“Sound money is money that gains in value slightly over time, meaning that holding onto it is likely to offer an increase in purchasing power”

Saifedean Ammous

Key Takeaways

- One reason gold has been used as a store of value and medium of account is because of its low annual supply growth. The optimal money would have zero supply growth.

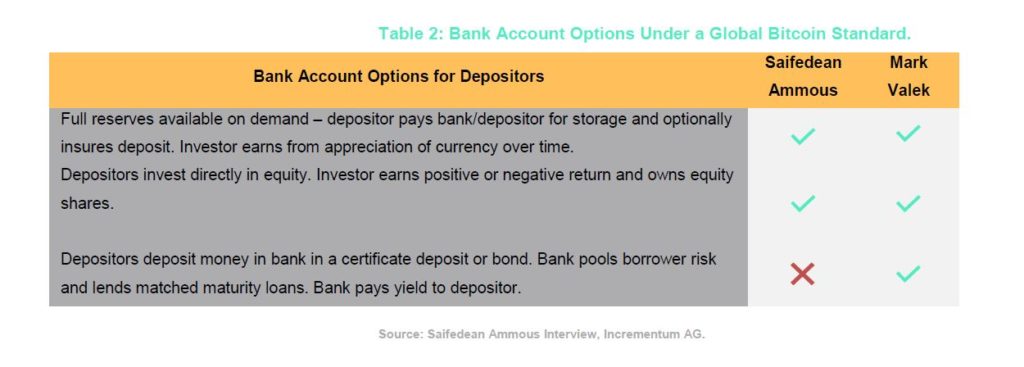

- In a free market for money, money would appreciate in value every year. Therefore, banks would no longer pay interest on deposits. Instead, depositors would choose between a deposit contract, a mutuum contract, or a private equity investment.

- A debt-based monetary system must be inflationary because interest payments must be made. As investors gradually purchase cryptocurrencies and pay off debt in the fiat system, the fiat money supply will contract over time.

We want to Thank Saifedean Ammous for having an exclusive conference call with Demelza Hays and Mark Valek from Incrementum. Saifedean Ammous is a Professor of Economics at the American University in Lebanon, and he is the author of the bestseller The Bitcoin Standard.

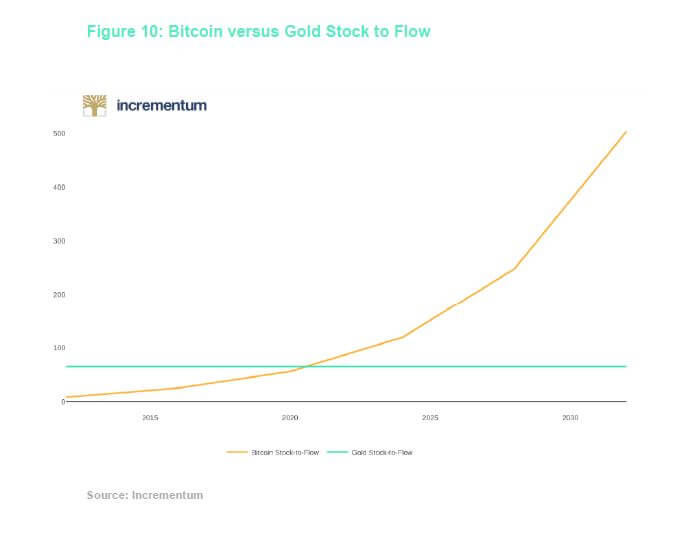

Bitcoin’s Stock-to-Flow Ratio catching up to Gold’s

A starting point for Saif’s analysis of different monies is the stock-to-flow ratio. Readers of our sister report – the “In Gold we Trust” Report are well aware of this concept, as we have discussed it at length. Most people fail to understand why gold has been used as a store of value for thousands of years. It is true that Gold is scarce. However, it is definitely not the scarcest metal at all. Rather its above-ground quantity has the most constant quantity of any rare commodity available. The quantity of a good can be expressed in the stock-to-flow ratio. A high stock-to-flow ratio means its quantity is not inflated very much. An ideal unit of account for measuring value obviously needs low fluctuation of the ‘yard stick’. The master of the British Mint and inventor of the gold standard, Sir Isaac Newton, said,

“Gentlemen, in applied mathematics, you must describe your unit.”

