Thanks to the incredible speed Solana offers, and due to the timing of Solana’s market entry coinciding with “DeFi summer,” DeFi applications have always been a mainstay for this cryptocurrency. 178 DeFi projects are listed on the enterprise’s website as of September 2022.

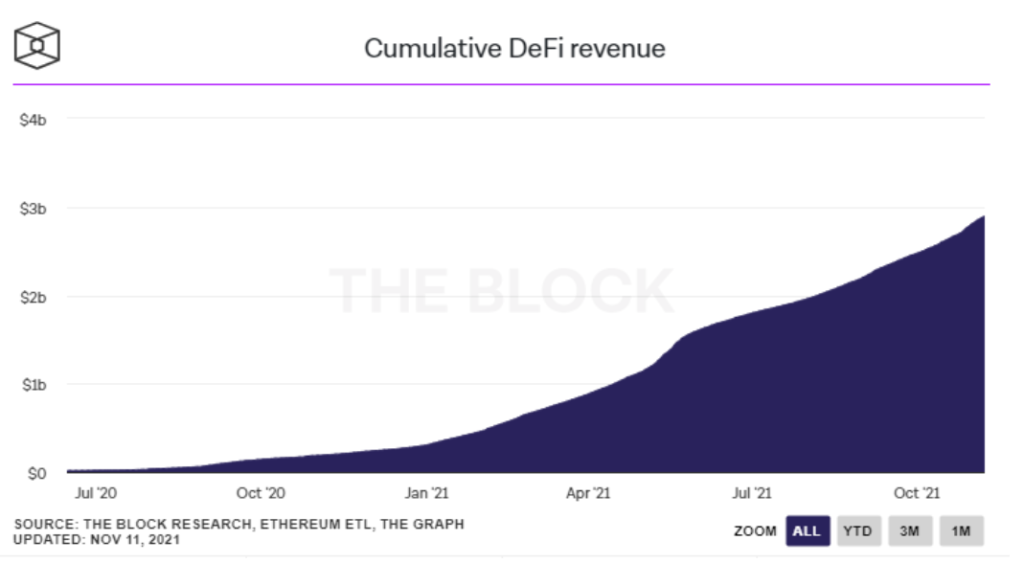

DeFi is an integral part of any blockchain ecosystem because of the possible earnings generated. While Ethereum miners get paid handsomely via transaction fees, Solana’s business is more service-oriented. Cumulative DeFi revenue across all blockchains is set to surpass $3 billion soon, and Solana is well-positioned to grab its share of this emerging market.

