This report presents the survey results of Cointelegraph’s second annual survey of professional investors from traditional finance (TradFi). This survey provides a comprehensive record of the cryptocurrency investments of professional investors, including changes in their attitudes toward digital assets and their future allocation plans.

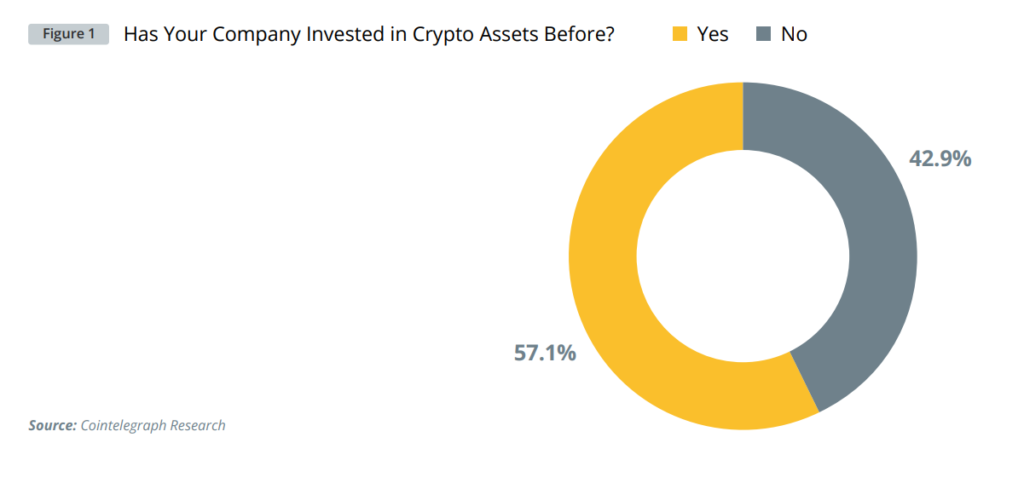

The main findings confirm the rumors that institutions are investing in cryptocurrencies. Over the last two years, the percentage of institutional investors that have bought cryptocurrencies has increased by 22%. The new survey shows that 43% of professional investors have invested in cryptocurrencies, up from 36% in 2020, and that 19% plan to buy them in the future. Out of the 48 respondents that reported they do not currently own crypto assets, 16 of them said they plan to invest in crypto assets in the future. This means that the majority (62%) of the professional investors that responded to this survey are interested in having digital assets in their portfolio.

This survey had 84 responses from professional investors across the world, with a focus on the United States, Europe and Asia. Respondents included traditional banks, asset managers and pension funds. This report focuses on buy-side, not sell-side, asset allocators. Therefore, we did not send this survey to crypto funds that are invested 100% in digital assets. The goal of this report is to gauge the demand for digital assets from traditional financial intermediaries.

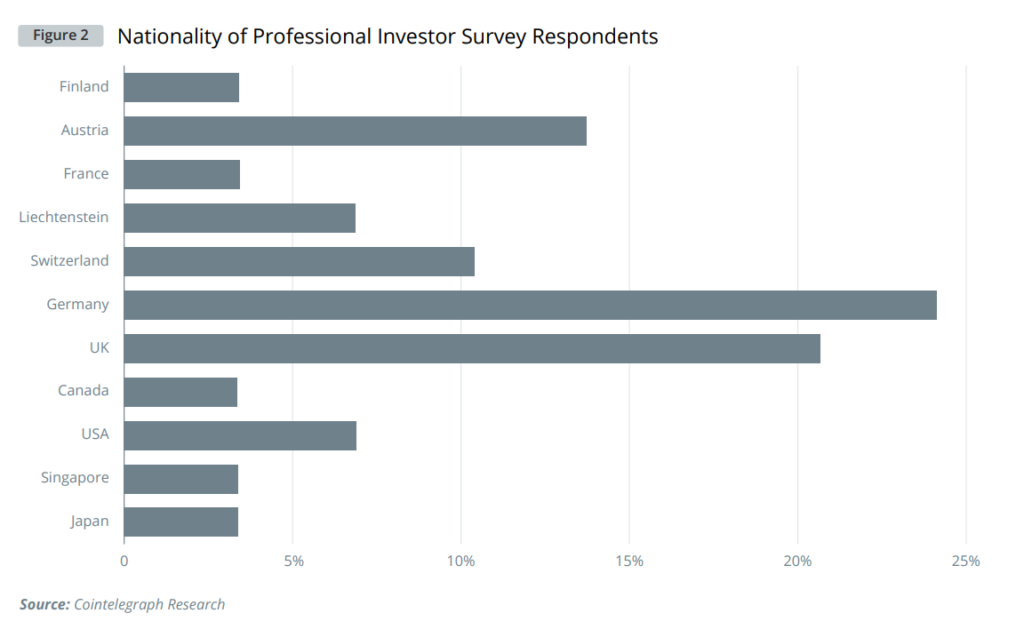

The survey was delivered via email to 6,004 registered professional investors with the financial market authority in 11 countries: Japan, Singapore, the U.S., Canada, the United Kingdom, Germany, Austria, Switzerland, Liechtenstein, France and Finland. Investors were given a two-week period to respond in July 2022.

The majority of the respondents came from Germany and the U.K., followed by Austria and Switzerland. When sorting the survey results by country, the respondents from the U.K. managed the most assets. In total, the respondents manage $316 billion in assets, 3.3% of which, or approximately $10.42 billion, is invested into cryptocurrencies. Austria’s respondents worked in firms with the highest headcount. The majority (83%) of the respondents worked in firms with fewer than 50 employees. Only one woman in charge of asset allocation decisions at her company responded to the survey compared to 81 men. The median age of the respondent was 48.8 years old.

Total institutional holdings of cryptocurrency through trusts and funds was estimated to be $62.5 billion at the end of 2021, according to CoinShares. This number does not include direct Bitcoin (BTC) holdings, worth more than $10 billion, as of March 31, 2022, or venture funding volume, worth $25.1 billion in 2021.

Out of the 19.15 million BTC in circulation, an estimated 7.54% (1,444,201) are held by institutional investors ranging from publicly traded companies, such as Tesla, private companies, such as the insurance provider MassMutual, exchange-traded funds (ETFs), such as VanEck, and countries, such as El Salvador.

However, institutional interest is difficult to measure directly. Quantifying the largest traditional financial investors in cryptocurrencies is difficult because many institutional investors do not disclose their holdings of cryptocurrencies publicly. Furthermore, many institutional investors have indirect exposure to cryptocurrencies and blockchain technology via the stocks that they hold. Instead, surveys can be used to estimate the real magnitude of institutional cryptocurrency holdings.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.