Several blockchain-based companies are publicly listed on stock exchanges throughout the world. Some of them are trading at an unwarranted price given their revenues and earnings potential. Some have even already gone bust like Riot Blockchain Inc. (RIOT) that dropped 97% from an all time high of $46 in 2017 down to the current price of $1.33, or they have switched business models like Fortress Blockchain Corp. now called Fortress Technologies Inc. (FORT) after quarters of consecutive million dollar losses.

This article is a sneak peek of the Crypto Research Newsletter published every week to our subscribers. We do not often publish these posts publicly, so if you would like to receive professional financial analysis of crypto assets weekly subscribe here: https://cryptoresearchnewsletter.substack.com/

In this week’s edition of the Crypto Research Newsletter, we discuss how to value publicly listed blockchain stocks, and how some investors with deep pockets are turning overvaluation into an opportunity.

There are several ways to value a publicly listed stock. This week, we wanted to evaluate if Michael Novogratz’s Galaxy Digital Holdings Ltd. traded on the Toronto Stock Exchange with ticker GLXY was a good buy or not. Galaxy Digital does venture capital, they sell investment products, they do lending, and they do market making, amongst other activities.

The market capitalization of Galaxy Digital is $88.56 million Canadian Dollars (CAD). The stock price is $1.32 CAD. Is this a good buy at $1.32 or not? There are many ways to answer this question, but a simple way is just to compare Galaxy Digital’s price to comparable firms.

