The growth of the cryptocurrency market has been explosive in recent years, as more investors and institutional players have entered the fray. Crypto adoption rates continue to rise around the world, with Asia leading the way in terms of institutional interest. This growth has led to a wider range of products and services across the industry, leading to a positive feedback loop that has helped to drive adoption even further.

The crypto industry has been around for over a decade now and, like many other industries, started with speculative use cases focused on retail users, which goes hand-in-hand with high volatility. Institutional adoption is a direct result of more mature and institutional-grade products in the market, in turn leading to a positive feedback loop with growing institutional interest and products that stand the rigorous tests of compliance and scalability.

Pre-2017, crypto liquidity was limited to a handful of exchanges with a few million dollars in volume across all assets — this has dramatically changed in recent years. More liquidity venues with subsequent on-off ramps between fiat and crypto have been vital to crypto succeeding in institutional use cases.

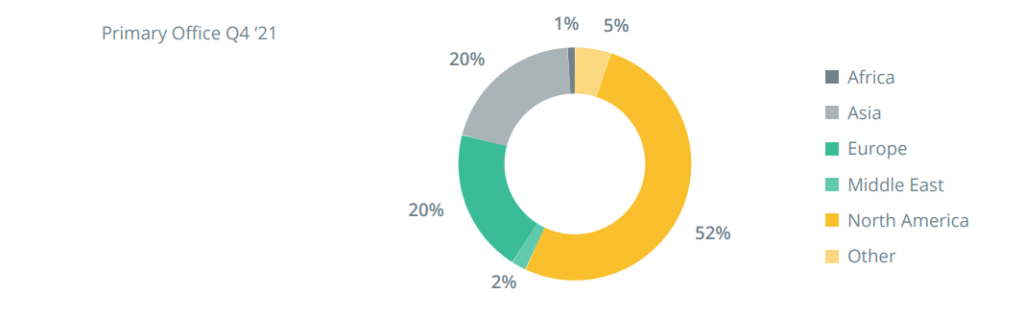

Crypto Funds by Continent

According to Fidelity’s study, adoption rates in Asia are higher (71%) than in Europe and the United States. Fidelity found that 56% of Europeans and 33% of U.S. institutions now hold investments in digital assets, up from 45% and 27%, respectively. As of the end of Q4 2021, there were more than 860 crypto funds across the globe with primary offices in more than 80 countries, according to data from Crypto Fund Research.

The pace of new fund launches began to accelerate in the first quarter of 2021, and this trend continued during the rest of 2021 as new fund launches outpaced fund closures for six consecutive quarters. Just over half of all crypto funds are based in North America, most of which are in the United States. Europe and Asia are each home to around 20% of funds.

From limited liquidity and a small number of exchanges to more than 860 crypto funds in over 80 countries, the cryptocurrency market has come a long way in a short time. With institutional adoption rates on the rise and growing interest from investors around the world, the industry is poised for continued growth in the years ahead. As more mature and institutional-grade products enter the market, we can expect to see even greater adoption rates and increased interest from traditional financial institutions.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.