As the world of cryptocurrencies and digital assets continues to grow, the opinions of professional investors remain divided. The Cointelegraph 2022 survey sheds light on the current sentiments among these investors, revealing a stark contrast with the results of a Fidelity survey. This article delves into the factors influencing institutional demand, the evolving landscape of blockchain technology, and the potential shift in investment focus towards applications of tokens.

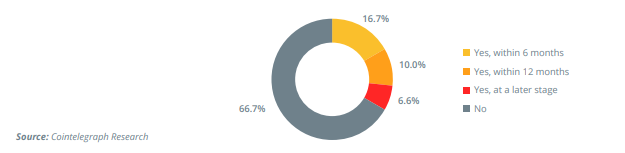

Out of the 84 respondents from the Cointelegraph 2022 survey of professional investors, 48 reported that they are not currently owning cryptocurrencies. Out of those 48 people, two-thirds reported that they do not plan to ever invest in cryptocurrencies. On the other hand, onethird reported that they do plan to buy cryptocurrencies sometime in the future. This is in stark contrast to the results of the Fidelity survey which found 70% of the institutional investors are expected to buy digital assets in the future.

Is Your Company Planning to Invest in the Future?

A few anti-cryptocurrency respondents commented on why they do not own cryptocurrencies, commenting, “Crypto is pure speculation, where unlike Dutch tulips and other bubbles, there is no underlying asset base,” and “It’s rubbish and there is very little real risk management. Just smoke-and-mirrors,” and “I would rather invest in lottery tickets than crypto.”

Institutional demand is driven by the availability of sophisticated trading instruments, but it also drives their development — a classic chicken-and-egg dynamic. We’re seeing markets maturing but nowhere near the speed at which the digital assets and DeFi, in particular, innovate.

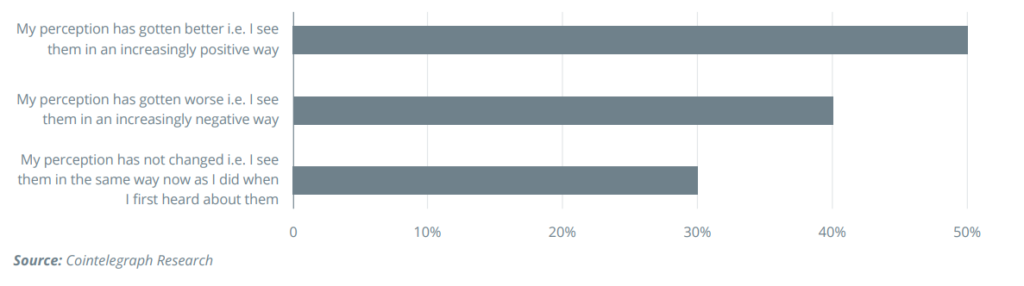

How has your perception of crypto assets changed over the last five years?

The last six years have been dominated by the fat protocol thesis of cryptocurrency investing. In a nutshell, it posits that the majority of value is captured at the protocol level in digital assets, and only a small portion at the application level.

That is likely to change soon, as blockspace becomes more of a commodity. Many blockchains have a more or less identical feature set by now, and Ethereum Virtual Machine compatibility plus improvements in bridging technology mean that applications can move from chain to chain or deploy on multiple platforms at once.

Bridging technology like Layer Zero, Quant and THORchain, to some extent, add one more option for institutional demand. But ultimately, blockchains are the medium of of transmission and storage. When we look at the historic development of telephone networks, we can glimpse how this is likely to play out.

While a lot of values are captured on the “protocol” or infrastructure level initially, these companies do not worth even a fraction of the applications building on top of telecommunication infrastructure. Depending on the exact definition, it could be argued that 6 out of the 10 most valuable companies in the world are built on top of telecom infrastructure.

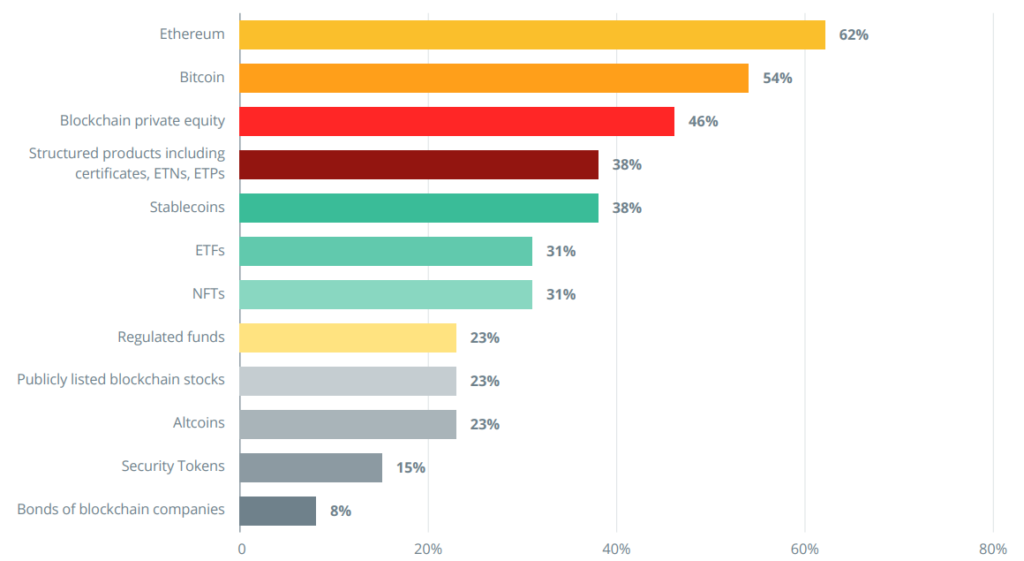

Which digital assets would your company be interested in investing into in future?

It is very much likely that this will repeat with blockchain technology, as it should, since a chain with no application other than the sending and receiving of tokens is very limited in value. This is why we assume that institutional investors will invest in the application of tokens in the near future to a higher degree than into native blockchains.

One major blocker into institutional demand for digital assets we have seen across the board is regulatory concerns. Banking is one of the most tightly regulated industries in the world, and as a result, bankers do not feel comfortable investing substantial amounts into assets with unclear legal implications.

The recent Tornado Cash sanctions placed tens of Ethereum addresses on a U.S. Office of Foreign Assets Control list and illustrated the validity of legal concerns quite well. From one day to the next, transacting with these smart contracts could be fined with up to 30 years of jail, and substantial funds were frozen in the protocols vaults, even though they belong to users.

Another major concern is liquidity and market contagion. The collapse of TerraUSD (UST) was caused in part by the transaction bandwidth constraints of the Ethereum blockchain and lack of deep liquidity in even the largest stablecoin pools.

We expect institutional demand to start growing much faster when and if regulators offer clarity on the legal and tax implications of digital asset investments. This adoption will also solve most of the liquidity concerns. Institutional demand will enable institutional supply and vice versa. If transactions are taking place on chains themselves or on permissioned rollups or even in private pools, it will be interesting to see.

In conclusion, the future of blockchain technology and digital assets is expected to be shaped by the increasing value of applications built on top of the infrastructure. As the industry matures and blockchains offer similar features, the focus of institutional investors may shift from native blockchains to the applications of tokens. This transition could potentially mirror the historical development of the telecommunication infrastructure, with companies built on top of it becoming increasingly valuable.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.