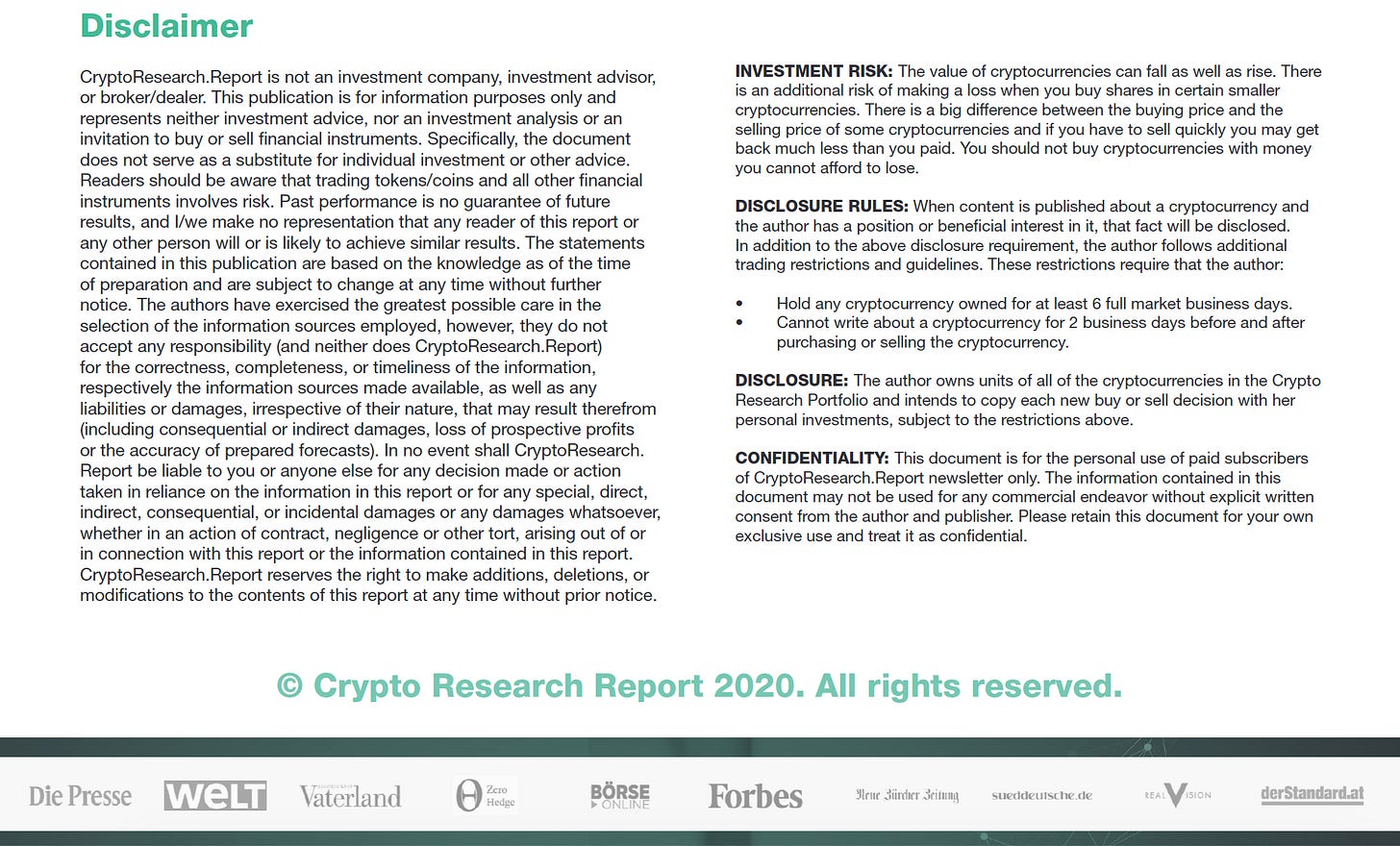

Comparable blockchain firms that are listed on the Toronto Stock Exchange include Hive Blockchain Technologies Ltd., Bitfarms Ltd., Cryptostar Corp., Neptune Dash Technologies Corp., Fortress Technologies Ltd., and AnalytixInsight Inc. The market capitalization, revenue and Price to Sales Ratio (P/S) are listed in the table below.

Table 1: Price to Sales Ratio of Publicly Listed Blockchain Companies

Source: Toronto Stock Exchange, CryptoResearch.Report

Just a quick glance at the table shows that Galaxy Digital is relatively low priced compared to other blockchain firms. Galaxy Digital’s Revenue in 2019 was $156 million, higher than the company’s $92 million CAD market capitalization. This gives Galaxy Digital a P/S Ratio of 0.59 compared to the group average of 13.9. Galaxy Digital’s stock has increased 26% since the beginning of this year from $1.05 to $1.33. However, the company is still not turning a profit after costs.

A quick glance at Table 1 also shows a humungous outlier. Namely, Neptune Dash Technologies Corporation. Neptune Dash is a company that hosts masternodes on the Dash network. They currently have 16 masternodes, or approximately 16,100 Dash worth around $1.7 million USD and they have invested in Cosmos (ATOM). Even though everyone says that Tesla is overpriced, Tesla (TSLA) is still only trading at a P/S Ratio of 6.5x their annual revenues. Apple (AAPL) trades at 5.5x their annual revenue.