Even though gold has a very high stock-to-flow ratio, Bitcoin will soon have a higher one. Its capped supply is one reason Saifedean Ammous claims that Bitcoin is even better than gold.

In the figure below, Bitcoin has a stock-to-flow ratio of around 71 currently, but by 2020, because of the halving, the ratio will be going up to 119.

Taming Bitcoin’s Volatility?

In The Journal of Structured Finance, Saif wrote a paper, “Can Bitcoin’s Volatility Be Tamed”, about how the price of gold is affected by the demand from the jewellery market and industry. When people sell gold excessively, the price of gold drops. However, demand from jewelry makers and industrial fabricators absorbs the price drop, which creates a lower bound for the price of gold and has a moderating effect on the volatility of gold’s price.

In Paul Krugman’s article on why he is a crypto skeptic, he explained that Bitcoin is not “tethered” to the real world like gold.[1] Since there is no real-world market that has demand for Bitcoin, the price of Bitcoin has no lower bound, and therefore, Bitcoin can never ascend to the role of money. However, Saif answers Krugman’s critique with a quote from Theory of Money and Credit by Ludwig von Mises,

“The significance of adherence to a metallic-money system lies in the freedom of the value of money from State influence that such a system guarantees. Beyond doubt, considerable disadvantages are involved in the fact that not only fluctuations in the ratio of the supply of money and the demand for it, but also fluctuations in the conditions of production of the metal and variations in the industrial demand for it, exert an influence on the determination of the value of money.”[2]

As Saif explains, fluctuations in the demand from industry cause gold’s value to fluctuate and prevent it from being a purely monetary asset that reflects monetary demand only. He says that gold is not money because of its industrial activity. Industrial activity is secondary in the determination of the value of gold. For Mises, a money that has only a monetary demand will be a superior form of money because the value of money will be based purely on time preference. According to Saif, in a situation where Bitcoin becomes the only money in the world, hypothetically speaking, then the demand for Bitcoin is just the demand for cash balances. In other words, Bitcoin demand is a reflection of time preferences.

Mark Valek, author of The Crypto Research Report and fund manager at Incrementum, compares Saif’s idea with the “reservation demand with gold”. The volatility of gold, due to this reservation demand, will probably always be lower than Bitcoin as long as Bitcoin is only a store of value and only potentially has monetary demand. However, in the future, if hypothetically a majority of people adopt Bitcoin as unit of account, the volatility would be lower than gold because Bitcoin would be the denominator of goods and services. In fact, if one starts using Bitcoin to measure goods and services the volatility would go to zero, like during a gold standard.

Saif explains, “That is the idea of the stock-to-flow because, with gold, and especially silver, yearly mining production does not significantly impact total above ground supply compared to other metals. You want your money to be purely your money.”

Mark compares the predetermined stock-to-flow ratio of Bitcoin with other rule-based monetary policies, such as Milton Friedman’s automated k-percent rule[3] and John Taylor’s Taylor Rule, that attempt to stabilize the purchasing power of money over time. On the other hand, these attempts do not achieve long-term sustainability because of political tension explained by Gordon Tullock and the Public Choice literature on economics.

However, Saif does not believe that the k-percent rule and Bitcoin’s algorithm are equivalent. “The key thing for me is that the value of money should be determined by the market for money, which is the supply and demand for cash balances.” The supply and demand for money are what determines the price and the interest rate for money. It is very different from the rule-based monetary policies because they want to calculate the right price, and then they want the market to adjust.

While discussing the topic of Bitcoin with Larry White, he argued that gold has an advantage over Bitcoin because its supply is elastic in the long run. Gold supply increases by 1–2 % every year and inflation compounds. Within a 40 to 50 years, the supply of gold will double. However, Saif couldn’t disagree more. According to him, what makes gold a good money is the fact that it has the least supply growth. Larry White is a supporter of fractional reserve banking on top of a gold system because he holds that a fully backed gold standard would have a shortage of money. Therefore, for Larry White, the reason gold became an international money is because of the small 1–2 % in inflation every year. In contrast, Saif says, “Gold wins out because the demand for money is always a demand for a money that can be inflated the least. The demand for money is always growing and the value of non-inflationary money always grows in the long run. If we follow Larry’s argument, then we have to ask why did silver or copper not become money instead of gold since they have supplies which are more elastic to demand?”

