Ronald Stöferle

Hi and thanks for joining. To give you some background on our company; Incrementum was founded in 2013 in Liechtenstein and we’re currently managing five investment funds. We’ve also got a wealth management department which is led by our CEO, Stefan Kremeth, and we also have a research department that produces the “In Gold We Trust report”, which is well known all over the globe. Similar to the approach of the In Gold We Trust report, we launched the first edition of the crypto research report in December.

We’re truly looking forward to this discussion. We like to think out of the box and we are very open to the crypto space, especially since we believe in the free markets and competing currencies.

Mark Valek

I think we are covering two very emotional topics, gold and cryptocurrencies. Sometimes you have different opinions between people who like gold and people who like cryptos. I believe we are at the intersection. We are not only open-minded towards crypto, but we actively embrace it because it’s a huge influence on monetary affairs. If you close your eyes to the developments in the crypto scene, you won’t get the big picture. Crypto is now a part of the investment ecosystem and it will stay a part going forward.

Demelza Hays

Wonderful. I think we should allow each of our advisers to briefly introduce themselves and explain which company they represent and how they became interested in cryptocurrencies. Stefan, why don’t you start?

Stefan Wieler

I’m currently director of the Board of Goldmoney, former BitGold. We used to be primarily a precious metal custodian and we have a platform which allows customers to open an account the same way you would open a PayPal account and then purchase precious metals, primarily gold, but also silver, platinum and palladium, in a very efficient and cost effective way. Basically, we are a custodian and we provide a platform for you to trade. But there is no third-party risk with us because the metal is held on customer accounts. I would say the unique feature of what we offer is that you can pay using your precious metals, i.e. you can transfer within the network. You can pay via a MasterCard, et cetera, and the end goal is that you can pay everywhere with the gold directly, therefore we allow merchants to accept precious metals as a form of payment.

For context I’ll give you a bit of background on Goldmoney. The company was founded about 17 years ago by James Turk, and in the beginning they only offered custodial services. In 2014 Joshua Crump and Roy Sebag founded a company called Bitgold that developed the platform that allows Goldmoney’s current payment feature. That company did an IPO in 2015 and I was a Series A investor. I was still working for an energy hedge fund; I’ve been a commodity analyst for all my life, mostly on energy.

Shortly after the IPO, Bitgoldpurchased Goldmoney, merged the two companies and called it BitGold. From the start BitGold accepted cryptocurrencies as a form of funding your account. Clients would send us Bitcoin and Ethereum and we would sell those right away on an exchange and purchase metal for the client. And recently we started offering cryptocurrency storage on the platform. Right now we offer cold storage the same vaults we store metal and our customers seem to love it. Consequently, in the last seven weeks of 2017 we had about $22 million worth of sales. At the moment we only do Bitcoin and Ethereum, but this will change.

We are also working on a custody solution for institutional investors called Blockvault. The product allows for a full audit with an external audit company like we currently do for gold and other precious metals. For example, KPMG will be able to count the inventory of a client’s cryptocurrencies without being able to read the key, which is essential. We can store it in the same vaults we store precious metals and it will be fully insured. We should be ready by the end of the second quarter 2018 to launch this service. I’m a director on the Board of BlockVault.

Demelza Hays

Thank you. It’s interesting to hear that there are institutional grade vaults coming now for cryptocurrencies. That is really a unique selling point.

Stefan Wieler

We are not the first to offer cold storage in a vault in Switzerland. There are other companies that are doing that in Zug. But those companies simply put a server in a vault and if your cryptocurrency is on that you can’t audit it. It’s like a memory stick. What we are working on is a way that an external auditor can audit the entire inventory. That’s the only way you can get insurance.

Demelza Hays

Let’s move on to Oliver; would you kindly introduce yourself?

Oliver Völkel

My partner and I, Arthur Stadler, have a law firm in Vienna. We specialize in cryptocurrency and blockchain technology related fields of law. My background is banking, finance, capital markets law and I’ve done a little transaction work in the past. Somehow cryptocurrency related law fits nicely into the spectrum of legal fields that I have dealt with in the past. We are advising a big number of Austrian and international clients, and also banks, on cryptocurrency related matters. I can’t tell you much about our clients, but by way of example we have helped with initial coin offerings in Austria to establish it as a new form of financing.

Demelza Hays

Wonderful. I think it is public knowledge that you helped the first Austrian ICO HERO, isn’t that correct?