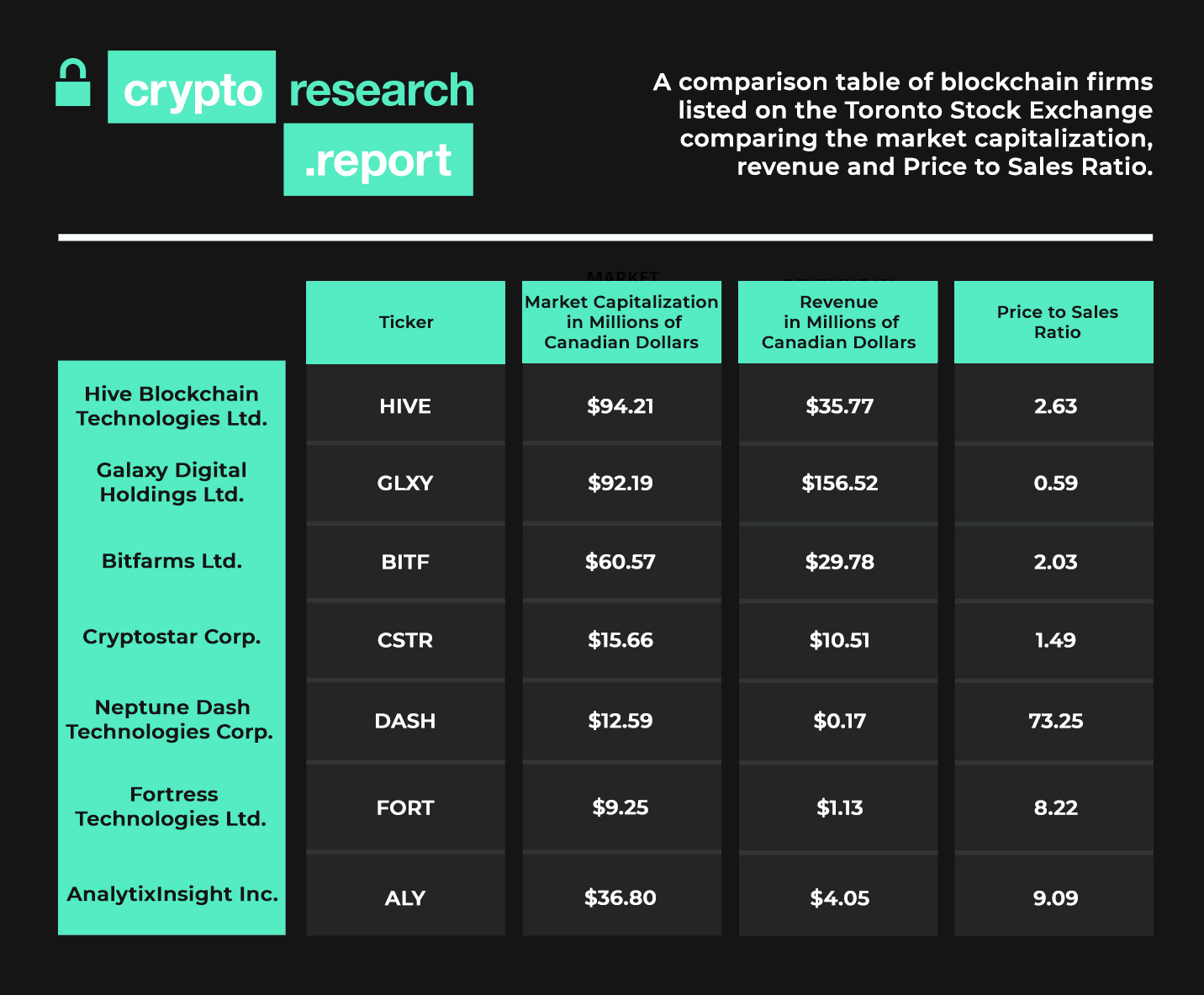

Figure 1: Neptune Dash Stock and Dash are Highly Correlated

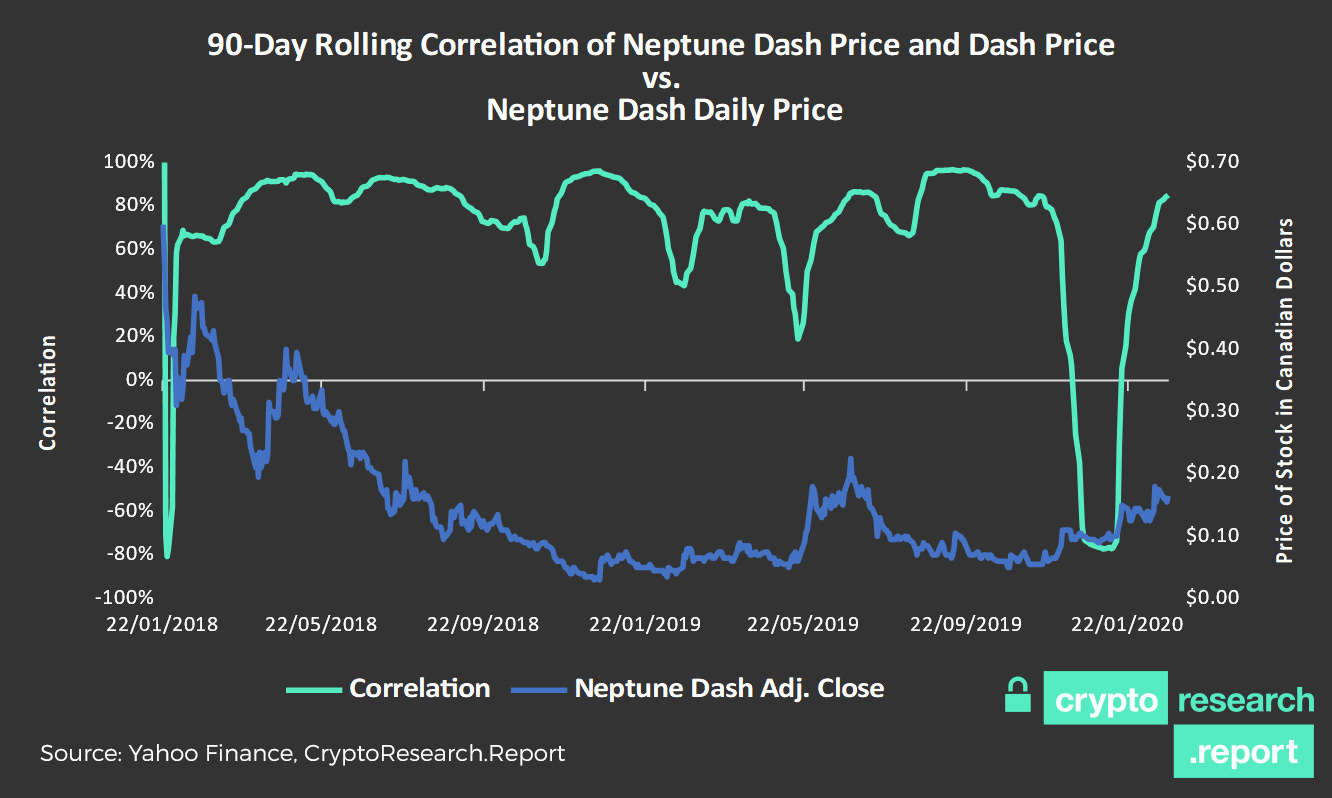

Figure 2: Grayscale GBTC Stock and Bitcoin Are Even More Correlated!

So how can a 73x P/S Ratio be warranted? One interpretation is that 73x could be a very early stage startup multiple meaning that investors expect for Neptune Dash to earn a lot more in the future than they are currently earning.

Another interpretation is that institutional investors cannot easily hold privacy coins directly in their portfolio, and are therefore, willing to pay more for a publicly listed stock that gives them access to privacy coins. There is some evidence of this with stocks like Grayscale’s GBTC Bitcoin tracker that has more often than not traded at a 20%-30% premium over the spot price of Bitcoin during the past few years.

Grayscale has 303,363,800 outstanding each worth $11.72 USD, and each share is backed by 0.00096645 Bitcoin, worth approximately $9.33 USD. This means that GBTC shares are trading at approximately 25.6% premium over the spot price of Bitcoin. An obvious trading strategy would be shorting GBTC and holding Bitcoin long, but this has not worked well in the past for traders, because GBTC’s premium has persisted month after month. Grayscale has approximately 293,185 Bitcoin under management and charges a 2% annual fee on a passive investment strategy, which at first glance, seems high, but is actually quite reasonable given the fact that cryptocurrency custody is not that straightforward.

