The Bitcoin core developers have proven cautious about making changes to the foundation created by Nakamoto. Back in 2016/2017, when it took six days for transactions to settle, some users demanded a remedy in the form of larger block sizes to allow for more transactions per second.

This proposal did not meet developer support or miner acceptance. The situation became untenable for some, and Bitcoin Cash was born as a result of this confrontation. Bitcoin Cash increased the block size eightfold and can process up to 250 transactions per second (TPS).

How Bitcoin miners agree on transactions

Bitcoin uses the proof-of-work (PoW) consensus, which was first implemented in Hashcash. PoW forces miners to try quintillions of different numbers (called nonces), which get appended to the data in a block, and are then hashed using the SHA256 cryptographic function. The resulting hash is 256 bit (32 characters) long and changes radically with even the slightest alteration of the underlying data.

Hashing is a sound way to make data tamper-proof. The Bitcoin protocol only accepts hashes with a certain number of leading “0” characters. Since SHA256 is a unidirectional function, miners cannot work backwards from the desired hash to a fitting nonce but must try different numbers until one produces the desired result.

The number of leading 0s is set to such a length that all the miners in the world combined can only compute one block every 10 minutes on average. This is Bitcoin’s block time.

Every block is linked to the block before, hence the moniker “blockchain.” Other miners verify a submitted block to ensure the same coins are not sent twice, or from an address a user doesn’t control. Only if they agree can a miner claim their rewards. Fraudulent activity means doing all the calculations in vain and wasted work.

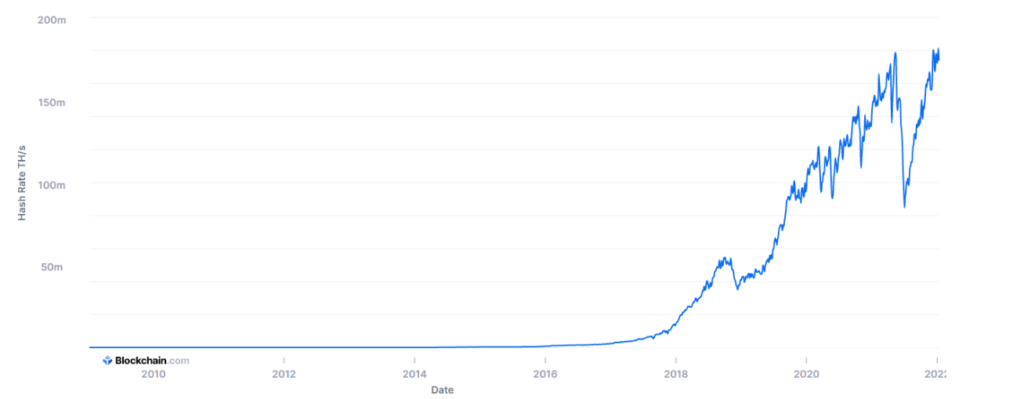

Miners follow the longest possible chain of blocks. If an alternative version is proposed, it would need to recalculate all the blocks from the point of deviation onwards and overtake the main chain to write a different transaction history, known as a 51% attack, because the attacker would need the majority of the entire network’s hashing power to succeed. Hackers could use such an attack to reroute payments and empty wallets without controlling their private keys.

Since the Bitcoin Core network currently has an astounding 185 quintillion hashes per second capacity, it is not economically possible to mount such an attack.

This article is an extract from the 80+ page Scaling Report: Does the Future of Decentralized Finance Still Belong to Ethereum? co-published by the Crypto Research Report and Cointelegraph Consulting, written by ten authors and supported by Arcana, Brave, ANote Music, Radix, Fuse, Cryptix, Casper Labs, Coinfinity, Ambire, BitPanda and CakeDEFI.