Oliver Völkel

Yes, that’s correct.

Demelza Hays

How much did they raise?

Oliver Völkel

They raised about US$2 million.

Demelza Hays

Okay, wonderful. I guess there are more projects in the pipeline?

Oliver Völkel

Correct. In fact there are huge projects in the pipeline from internationally well-known corporates and firms who are acting on the global stage. Very soon we will announce a new ICO that we are doing for an internationally known television company. This seems to be a new way to raise funds.

Demelza Hays

Wonderful. Thank you so much for taking time to join us today, Oliver. To conclude, Max, would you like to introduce yourself?

Max Tertinegg:

Yes, sure. We started our company Coinfinity in 2014 and personally I’ve been involved in the crypto space since early 2011. Consequently, I’ve seen a couple of highs and lows in the crypto scene. Our company is a crypto coin broker with different sales channels. We started with the first Austrian Bitcoin ATM in our office in Graz and then expanded to around 30 ATMs all across Austria. We have a voucher project which is called Bitcoinbon where you can buy Bitcoin vouchers at about 5,000 points of sale in Austria. We have a web platform with a few tens of thousands of users where you can buy and sell cryptos. In 2018 we are focusing on developing a private banking department for high net worth individuals because we see a lot of demand for this service.

Demelza Hays

Excellent. Bitcoin Swiss, which is a brokerage in Switzerland, began with ATMs, and I found it surprising that they are applying for a bank license now in Switzerland but at the same time they sold their ATM network. I always thought it would be cool if I could have a crypto bank account and then go to a Bitcoin ATM and withdraw from my account directly. But that doesn’t exist quite yet.

Max Tertinegg:

Yes, and also just to add a note to this. There is a big problem with Bitcoin ATMs regarding banks and co-operations with banks, because banks just hate cash because cash is the tool for money laundering. Therefore, if you have cash coming in or going out of your crypto business it’s really hard to do co-operations with banks. This might be a reason why they sold the crypto ATM network.

Mark Valek:

Are you guys applying for a bank license?

Max Tertinegg:

No, not yet, but just today I talked to Oliver about maybe getting a Zahlungsdienstleisterlizenz for Austria to do some payment processing, but not for a banking licence, not yet.

Demelza Hays

Very good. Thank you so much to all of our advisers for joining us today. I guess we can go ahead and begin the discussion. To open the board, I would like to talk about the market tanking the past month. We’ve had about a 50% decline in Bitcoin and we’ve had an even further decline in the total market cap of all the cryptocurrencies, and I would like to know if any of you have any reasons for this development.

Max Tertinegg:

I think there is one very obvious reason; the market was too overheated. There was a really big disconnection between prices and everyday usage and technology developments. What we have seen repeatedly over the last couple of years is that the market gets hyped up to a point where it’s not sustainable. I am personally very happy that we have had this correction because now we can focus more on technology and on development of coins.

Oliver Völkel

I heard a rumour that there were a couple of big exchanges in the past that were influencing the price to go up on a very unsustainable level. I have no idea if that’s true or not. I also heard a rumor that regulators had something to do with the crash due to their concerns about cryptocurrencies. However, in my opinion I don’t think that a single country’s regulator matters much for the global cryptocurrency market.

Stefan Wieler

There is one thing that is fascinating about the main cryptocurrencies; they have a very strange supply function, which you won’t find in nature. For example, let’s compare Bitcoin to a commodity because I think cryptocurrencies are commodities.

For a traditional commodity you basically deploy more capital, you put more energy in it, you put more labor and time in, and at some point in the future you’ll get more out of it. The price incentivizes you to produce more. Cryptocurrencies, for obvious reasons, don’t function that way, which makes cryptocurrencies inherently volatile. And you don’t really have a supply and demand function where the price can really impact supply at all, it can only impact demand.

Crypto miners were making huge margins, which were not sustainable. There is nothing in our economy over the past couple of thousand years that would have had these margins. There is no margin like this that has been sustainable, unless it’s a government monopoly. I therefore think this is a very healthy correction. I don’t know what triggered the sell-off, but I think this is a sustainable business for the future, not just some pump and dump bubble thing like tulips.