When comparing the Neptune Dash stock price to the Dash price, an average 90-day rolling correlation of 70% is found over the past two years since Neptune Dash was listed on the Toronto Stock Exchange. The only time that these two assets had a negative correlation was during December 2019 and early January 2020, when the price of Dash was going down and the price of Neptune Dash stock was going up. This can most likely be explained by the fact that the drop in Dash’s price triggered a massive selloff of Dash masternodes, which meant that the existing masternodes earned more. Since Neptune Dash runs masternodes, this means that their earnings went up on each node.

In contrast, the GBTC average 90-day rolling correlation with Bitcoin is much higher, at 83% over the past five years and 92% over the same time span that the Neptune Dash and Dash correlation was calculated over.

One final note on this peer group of blockchain firms: there is an unfortunate back story to Fortress Technologies Ltd. The company was listed on the stock market in 2018, and is currently trading at $0.12 CAD. This is the epitome of a crypto penny stock. The company has basically no information on their website and the last post that Fortress Technologies Ltd. made on their Twitter account was in 2018 shortly after being publicly listed. We were surprised to find that Roy Sebag and Josh Crumb from Goldmoney are part of the Fortress team. Apparently, their attempts at Bitcoin mining did not pan out as expected, as they officially removed “blockchain” from their name in April of 2019 after consecutive quarters of layoffs and losses.

In conclusion, Grayscale and Neptune Dash seem grossly overvalued when comparing their share price, number of shares outstanding, and earnings. This is most likely a symptom of all stock prices being grossly overvalued because the Fed’s faucet of money is flooding the market and investors are betting on scarce crypto assets as being a hedge against fiat inflation. This will not last forever, but as Keynes said, “markets can remain irrational a lot longer than you and I can remain solvent.”

This Week’s Top Cryptocurrency News

Wyoming’s Blockchain lady, Caitlin Long, is starting the first Bitcoin Bank called Avanti. We are personally excited at the CryptoResearch.Report, because Caitlin is one of the few people in the Blockchain space that combines competency, hard-work, and honesty – all qualities needed for a company to have long-term success in the crypto world! Read more.

Tomorrow, Wednesday the 26th of February, the U.S. Securities Exchange Commission will decide if the Wilshire Phoenix exchange traded fund (ETF) on Bitcoin will be approved or not. If approved, the ETF will have fees of 68 basis points (0.68%) per annum and a maximum share price of $2,500 USD. Read more.

No Central Bank Digital Currencies (CBDCs) have been officially launched so far, but Sweden will probably win the race with their e-krona. Read more.