Can a Deflationary Monetary System Work?

Mark Valek gets right to the point and asks, “Does the monetary system need inflation at all?” Some gold proponents would argue that the monetary system needs some monetary inflation to keep up with population growth. Saif claims the following: “From a mathematical point as well as from the perspective of a Bitcoin maximalist, I think the argument against inflation is quite strong as outlined by Philipp Bagus’ book on deflation[4]: the hardest form of money is one with constant money supply and zero elasticity.”

Demelza Hays, author of The Crypto Research Report and fund manager at Incrementum, mentioned her 2017 Forbes article based on the work of Professor Dr. Antal Fekete. She posited the question to Saif, “For me, it looks like we want to have a currency with a high stock-to-flow ratio, but if we take to the logical conclusion, why do we need money that has any flow at all?”

“We don’t need any flow! But we also don’t know any other economic good that is more reliable at limiting flow other than Bitcoin, which has a small annual inflation rate still. The government will make more fiat money flow, the miners of gold will make more gold flow, the miners of silver will make more silver flow. If you could find a way to make a money that doesn’t have any flow, then go for it! That is what Bitcoin will be doing in about 100 years from now.”

Saifedean Ammous

The Current Monetary System is Debt-Based

Mark Valek holds that central banks follow inflationary monetary policies and governments support inflation when the monetary system is debt-based. “If we have debt as the basis of our money, that requires an ever-increasing money supply. Otherwise, I don’t know where the interest for the debt should come from. Do you agree with that?”

“Yes, I definitely agree on that,” answers Saif. “I go even farther than most Austrian economists. In a free market for banking, depositors would not earn any interest on their deposits because the money would be appreciating in value, which is the real return. Essentially, lending money to the bank enables depositors to save on the cost of securely storage money. The second kind of money would be the direct equity and that is the model of Islamic banking, which is also the model of traditional banking. If you are going in on an investment, I think what it comes down to is what society accepts to be legitimate. If a society accepts that it is ok for the government to impound the property of the borrower if they can’t pay back, then effectively you are monetizing the property of the borrower, which is the collateral. Thus, you are effectively monetizing the collateral. Interest lending carries collateral that can be impounded and repossessed by the bank. Effectively, it makes the certain asset monetized because you have issued a loan backed by that asset which is not money, it is a house or car or a piece of land. That kind of business model is only accepted in places when it is fine for the government to impound that property when the borrower defaults. On the other hand, if the borrower’s collateral cannot be impounded, then lenders often reject these kinds of deals and banks do not engage in them.

In a world where banks can only lend deposits or invest in direct equity and they cannot repossess collateral, then the bank cannot make guarantees obviously, because there is always a risk in business. Since the bank cannot create money from fractional reserves and must first bring in money deposits from clients, they cannot guarantee the solvency of their depositor accounts. So, the depositors are accepting unlimited downside of complete default of the bank, and the bank is asking them to accept limited upside. So, the notion of interest without risk of default is untenable in that kind of world. Nobody would put their money with someone who tells you,

“If we lose, you lose all your money and if we win you only get 3 %. Consequently, everybody would go into equity investments. Either you put money into a bank as a deposit available for maturity in which case you pay the bank a fee for the storage and for making the money available for you. Or if you have money that you are willing to sit on, you invest it as equity in some other business and it is the job of the bank to match maturities between the borrowers and the lenders.”

Saifedean Ammous

Although, Mark Valek does not agree with Saif 100 %, he thinks that in addition to full deposits and equity investments there will also be demand for debt instruments or deposits. “I think also in a zero-inflation monetary system there would definitely be demand for investments not only in equity but also in debt. A differentiated capital structure of a company enables different payout characteristics for investors. Low returns on bonds or also lending accounts at banks, enable the investor to receive predictable cash flows with higher seniority in case of bankruptcy. It’s important to note that these would not be riskless investments.”