Ronald Stöferle

Great thoughts. The market was obviously overheated, and I think there were various indications of that. Looking at investor behavior people were just trying to rush in as fast as they could. This is obviously a sign of an overheated market. It’s worth pointing out that cryptocurrencies is a retail-led market. Other markets are usually led by institutions, and the institutions come in first, and retail comes in last. How do you guys see this institutional side of the equation? Are they coming late? Are they coming at all in a significant matter? I think the capacity and potential is much higher from that side.

Stefan Wieler

We talked to some of the institutional guys. I would make a distinction between traditional institutional investors and the players that are in the crypto space right now, which at this point are so big we have to consider them institutional. Look at who is holding most of the coins; it’s a very small group of people that controls the mining space and owns a lot of the assets. But I think what you are referring to is the traditional institutional guys, which from what I know, are few. I know some institutional investors that are completely private, that run their own money. I know personally that they’re actually in this space for a very, very long time but they do not invest client money in this. I think that’s something that is still missing in the space and that’s because you don’t have proper custody at the moment. That’s why these companies cannot invest in cryptocurrencies directly. They therefore invest in companies that are involved in the crypto space, for example our company. So you don’t have these traditional money managers actively investing in the space the same way they’re actively investing in the equity markets. It will be interesting to see what happens when that market develops, e.g. if it takes out some of the volatility.

Ronald Stöferle

Thanks, Stefan. Mark, Oliver, anything to add on that point?

Oliver Völkel

From a legal perspective large institutional investors, pension funds or banks, would perhaps be interested in cryptos, but they have a strict regime of capital requirements. EU requirements prevent them from investing in all sorts of assets. So from a legal perspective this could also be a reason why we don’t see much involvement of institutional investors yet, at least in the European Union.

Ronald Stöferle

Do you think, Oliver, that there would be at least some leeway for big institutions, insurance companies, pension funds etc. to have an allocation to cryptos if they are classified as a new, alternative asset class?

Oliver Völkel

The problem is not so much the legal classification of the asset class, but rather what an investment in such an asset class would entail for the capital structure of the bank, pension fund or the institutional investor. To give you a brief overview, the capital requirements regulation stipulates that you have to have a certain amount of Tier 1 or Tier 2 capital and the way you calculate how much capital you need is by multiplying your investment with the risk factor. The less risk something has, the less equity you need for an investment. If the calculation for cryptos shows that you need 100% security deposit it simply is not interesting for any institutional investors because it’s a very expensive investment. They would rather invest in something less risky and do a lot more investments, because the equity requirement is lower. I think this is the reason we don’t see much investment from banks or institutional investors.

Stefan Wieler

Currently you don’t even have hedge funds being as active as you would think, considering the potential upside and high volatility. This is not even because of regulatory reasons, but because they don’t want to. To quote somebody we talked to: “I cannot give some kid $50 million to have some data on a server somewhere in a garage in Silicon Valley”. So even hedge funds, who can do what they want with their capital, are not as invested as they want, or not invested at all, because they don’t trust the crypto space. They don’t trust this thing and they don’t trust themselves being technologically savvy enough to have it in their wallet and put it in the safe.

Demelza Hays

Excellent point. Private keys get hacked very frequently, as we saw with a cryptocurrency company in Liechtenstein called Aeternity, They were attacked during the parity hack and I think they lost approximately $20 million within a matter of seconds. Getting hacked is definitely a risk.

Ronald Stöferle

It seems that the factor preventing cryptocurrencies becoming more institutionally accepted is primarily an infrastructure problem. Would you agree with this conclusion?

Stefan Wieler

Yes, I think that’s what we’re hearing when he talks to major players. Currently they are all pointing out that infrastructure is a big issue. And obviously there’s also still a lack of a rigorous regulatory framework

