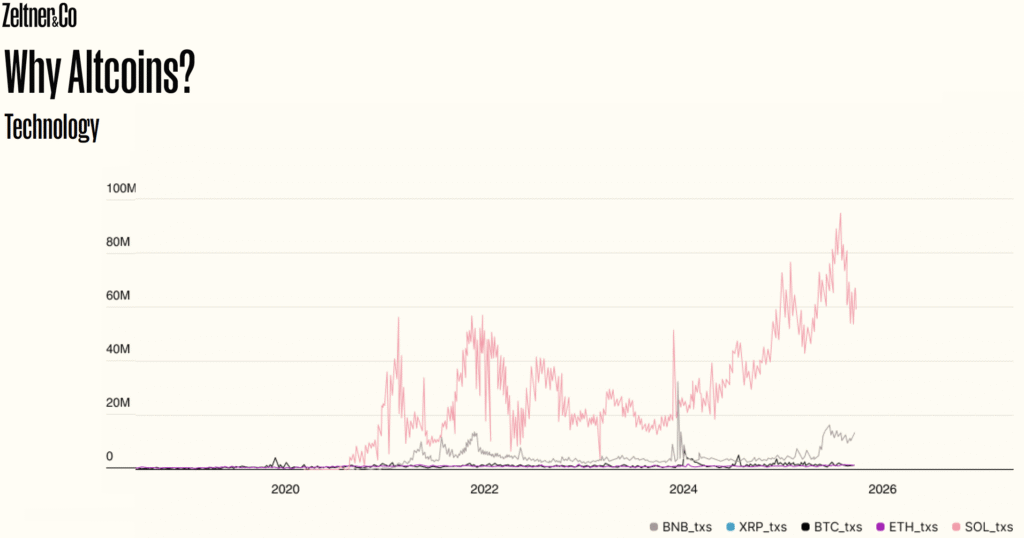

Take Solana, for instance. This is another example of an altcoin that has outperformed Bitcoin over the last 90 days. Bitcoin’s design prioritizes security and decentralization; however, that comes at the cost of transaction speed and cost.

As a result, applications requiring fast, low-cost payments, such as on-chain trading and lending, have moved to more scalable blockchains like Solana.

In 2025, Solana processed 100 million non-governance transactions per day, representing many multiples more than Bitcoin. While Bitcoin has cemented its role as a store of value, altcoins such as Solana address different targetable markets, such as real-world asset tokenization and decentralized finance.

How Zeltner & Co. invests in cryptocurrencies: fundamental analysis with active management

Now that we’ve discussed why Bitcoin and why altcoins, let’s turn to the third and most practical question — why the Zeltner & Co. Cryptocurrency Frontier AMC?

The Zeltner & Co. AMC integrates fundamental analysis, active management, and a proven performance track record.

What Does Fundamental Analysis of Cryptocurrencies Mean?

In traditional finance, fundamental analysis means visiting firms in person and doing field research to glean new information about a particular company or investment.

In crypto, it’s different. Zeltner & Co. analyzes on-chain and off-chain data to assess real economic activity — including:

