The fusion of traditional investment strategies with the innovative world of Bitcoin has created a new horizon for institutional investors. This groundbreaking report delves into Bitcoin’s potential to revolutionize asset portfolios, offering a meticulous analysis of its historical performance and strategic importance. It uncovers the compelling reasons driving institutional interest towards Bitcoin and addresses the challenges and opportunities this digital asset presents. With over 120 pages, six chapters, and 94 charts, this report provides a step-by-step guide for institutional investors who want to learn more about Bitcoin.

Download ‘The Case for Bitcoin in an Institutional Portfolio’ Research Report.

Bitcoin’s Strategic Impact on Institutional Portfolios

In exploring the optimal allocation strategies and time horizons for Bitcoin investments, the report highlights Bitcoin’s unique market behavior. It discusses the balancing act of volatility and returns, providing a nuanced view of how Bitcoin can enhance portfolio diversification. The report also examines the global regulatory landscape, crucial for institutions navigating this new terrain.

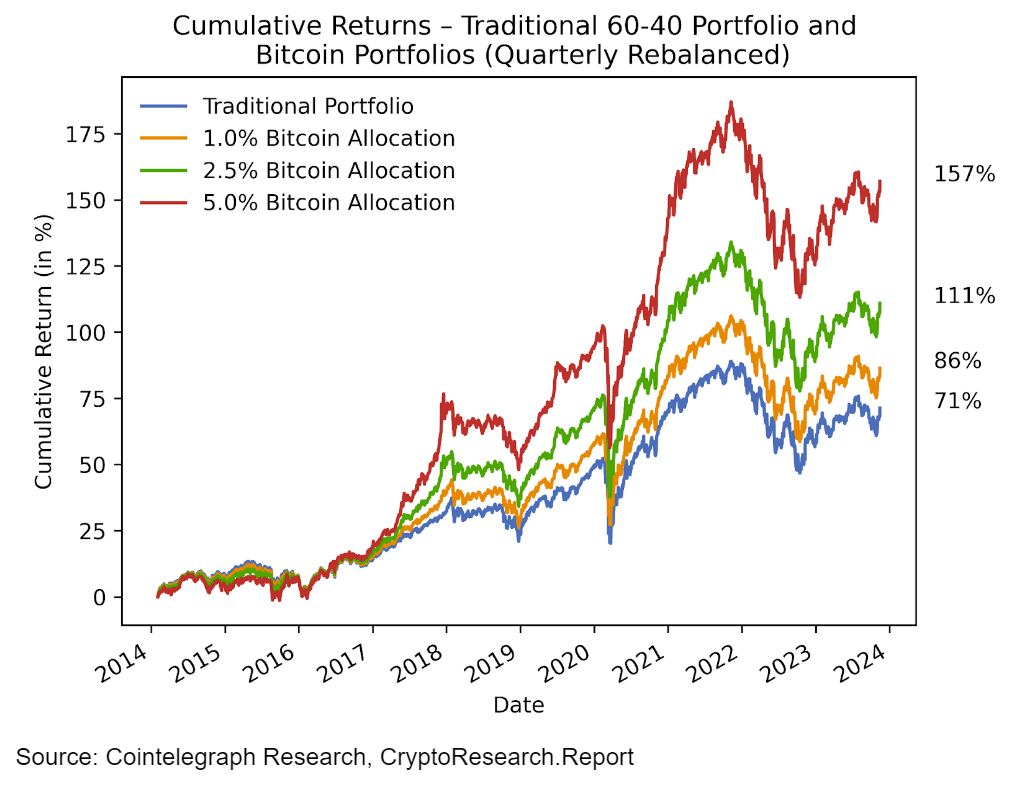

Between 2014 and 2023, a portfolio with a traditional 60-40 allocation in stocks and bonds, rebalanced quarterly, achieved a 71% cumulative return. However, this return was significantly enhanced to 157% by incorporating just a 5% investment in Bitcoin. This stark contrast underscores Bitcoin’s powerful influence in portfolio performance, demonstrating its effectiveness as a diversifier and a potential source of higher returns in mixed-asset portfolios.

The report further addresses the infrastructural aspects of institutional Bitcoin investment. It sheds light on the technological and operational considerations essential for incorporating Bitcoin into traditional investment portfolios, emphasizing the importance of security and regulatory compliance.

Expert Insights and Forward-Looking Analysis

The report is a culmination of expert research, drawing on diverse perspectives from finance and technology. It’s an invaluable resource for institutional investors, providing a comprehensive understanding of Bitcoin’s role in the future of finance and offering forward-looking insights into the evolving landscape of digital assets.