Demelza Hays

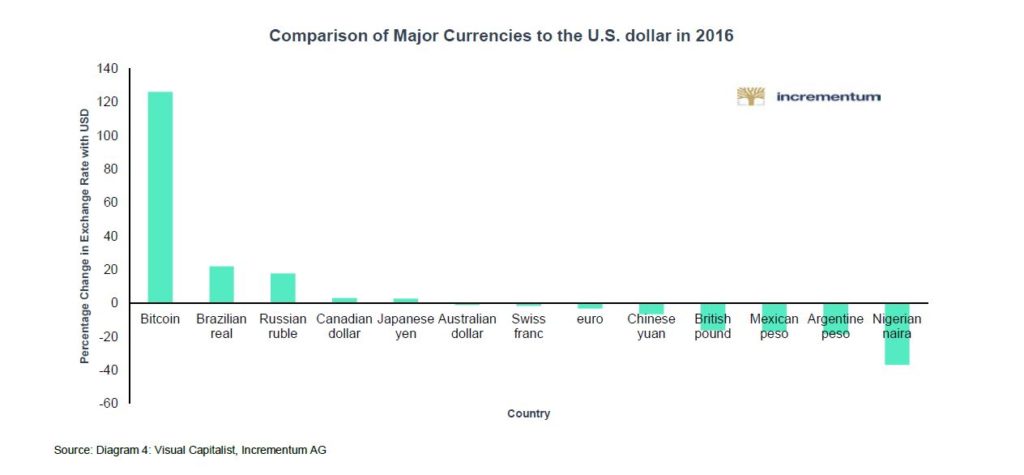

The media is reporting that Bitcoin lost 50% of its value since December 2017, but it is interesting to consider that in January 2017 Bitcoin was at $1,000 and now it’s at $8,000. So we still had a 700% annual increase despite a 50% drop in the past month. And I guess another question for that topic is do you see this trend changing? What is your outlook for the first and second quarter of 2018?

Max Tertinegg:

I’m driven from a technological perspective rather than from an investor’s perspective. We recently made the first lightning transaction on a Bitcoin ATM worldwide in our Bitcoin ATM in Graz, which was really awesome to see, that you can send Bitcoin without hitting the blockchain with very low fees at a fraction of a second. This promise of a lightning network that has been floating around for the last two or three years will come into existence in the next couple of months. I think that this will be a very big factor. This development will give a much bigger usage or utility to the whole Bitcoin network because currently I would say 95% of all people who use Bitcoin are using it as a form of investment, but not as a form of payment. So the payment system character of Bitcoin hasn’t been very big. But with the dawn of the lightning network I think that we will see an explosion in cryptocurrency payments and this will on the other hand give Bitcoin a much bigger value. I’m not sure if this will happen by the end of the year but my outlook is very promising. So I think that Bitcoin easily could rise to $50,000 this year.

Ronald Stöferle

Great, Max, then just to put on my investment hat, so long Bitcoin, short Bitcoin cash?

Max Tertinegg:

Yes. Yes, definitely.

Ronald Stöferle

Okay. Thank you.

Demelza Hays

Stefan or Oliver, do you have an outlook for 2018?

Oliver Völkel

I would actually refrain from giving any outlook because I am not confident enough in my ability to predict the market. So I really can’t add to this.

Stefan Wieler

I’m glad I’m not the only one. I just don’t know. I used to work for investment banks and I had to make an oil price forecast and I always hated that part of the job because you were almost by definition wrong. But with proper analysis, you can identify what drives the price of a commodity and if you did a good job, you can – more often than not – say in which direction it will go. With Bitcoin I have absolutely no idea what is driving the price at the moment. I can see cryptocurrencies having amazing utility as it develops, but currently I would say 99.9% is for speculation, it’s really not used as a form of payment at all. And it is not used like money at all. Nobody that is not printing or not mining it can pay their employees in cryptocurrencies because your labour cost can basically go up tenfold overnight. But as it becomes a form of money I see how the utility of this thing goes up. Over the long run I think the way is clearly up, but what happens over the next quarter or two, I just don’t know. My big philosophical view is that in the end it’s an alternative form to fiat currency the same way gold is. Because I’m very bearish on the fiat currency system I believe that anything that is an alternative to fiat currency will go up in fiat currency terms over time.

Demelza Hays

Definitely. So all three of you work with cryptocurrency in your professions; are you seeing an increased interest from potential clients?

Stefan Wieler

Yes, definitely. We allow people to hold cryptocurrencies on the platform. We have only offered storage since November and it has gone absolutely through the roof. We only offer Bitcoin and Ethereum at the moment and we actually haven’t launched BlockVault yet. What we offer right now is simply cold storage in a secure vault. As I mentioned we sold about 22 million coins in the last seven weeks of 2017, we facilitated about $22 million of sales. If you scale that up to a full year it equates to about $150 million, which is already a tenth of coin base. The interest probably has come off a little bit during the sell-off, but it’s still very good. Given what happened with the price, the interest has been stellar.

Demelza Hays

Wonderful. Oliver or Max?

