The price of Bitcoin, by far the biggest player among all cryptocurrencies, fell more than 10% within the last few days. Other major cryptocurrencies, such as Ethereum, Litecoin and Bitcoin cash, have also decreased in value, but Bitcoin’s decline generates the most headlines, as earlier this year, it noted the record $10,000 per bitcoin and was showing no signs of slowing down. In the course of the last few days, Bitcoin lost $30 billion in value, going down 0,22% within the last 24 hours. Created by unknown individual(s), Bitcoin was designed to enable fast, cheap transactions without using traditional banking, and when its price went up at the beginning of the year, many started to regard it as a ‘safe-haven asset’ and the answer for the global trade crisis connected to coronavirus. China’s participation in the cryptocurrencies’ market is enormous, so given the latest course of events regarding the virus, the cryptocurrencies’ decline seems natural for some, while other industry experts, such as Vitalik Buterin call it “rationalised bullshit”.

Despite Bitcoin’s drop in value, many remain positive about its future, as it is driven by demand, rather than GDP. The entire business model of Bitcoin is based on scarcity, much like the former monetary programs, which only allowed printing the amount of money corresponding to the actual amount of gold. To ensure such scarcity, Bitcoin invented the process of halving, or simply reducing the total supply over time to boost the value of the cryptocurrency. Typically, Halving takes place every four years and the next one is set to take place in May 2020. Experts predicted that the price of Bitcoin would increase several times and reach up to $70,000 per bitcoin. Whether it is wishful thinking or an accurate prediction, only time will tell.

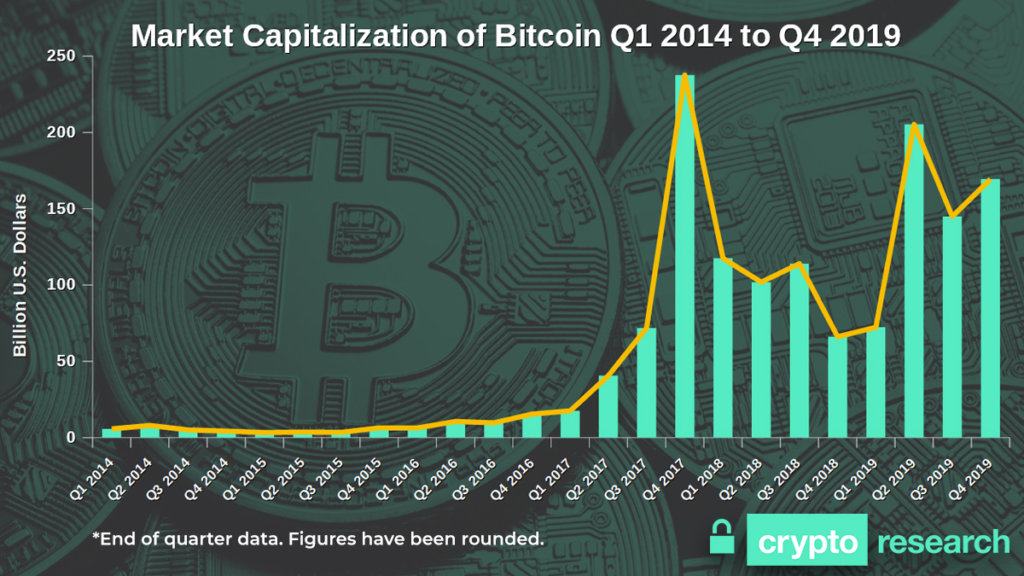

Nevertheless, it is without a doubt that Bitcoin continues to develop and improve its services, particularly in terms of privacy and scalability. In the first half of 2020, we can expect the launch of a consumer application for Bitcoin and cryptocurrency purchases. The app will be supported by Starbucks, Microsoft, and Boston Consulting Group. Despite a sudden decline in value, Bitcoin’s market capitalization equivalent is substantial. According to Statista’s database [1], between the first and last quarter of 2019, it increased by over 57%, from 72,37 billion dollars in the 1st quarter to 169,44 billion dollars in the 4th quarter. Square, one of the companies, which included Bitcoin in their payment methods, observed a 60% rise in the number of active users in the last quarter of 2019. The company’s revenue increased by 41% within a year, reaching over $1,3 billion dollars. Why is their success attributed to the Bitcoin adaptation? Half of $361 millions produced by Square’s Cash app were generated by Bitcoin transactions – in just 3 months. Numbers seem to be in favour of cryptocurrencies, even when investors are not. During the meeting with crypto representatives, the famous investor Warren Buffet was reported to have donated all cryptocurrencies he was given to the charity, stating that “I don’t own any cryptocurrency. I never will.” Regardless of the current crypto landscape, Bitcoin’s kingdom is yet to fall, but will it quickly recover? Remains to be seen.

Change is the only constant in the world of cryptocurrencies. Although Bitcoin lost $30 billion in value within just a few days, it continues to attract customers across numerous applications, having generated half of Cash app’s revenue in just 3 months. Powered by demand, it may rise again, once scarcity’s in play.

[1] See Market capitalization of Bitcoin from 4th quarter 2013 to 4th quarter 2019, Statista

Sources:

https://www.forbes.com/sites/billybambrough/2020/02/27/bitcoin-has-crashed-now-what/#eb5196d538a0

https://cryptovest.com/news/bitcoin-btc-price-falls-through-several-supports-as-coronavirus- fears-grip-the-globe/

https://www.techspot.com/news/84185-square-half-cash-app-quarterly-revenue-came- bitcoin.html