However, in this monetary system, investors would not necessarily need to risk their Bitcoin in a security investment, such as stocks or bonds, but they would still experience an appreciation of the currency in form of a real increase in the purchasing power of money. If investors do lend out Bitcoin to a bank or financial intermediary who pools the risk of their borrowers, then the bank should pay a fee to the depositor for accepting counterparty risk.“ So, there may be a case for such a thing as a low-risk interest rate investment but probably the tendency would be much lower to take this kind of risk. This is just a minor disagreement,” Mark adds.

Mark responded to the full reserve argument with the common critique posited by mainstream economists, “Will a deflationary monetary system hamper growth like the Keynesians claim?” Mark holds that a debt-based monetary system needs inflation in order to stimulate research, development, expansion, and intervention. However, under the classical gold standard, capital markets still existed. Even though there was some kind of gold flow or inflation, the productivity was higher than the inflation rate of gold.

“Yes absolutely,” Saif believes. “In order to create interest in a debt-based system, the bank monetizes the collateral, and in order to run fractional reserve banking, it allows a central bank to create money and a fractional reserve system would be unstable without a central bank. The central bank can become more inflationary by manipulating interest rates downwards, which enables the government to borrow and spend more. There are different layers of inflation, and the key is to create parts of the economy that are dependent on this credit money. They end up with all these industries and all these people employed because of that money; they are politically connected, and they need to keep that money going. This is a bug, not a feature, you would want to get rid of that, you would want to make it that there is no money creation going on so that investments have to come from real saving. In this case, you would have an actual functioning capital market. Maturity matched.”

A Free Market for Money

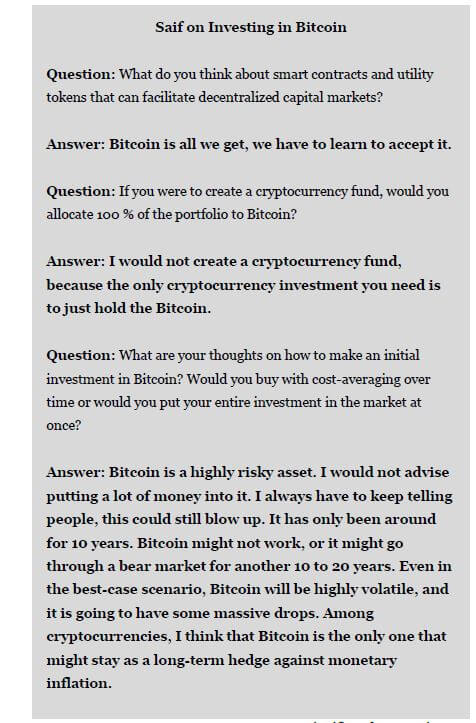

Transitioning to the future outlook for the money market, Demelza asked, “If all the central banks around the world respond to Bitcoin by decreasing the flow of their currencies and making their currencies harder, do you think that Bitcoin and central bank-issued fiat currencies will compete alongside each other like Uber and taxies or Airbnb and hotels? Or do you think one is going to completely substitute the other?”

Saif’s answer: “For the first time, people have an alternative; they can opt out of central banking. This was not possible before Bitcoin, but it is possible now. Bitcoin will limit the ability all these government from inflating. You can imagine Bitcoin developing a so-called monetary Batman that is hanging in the shadows of every central bank and is waiting for that central bank to begin inflating the money supply, and then people in that country would jump into Bitcoin. When they jump to Bitcoin, its value will significantly appreciate.

Saif thinks it is good to think of Bitcoin as a small side bank account that you have for a rainy day. He said, “The important thing is that you may be stuck in a country one day where you got robbed, you don’t have access to your bank account, and you do not have money. If you have Bitcoin, you can get out of trouble by buying an airline ticket with it. I think it is important to understand the value proposition.”