Oliver Völkel

What’s very interesting is that in particular German corporations are moving to Austria to do crypto business in Austria, to headquarter their businesses here and then try to go back to Germany with their services because it’s simply much easier here in Austria to do cryptocurrency related business because of the regulation and laws that apply in Austria compared to Germany. Also, we have seen a shift in the structure of who is actually trying to get advice from us because in the past couple of months we have seen a lot of private investors who have fallen for scams and who are trying to find recourse now, which is quite difficult due to the nature of cryptocurrencies, if they are gone they are usually gone. But I’ve heard from well-informed circles that the law enforcement agencies already have quite sophisticated methods of tracing cryptocurrencies. But I think this is a sign that we need to do more educational work in the public to bring closer to people the dangers that are associated with using cryptocurrencies. But for some people if they are dealing with cryptocurrencies, it doesn’t feel like real money. That’s why they spend it more loosely or they don’t really think about it that much. And also cryptocurrencies are associated with giant profits in a matter of months. The most ridiculous promises that are made online don’t actually scare people; they really believe it. I have therefore seen an increase of individual clients who have fallen for such scams. If it continues it has the potential to damage the whole effort that we put into this to make cryptocurrencies become more mainstream. I think this is something we should all work together with to try to avoid.

Demelza Hays

Yes, that’s a great point. I was thinking the other day about how the saying “10X”. 10X wasn’t really a saying before the cryptocurrency market existed. The next question that I wanted to move on to was the relationship between cryptocurrencies and gold.

Stefan Wieler

Philosophically gold and cryptocurrencies are linked, because they are an alternative to fiat currencies. Gold fulfills this role because it’s a store of value, it’s a unit of account and it’s a form of exchanging value. Gold is a better store of value than fiat currencies because fiat currency hasn’t really been a stellar store of value, at least for a long time. The idea of cryptocurrency is similar to that, moreover it is outside of the banking system and it is not controlled by a government in the sense that you cannot just print it. That said a lot of gold supporters hate cryptocurrencies and vice versa. Gold and cryptocurrencies are two different forms of money that at the moment exist side-by-side and both have a similar promise; if the fiat system completely implodes you are not going to lose your savings. But they obviously work very differently. The most important cryptocurrencies don’t have a proper supply curve like gold has, so you can’t really make more if you want more or need more. Then obviously also if you’re a speculator, cryptocurrencies are great, if you’re a speculator in gold, that actually is not really a good deal, because gold just preserves your value. So if you look at it over 100 years it just buys you roughly the same things. So you’re not really getting rich with gold at allBut if gold goes to $10,000, it’s because the USDhas collapsed.

But with cryptocurrencies, those gains were possible, so it’s a very, very different world. There has been an argument that the sell-off in gold in late December was somehow linked to the rise of cryptocurrencies, that bigger investors sold gold to buy cryptocurrencies. I cannot confirm that. I don’t think that happened at all. Now on the way down, gold hasn’t done anything at all. So gold actually caught up to probably where fair value was before the cryptocurrency sell-off started, and then during the entire sell-off it’s been almost flat. So there is really no link between the two.

Demelza Hays

Those are good points. I know a few people that realized gains in the cryptocurrency market and invested in gold in mid-December.

Stefan Wieler

Cryptocurrencies opened up the discussion among millions of people for the first time in several generations about what money is. 2008 didn’t do the trick, and gold going from $200 to $1,800 and back to $1350 didn’t do the trick either, but cryptocurrency seems to have done the trick, that people are actually starting to think about what money actually is Once you actually start thinking about what money is you instantly lose confidence in fiat currencies. I can imagine that people who realize gains on cryptocurrencies buy gold. We’ve seen it since we started the business; people actually send us cryptocurrencies and buy gold with it. One reason might be because it might be the easiest way for them to send us money, but the other thing could also be that they just want to realize their gains, and rather than holding it on a bank account, they’re holding precious metals with us.

Ronald Stöferle

Something I loved when I found out about the cryptocurrency space was that people were actually asking the question: “what is money? What are the advantages or the disadvantages of fiat money, and what are the advantages of gold?”

I also like that people in the crypto space come from a more technical side and that they are finding out more about the monetary system. But it seemed that during the mania so many people rushed in and didn’t care about those topics at all. They were mostly buying because of rising prices, fear of missing out and so on. So I think that the discussion in the crypto space changed. I think there are major similarities between Bitcoin and gold, but there are also major differences.

