When thinking about investing in crypto assets, investors should not only keep an eye on the actual buying process. The custody of the assets also plays an important role in addition to the purchase, because a careless approach can lead to the loss of significant sums. There are fortunately already a wide variety of solutions to this problem.

In the research for this article, a new tendency regarding crypto custody could be observed. As described above, the custody of digital assets has been a much-discussed topic due to the regulatory initiative in Germany. Therefore, several startups have focused on this subject. However, the custody of crypto assets can be carried out by applying very different technological solutions.

Next-Generation Technology on the Horizon

The majority of the custody startups, e.g., Finoa, Tangany, and Upvest, rely on so-called hardware security modules (HSMs) for the storage of crypto assets. The main task of an HSM is to generate, store, or manage cryptographic keys and to protect them from unauthorized access.

Established banks such as Solarisbank AG and Bankhaus von der Heydt, however, already utilize the next technological generation for crypto custody called multi-party computation (MPC). Also, CommerzVentures, the corporate venture arm of Commerzbank, invested in the Series A funding round of the custody startup Curv, which specializes in MPC. Simply put, MPC is a cryptographic mechanism that requires multiple instances to sign a transaction. Therefore, such a solution eliminates the single point of attack for hackers.

Regardless of the technological stack, however, one problem currently appears to be common to all players. Insurances that protect investors against any form of loss of crypto assets are too expensive. This can be seen as the missing piece of the puzzle for comprehensive investor protection.

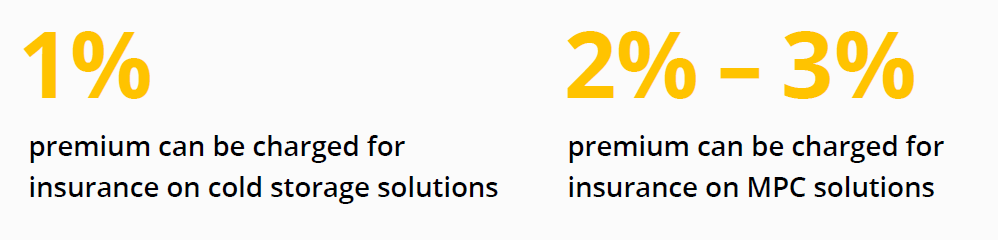

Insurance premiums for assets under custody are currently around 1% for cold storage solutions and between 2% to 3% for MPC based solutions. In the next few years, however, insurance providers will probably acquire more technological know-how for risk assessment so that lower insurance premiums can be expected.

Another rising trend is phone applications that enable investment in digital assets. One such application out of Switzerland is Relai, which has become one of the hottest trending apps on the Android app store. The Relai app allows anyone to buy Bitcoin without giving up their identity. The phone app works with one of the first Swiss regulated crypto companies, Bity, in order to buy Bitcoin. In addition to requiring no KYC, the phone app does self-custody, so there is no need to trust counterparties with private keys.

This app has made Bitcoin ATM transactions possible within the privacy of one’s own home and internet connection. In Relai’s first three months, they had more than 2‘000 app downloads in 20 different EU countries, more than 1‘000 investments per month, and more than €500‘000 in volume. This is a good innovation as many Bitcoin ATMs in Germany have had to shut-down due to Germany’s new licensing raj.

This variety of approaches and solutions shows that there is a constant discussion in the area of crypto-assets about the tension between usability, security, and the principle of “be-your-own-bank.” This debate is not only one of principle but, as we have seen here, also one of technology.

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.