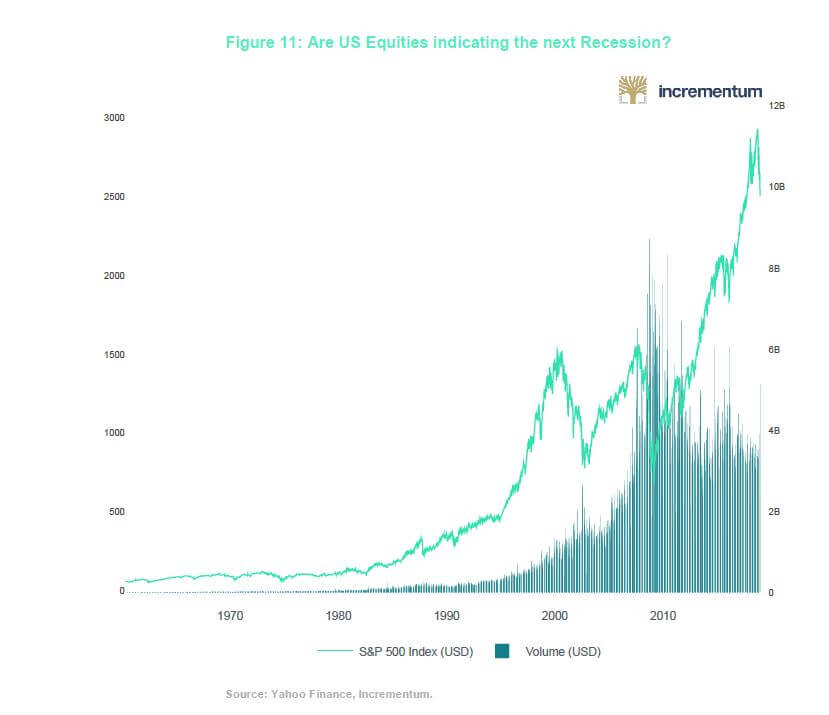

Mark echoed Saif. “We are very much on the same page because, even though we are optimistic, I think that from a portfolio point of view investors do not have to allocate a huge amount to have an impact. Investors can allocate a low-digit percentage, even as low as 1 percent of their entire net wealth, and it will have a huge impact if Bitcoin monetizes. Mark explains that Bitcoin is a binary investment. Either Bitcoin becomes some kind of monetary asset and store of value, or Bitcoin will be succeeded by something else and the price will go to zero.

Bitcoin: Two Paths to Monetization

If we muse about the future, how will the transition from being a store of value to a unit of account look for Bitcoin? Mark Valek considers two scenarios:

- Positive scenario: Bitcoin becomes a reserve asset for central banks. A domino effect could prompt more nations to buy Bitcoin to protect against speculative attacks and to ensure that public debt can be paid off with investments in Bitcoin. The Marshallian Islands already have investment in Bitcoin, and the Central Bank of Barbados wrote a paper on the topic in 2015.

- Negative scenario. Loss of confidence in the fiat system, and there will be a huge rush into the new safe haven being Bitcoin.

On the other hand, Saif sees a scenario in which Bitcoin ascends into monetary supremacy by each person slowly transitioning to Bitcoin. “Just a monetary upgrade. Install healthy software on a crappy windows PC, and it starts functioning better. The monetary system that we have creates money when debt is created. The flipside of that is that it destroys money when debt is paid off. We have had this sort of system for the past 40 to 50 years, and now we have another alternative, and everybody will jump into this new system (Bitcoin). Eventually, people can use Bitcoin to pay off their fiat debt. If we just keep paying off our debt, an orderly unwinding of the global monetary fiat system will ensue. Basically, everyone pays off all of their debt and the money supply contracts until it drops to zero, and then a new monetary system that is functional takes over the world. It might be slow or quick, but it doesn’t have to be messy and ugly.”

[1] See “Transaction Costs and Tethers: Why I’m a Crypto Skeptic,” Paul Krugman, The New York Times, July 31, 2018.

[2] See “The Theory of Money and Credit”, Ludwig von Mises

[3] See A Monetary History of the United States, 1867–1960.

[4] Bagus, P. (2015). In Defense of Deflation. Springer.