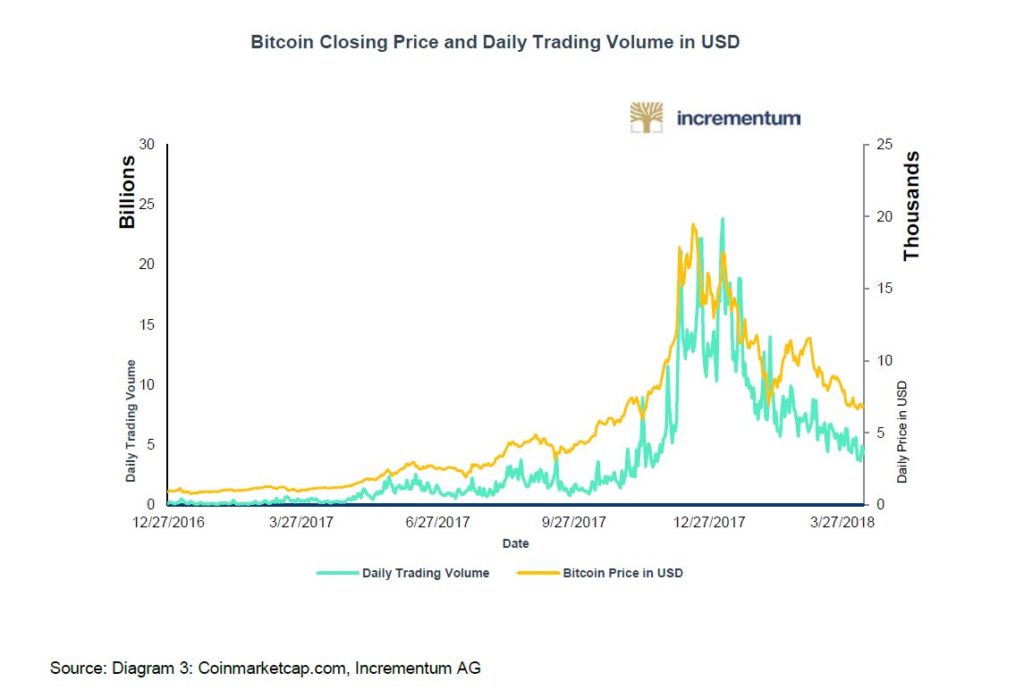

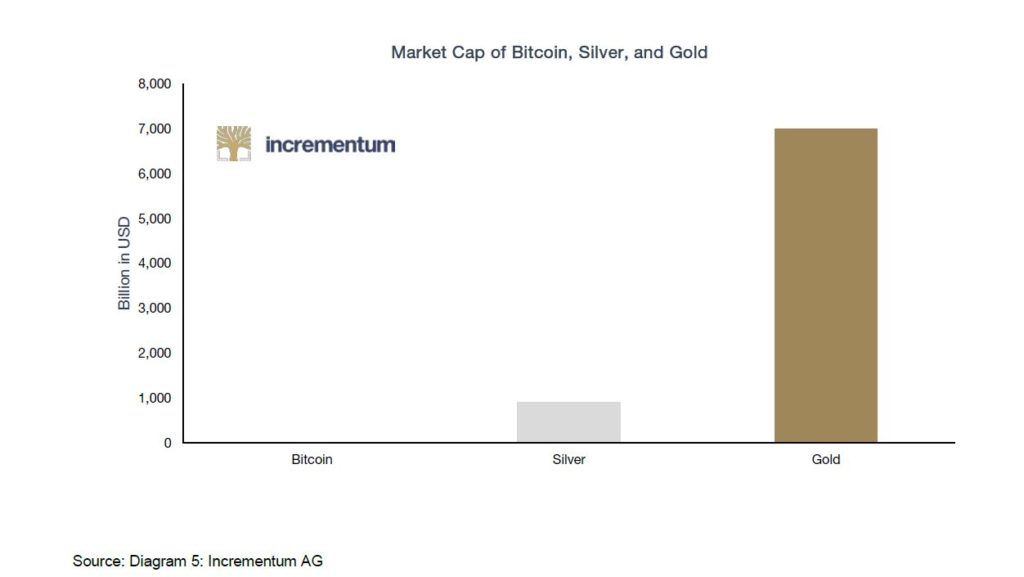

If you just compare the size of gold to the crypto space, gold is well valued at roughly 7 trillion at the moment, while the cryptos’ market value is around $400 billion. I think the most important difference is first of all the liquidity, gold is traded at roughly $250 billion a day, as we all know mostly on the futures market, so it’s not physical trading or physical gold trading taking place, while Bitcoin as I’m reading now, is trading at roughly $2 billion. I’m not sure if that amount is accurate, but in a nutshell liquidity is a huge difference. And I think there’s still very little overlap with cryptocurrencies and gold on the sources of demand and supply. This is something that I told James Turk three years ago when he was on a panel at a big mining conference in Zurich. The whole gold community hated this new competition coming up. I love the fact that James Turk embraced the idea of competing currencies and actually was very open when it came to this new form of technology because money is basically a technology, nothing else.

Stefan Wieler

Liquidity is actually a very interesting question; how much of the $2 billion do you think are people basically moving cryptocurrency from one wallet to the other, i.e. it’s not really traded?

Max Tertinegg:

Actually it’s not $2 billion, but rather around $20 billion.

Mark Valek:

Can you elaborate on the $20 billion, how much you think is actually real and how much is just basically a number?

Max Tertinegg:

It’s a question of what is real. So it’s more real than maybe the gold volume, because there’s no, or very little, paper Bitcoin. On the contrary there’s paper gold and real gold and currently we are in a situation where we only have real cryptocurrencies. So in that sense, it’s more real than the gold volume. But on the other hand if I have an exchange with a 0% fee, I can do 10 million a day trading volume without any cost. I therefore don’t think you can draw too many conclusions from these numbers.

Demelza Hays

I think that’s a great point. The OTC markets are estimated to be much larger than the exchange markets for cryptocurrencies. For example, Bitcoin Suisses has a prop book of approximately $3 billion and they’re settling their own trades within house and they don’t report any of the transactions to any type of data repository. The total global daily volume is much higher than what is reported on coinmarketcap.com.

Stefan Wieler