Figure 1: Solana has more than 178 live DeFi projects

Figure 2: Solana’s cumulative deFi revenue

Total value locked (TVL) in DeFi on Solana

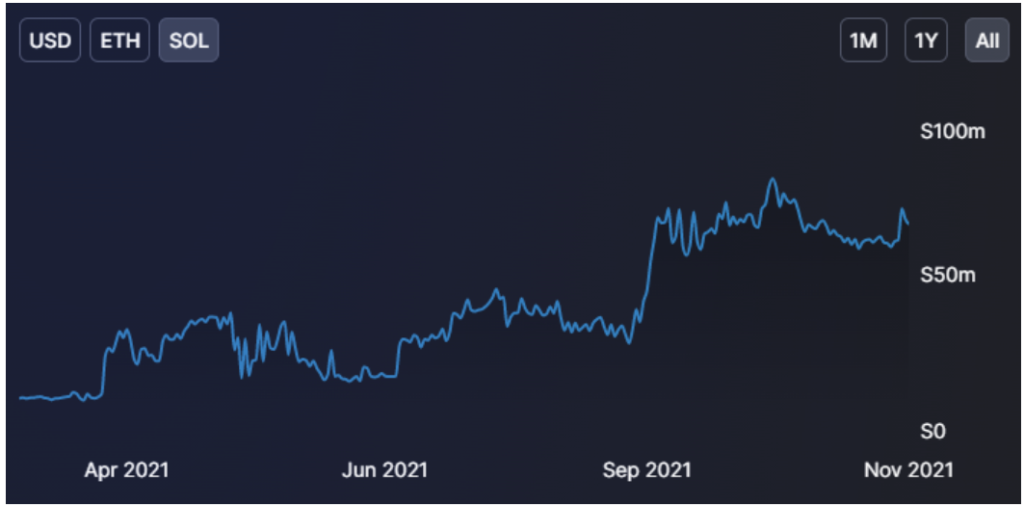

TVL is the total amount locked in a currency’s DeFi DApps. The best way to compare TVL is by denominating amounts in native tokens. SOL’s price has appreciated 20x since April 2021, and the dollar-denominated TVL would have increased by the same amount without additional SOL locked.

Figure 3: TVL locked in DeFi on Solana, denominated in SOL

A look at Defi Llama’s chart reveals healthy growth until mid-October, followed by a slump. 11 million SOL was locked at the beginning of April 2021 and 81 million SOL in October. $257.6 million of locked value grew to $14.8 billion during the same period.

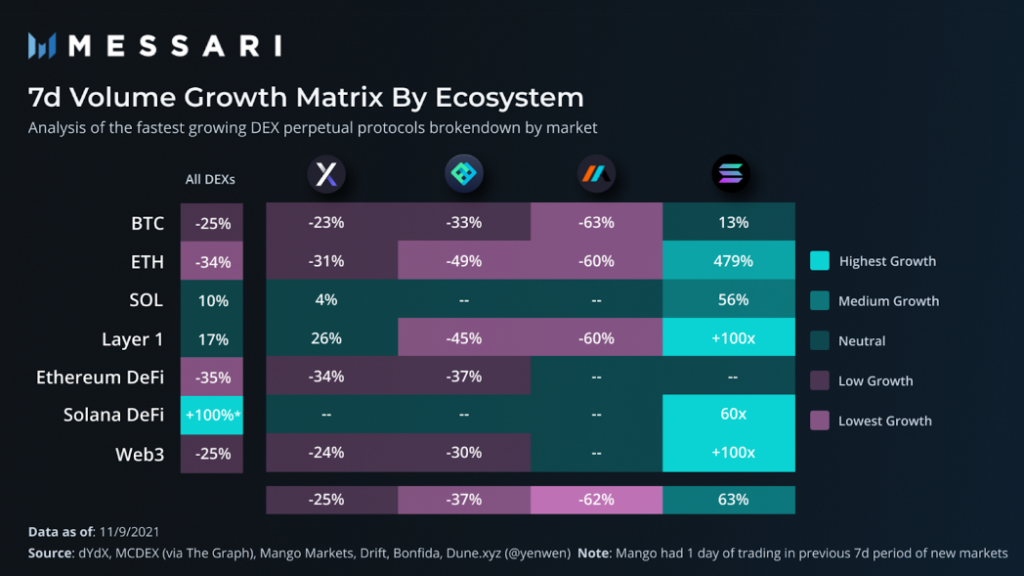

Research by Messari found extraordinary growth of perpetual future trading on Solana. Notably, SOL perpetuals on Solana DeFi grew 60x compared to 13% for Bitcoin perpetuals, showing a tight focus of the ecosystem on itself.

Figure 4: Perpetual future trading volume seven-day growth

Raydium and Marinade Finance are the two projects with the most value locked, while Mango Markets is the number one futures market. Serum, a DEX and a trading protocol developed by FTX exchange, is another important player.

But certainly DeFi is not the only driver of Solana adoption. Digital artists have also embraced the platform’s low fees and created some smash hits in the process. Therefore we will take a closer look at the role of NFTs in the Solana ecosystem!

This article is an extract from the 80+ page Scaling Report: Does the Future of Decentralized Finance Still Belong to Ethereum? co-published by the Crypto Research Report and Cointelegraph Consulting, written by ten authors and supported by Arcana, Brave, ANote Music, Radix, Fuse, Cryptix, Casper Labs, Coinfinity, Ambire, BitPanda and CakeDEFI.