Julius Baer is one of the leading Swiss wealth managers with a focus on personal advice for wealthy private clients. This asset manager’s advisory service for “Ultra / High Net Worth Individual (HNWI)” is now also for digital assets.

The customer segment of wealthy private individuals has been a large target group in the crypto space for several years. Different products are being offered by asset managers such as Vontobel, AMUN or GenTwo.

Although there exists a plethora of cryptocurrency investment opportunities. Professional and accredited investors appear to be unable or unwilling to invest. The best performing regulated alternative investment funds (AIF) for cryptocurrencies, the Systematic Distributed Ledger Technology Fund managed by CAIAC Fund Management AG in Liechtenstein and advised by Crypto Finance AG, had over a 100% return since inception in March 2019. Despite the phenomenal return, the fund has only managed to attract €14.36 million in assets under management.

This HNWI target group does not belong to the so-called “digital natives” that grew up with smartphones and the internet. This group is also not part of the “decentralized natives” that are skeptical of centralized institutions because of the 2008 banking crisis. In contrast to the generation of millennials, this target group is not tech-savvy and often has no interest in dealing with blockchain technology. In addition, there is no major loss of trust in central institutions. They grew up with them and perceive government and financial intermediaries to be secure.

Even more, this target group still has a high level of trust in long-term investment experience and established companies like Julius Baer. If a HNWI now has the opportunity to easily integrate a completely new asset class with attractive returns into its portfolio allocation, it even offers many advantages for the customer:

- Long-term trust in the asset manager through existing client relationship

- No new KYC process necessary (as with a new provider such as Grayscale)

- No responsibility regarding private keys of crypto assets

- Diversification within the existing overall portfolio

- Monthly analysis of overall risk and return metrics by asset managers

- No technical know-how (about blockchain, hash function etc.) necessary for investment

- Contact person digital assets available via asset manager

- Liquidity of the assets due to the cooperation between Julius Baer and Seba Bank

Not only the customer, but also the asset manager can benefit from this new offering, since in comparison to new providers in the market, they can already draw on an existing and above all wealthy customer base. Therefore they have lower acquisition and marketing costs and may even attract new customers from this offering of digital assets. As a traditional asset manager, this expansion from traditional to digital assets can therefore be a great opportunity for Julius Baer.

The cooperation with SEBA Bank AG, which is licensed under FINMA in Switzerland, is a great advantage here. SEBA is considered a dynamic FinTech and has been one of the pioneers in the financial industry since its foundation in November 2019. Julius Baer benefits from the following services from SEBA:

- Custody storage

- Trading and liquidity management

- Asset and wealth management

- Transaction banking

- Tokenization

- Offering of bitcoin, ether, litecoin, stellar and ethererum classic

In the press release of January 21, 2020 Julius Baer states:

“Julius Baer now gives its customers access to various solutions for storing and transacting digital assets to meet increasing demand.”

Julius Baer increased its total mandate penetration around advisory business from 24% in 2013 to 52% in 2019 and plans to increase this number to above 70% for the future. In return, the proportion of self-directed orders and execution only business shall be reduced.

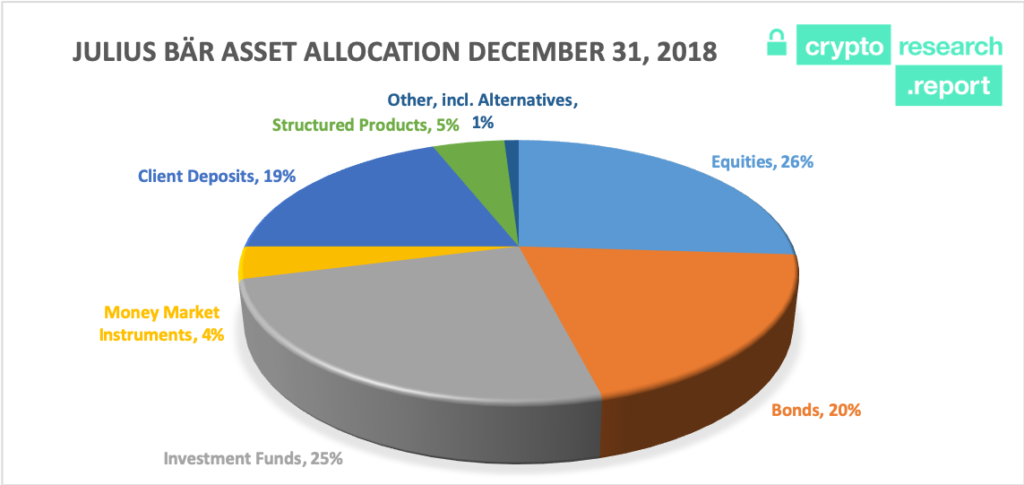

The switch to an increase in advisory services goes hand in hand with an expansion of advice in alternative asset classes. At the end of December 2018, the proportion of assets invested in alternative investments, which should also include crypto assets, was only 1%.

AuM breakdown by asset mix as of Decmber 31, 2018 of around CHF 400 bn

The current focus target group is wealthy private individuals who have little knowledge about digital topics such as crypto and blockchain technology. There is a potential risk that this client base might cease, if the new generation of “digital natives” manages their assets themselves. However, the offering of digital assets by Julius Baer could also be interesting for younger investors who have no time to deal with the technology or who are generally not interested in the technology and only participate in this new asset class due to reasons of return generation and diversification aspects.