I think the point that Ronni made about liquidity is definitely valid. Gold, for now, is still a way more marketable commodity than Bitcoin, for instance. But I think it’s also quite an achievement already that it has come so far and volatility and marketability probably go hand-in-hand to some extent. My outlook is that if this monetization process continues it will lead to falling volatility and increasing marketability, or higher liquidity.

Demelza Hays

To conclude on the gold topic, we are not sure that crypto is bringing more absolute money into gold, but I think we can be sure that the median age of gold investors is decreasing.

Max Tertinegg:

Yes, that’s a good point. I think it brings interest for a completely new generation. Anecdotally, everybody I know from my Wall Street days have Bitcoin, and some Ethereum. They all say it’s their insurance policy. And they all understand gold as well in that form. So gold used to be their insurance policy, now Bitcoin is their insurance policy. And I agree with Ronni, I think the overlap is relatively small. But this could change if you have more companies like Goldmoney, and if gold and cryptocurrencies become much more fungible, which it really isn’t at the moment at all.

Demelza Hays

That’s an excellent point. I read in the news recently that Perth Mint is looking at backing a cryptocurrency with gold, and I know there’s been a few other projects where they’ve had difficulties with custodianship, but I think it’s an interesting idea to try to make gold easier to use digitally .

Stefan Wieler

A gold-backed cryptocurrency will obviously be very different to what we have right now because with a gold-backed currency there is an element of trust, which obviously is the whole idea of cryptocurrencies; that you don’t need to trust anybody. So the minute you need somebody to store your gold, you need to trust that institution. But why would you do that? Why would you have something like a blockchain which is all about trust, but then you have to trust the company anyway to store your gold?

Ronald Stöferle

That’s a great segue to the last topic we want to discuss, which is the legal aspect and regulation. Oliver, you said from your point of view as a lawyer, it is really exciting to be in this space because you can actually influence legislation and new laws. I’d like to know if you think financial market authorities and governments underestimated the crypto space initially, but with the rapid price developments in the last couple of months they might be more open to it? I think proper regulation of the sector might turn out to be a big advantage, especially as it creates some sort of security for market paricipants. I’d love to hear your thoughts on the most recent developments, and also where you’re expecting the legal side to be a couple of months or years from now.