- Network revenue per chain

- Economic transaction volume

- Developer activity

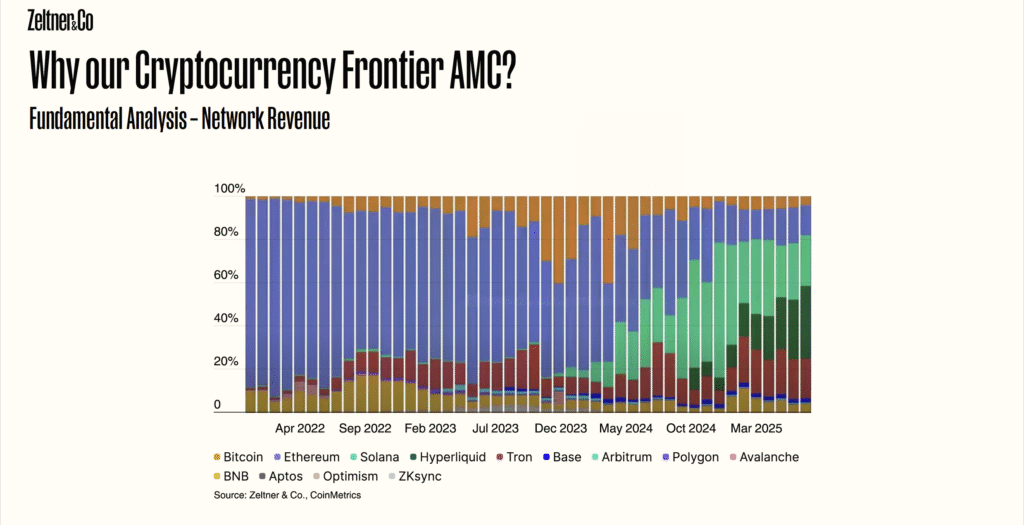

Understanding the real-world economic use of a blockchain allows us to separate projects with real user demand from those driven by hype or speculation. One of the key charts to monitor is network revenue per chain. The data shows that Ethereum’s dominance in total network revenue is declining, while Solana’s share is growing significantly.

If you invest in a passive, market-cap-weighted strategy such as the 21Shares Crypto Basket 10 Core ETP, you would remain overweight Ethereum — a backward-looking approach that fails to capture where user activity and value creation are actually going.

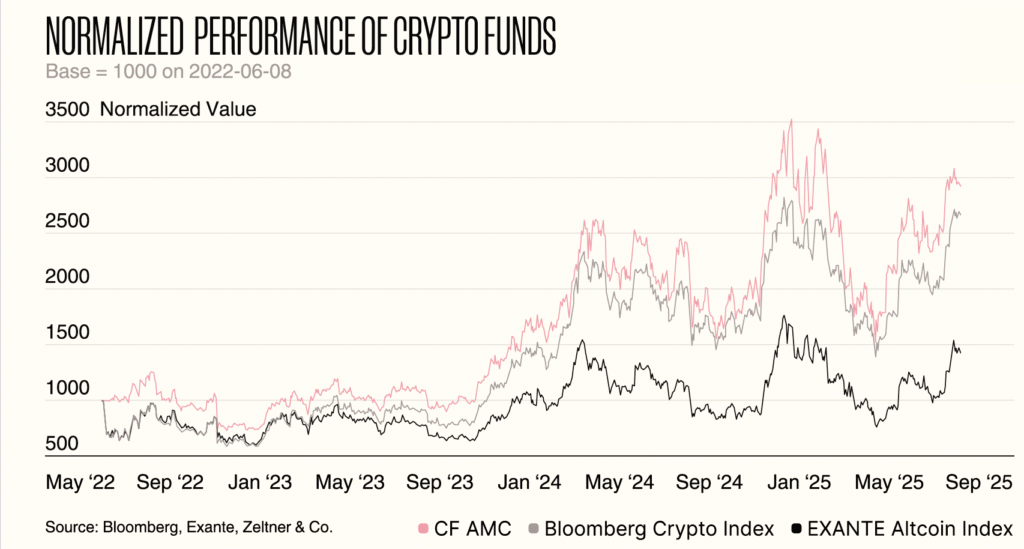

Zeltner & Co.’s active management strategy adapts to these shifts dynamically — overweighting the networks where growth is happening, not where it once was. Since the Cryptocurrency Frontier’s launch in June 2022, the AMC has delivered a +192.8% cumulative return, outperforming both the Bloomberg Crypto Index (+168%) and the EXANTE Altcoin Index (+42.3%) over the same period.

This outperformance is not a coincidence—it stems from proactive asset rotation and disciplined position sizing. During the 2025 cycle, Zeltner & Co. increased exposure to high-quality altcoins such as Solana, Chainlink, and Aave when on-chain revenue and developer metrics signaled strength. Conversely, they reduced risk in weaker projects when liquidity or activity declined.

The result has been smoother performance through volatile phases and stronger participation during market recoveries.

Even as Bitcoin remains the anchor of their portfolio, the alpha generation comes from understanding when and how to overweight emerging assets—an approach that few passive strategies can replicate.

Outlook

With Bitcoin’s dominance elevated and institutional adoption advancing, we expect continued dispersion between assets. That’s fertile ground for research-driven selection, risk budgeting, and disciplined execution—exactly the edge active management is designed to provide.

For qualified investors

To learn more about Cryptocurrency Frontier AMC, request the latest factsheet or book a 15-minute call with the Zeltner & Co. team at www.zeltnerco.com

Disclaimer

This article is provided for informational purposes only and does not constitute investment advice or an offer to buy or sell any financial instrument. Past performance is not indicative of future results. The Cryptocurrency Frontier AMC is available only to qualified investors under applicable Swiss regulations.