Winners and Losers

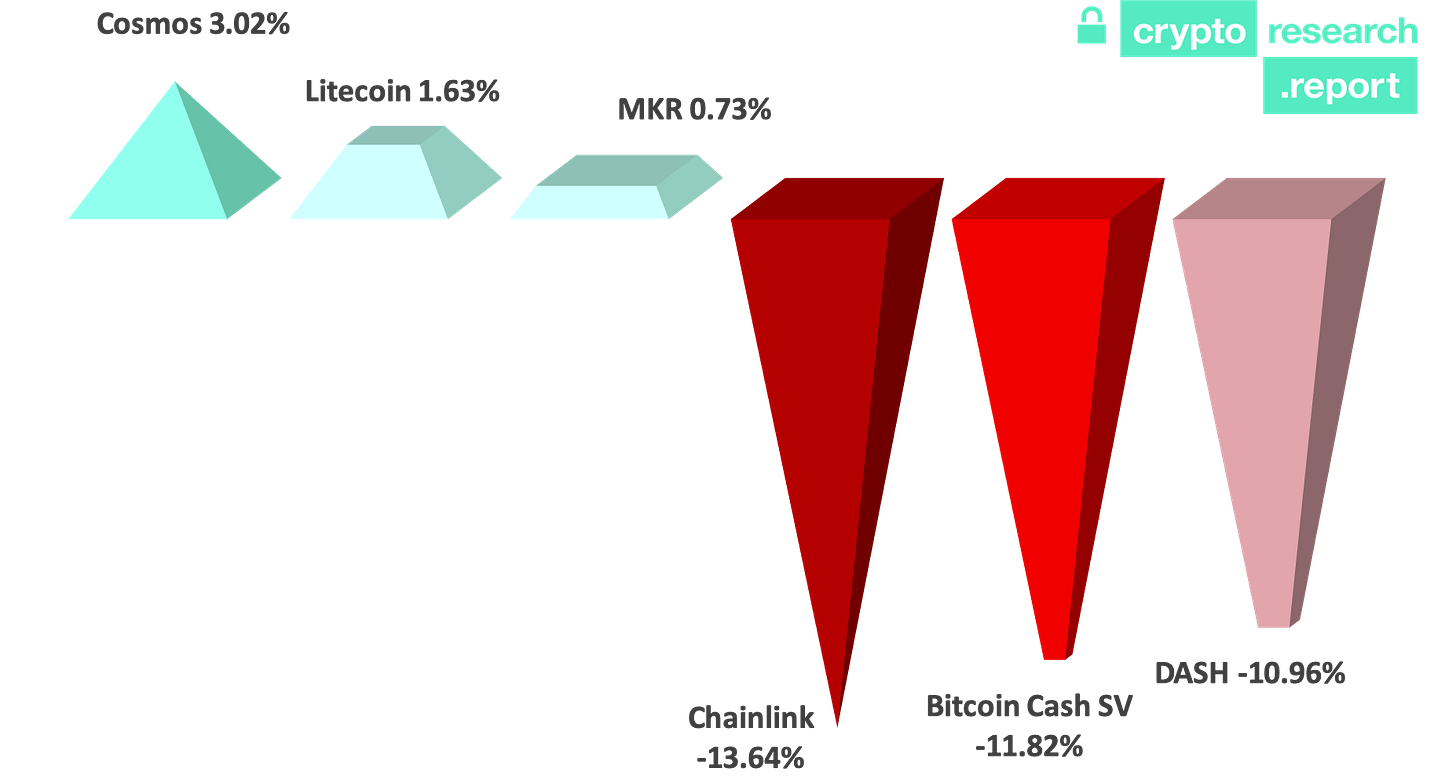

Everything that goes up must come down, and this week was not very kind to Chainlink or the crypto asset market in general. Chainlink is down – 13.64% this week, but is still up 116% year to date with a current price of $3.91 compared to $1.81 on January 1, 2020.

The past week’s largest cryptocurrency winners from the top 50 market capitalization are Cosmos (3.02%), Litecoin (1.63%), and MKR (0.73%).

The biggest losers were Chainlink (-13.64%), Bitcoin Cash SV (-11.82%) and Dash (-10.96%).

Figure 3: Largest 7-Day Returns for Top 50 Market Capitalization Coins

Source: Coincodex.com, CryptoResearch.Report

Crypto Research Report Portfolio

Bitcoin has had a second week of losses, and is down 1.21%. Due to the wide diversification of the assets held in the Crypto Research Portfolio, the weekly return for the portfolio was positive. This is mainly do to our gold coin Pax Gold shooting up 8.2% in value after the stock market sell-off. As of February 25th, 2020, the portfolio’s value increased by 205 basis points or 2.05% in the last six days since the last edition of the newsletter was published on February 19th, 2020. Gold is an interesting asset given the economic uncertainty surrounding the Corona Virus.

This section is for our members only. To see our entire portfolio in this week’s Crypto Research Newsletter, subscribe here: https://cryptoresearchnewsletter.substack.com/

That’s all for this week folks! If you would like to read our free 50-page quarterly report supported by Falcon Private Bank, Coinfinity, and Incrementum visit CryptoResearch.Report. The report is available in English and German.