Oliver Völkel

What we have to keep in mind, and let me stress this point, there is really no regulation-free space. No matter where you look, there is always a law that you can apply to something. The same is true for cryptocurrencies. The fun part of doing the legal work is that you can influence legislation. People want cryptocurrencies to become more secure; I have said before, with regard to initial coin offerings, that it’s not the Wild West. There are regulations that you have to adhere to, and if you don’t, either you fall under the capital markets law which is quite severe since there’s criminal punishment looming ahead of you, but also if you’re creating just regular token, there’s legislation you have to adhere to, which would be the consumer rights directive, for example. So there is no law-free space, so to speak.

That’s my first remark. The second thing is that in early 2017 regulators were extremely interested in cryptos; they were more cooperative with giving you their legal point of view. They don’t really do that anymore, or if they do, they simply give you a short sentence and that’s it; end of discussion. So from my point of view, it has been a little bit more difficult to deal with the regulators. I have only heard in the news that Germany and France were proposing, or will be proposing, a regulation draft. I have unfortunately not had access to this draft. It’s a huge piece of legislation that could influence the whole industry.

A second piece of legislation that will pass soon is the update of the fourth anti-money laundering directive, which will for the first time include a definition of what a cryptocurrency actually is. But this piece of legislation only applies to a small area of law, or a small area of the industry, namely people who are selling, purchasing and selling cryptocurrencies, or wallet providers. These will be covered and they will also have to adhere to anti-money-laundering rules in the future. So those are the two major developments that I see in the future. And from an Austrian point of view I can give you an interesting update, which is not at the legislative level but on the executive level. The Austrian financial authorities, recently released a note to all the finance centres in Austria where they say that a price increase would fall under capital taxation, which is actually wrong and which really raises tricky questions and difficult legal questions because it puts the burden to battle any wrong decisions of the finance centre on the people

Demelza Hays

If I could just ask, in what sense is it wrong? Because I think that other countries such as Switzerland consider crypto to be subject to a capital gains tax.

Oliver Völkel

It’s certainly wrong, in Austria at least, if you are selling cryptocurrencies and you are doing this either as a private person or as a small entrepreneur, then it would fall under your regular income tax, any price increase, or any gains or any profit that you have achieved from it, and not under capital gains.

Demelza Hays

I see, okay. Yes, that’s the case in Switzerland, it’s only professional investors that go over certain thresholds. So in Austria, retail traders have to pay that tax as well?

Oliver Völkel

Yes.

Ronald Stöferle

I’d like to hear from Max, because he told me once that it was really hard to get a bank account for his company and I know that his business is really growing quickly. So I’d like to hear a bit more from Max regarding his most recent experiences regarding legislation and the legal side.

Max Tertinegg:

I unfortunately still have to report the closing of our bank accounts. But I think this will get better once we have this fifth anti-money-laundering directive in national law, because the banks will have clear regulations. So currently people are sitting in compliance offices in banks and are not really sure what this whole crypto thing is. At the end of the day they are people responsible for the relationship with companies like us. So I don’t blame them, but it’s still hard for us to develop proper banking relationships. On the other hand, I have to say that there is a small number of very interested, mostly private, banks who actively are seeking co-operation with us. In the meantime I think we have six different working bank accounts, but we only use them for specific purposes.

There is interest from the banks but still the whole banking scene is very rough. Recently the Austrian financial market authorities sent a letter to all of the Austrian banks informing them that they should do more research into money coming from exchanges or companies like ours. I can also unfortunately report that many of our clients get their money frozen by the banks, e.g. if you want to sell 100 Bitcoins to us and you get a large amount of Euros, then you might be in the unfortunate situation that your money gets locked up for four to six weeks, until all the documentation is done. The problem is that the people in the standard banks just don’t know how to handle these cases. There is no proper expertise. I hope this will get better by the end of this year, but who knows?

Ronald Stöferle

Okay, thanks. Great. We’re getting close to the finish. Does anyone want to add anything?

Max Tertinegg:

I wanted to congratulate you on your crypto research report, I think it’s very good.

Demelza Hays

Thank you very much, Max. We’re looking forward to a good second edition coming out in late February, early March.

Mark Valek:

Sponsorship’s still open.

Demelza Hays

Yes, sponsorship is still open. We are looking for more sponsors to help us create better quality content and hire more thinkers and writers. If you think of anyone or any firm that may be interested in sponsoring the report, please have them email us at [email protected]

Ronald Stöferle

Also, if you have any ideas or topics that you want analysed, call us or drop us an e-mail. We’ll be glad to discuss it. It’s a new and young product and it will evolve.

Thank you very much to everyone for attending. Have a good day.